Ethereum’s future includes plenty of bullish-looking “positive dangling carrots,” according to Bloomberg Intelligence’s senior commodity strategist Mike McGlone.

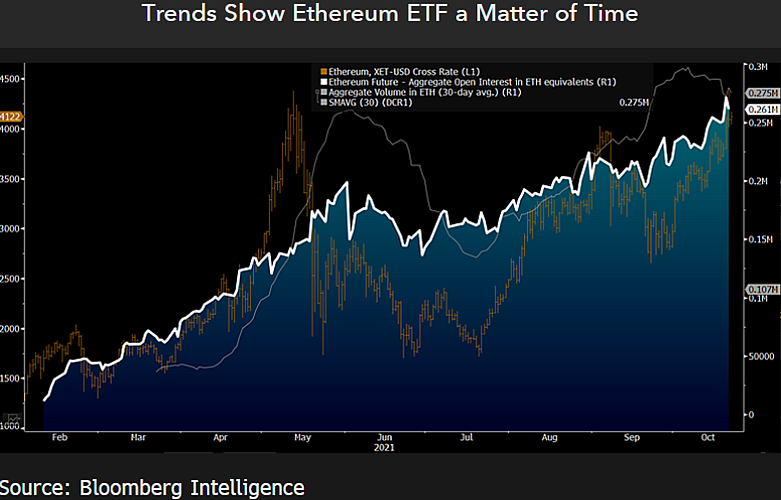

McGlone tells his 35,300 Twitter followers that it is only a matter of time before an Ethereum (ETH) exchange-traded fund (ETF) is established.

“Rapidly rising Ethereum open interest and volume show that a US ETF is only a matter of time, with positive implications for the price and negative for volatility.”

Ethereum (ETH) is trading at $3,979 at time of writing, down 4.6% in the past week, according to CoinGecko. The second-biggest asset by market cap hit its all-time high of $4,361 on October 21st.

McGlone is also bullish on Bitcoin (BTC).

“Bull markets are about positive dangling carrots and we see plenty ahead for Bitcoin and Ethereum. The launch of Bitcoin ETFs in the US appears as an iteration to get to what may better facilitate most investors – ETFs tracking the crypto market, like the S&P 500.”

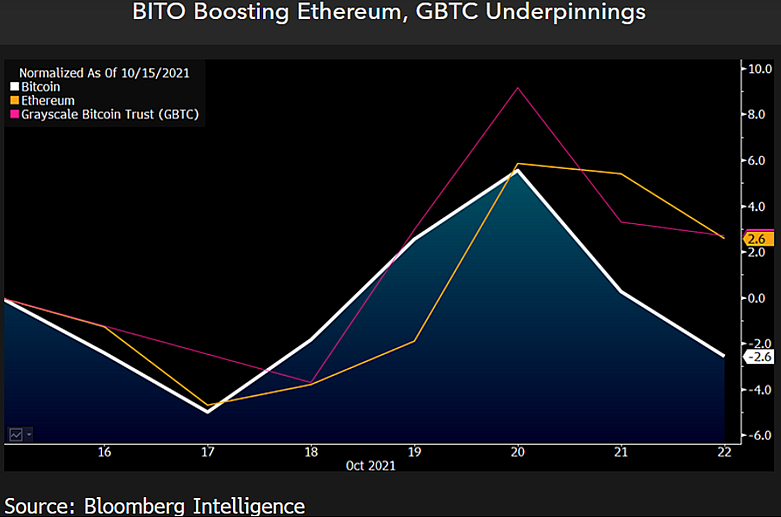

ProShares’ Bitcoin futures exchange-traded fund (BITO) exploded onto the market last week with the country’s second-biggest ETF launch of all time. Alternative asset management firm Valkyrie Investments launched the US’s second Bitcoin futures ETF just days later.

Regarding the ProShares launch, McGlone says,

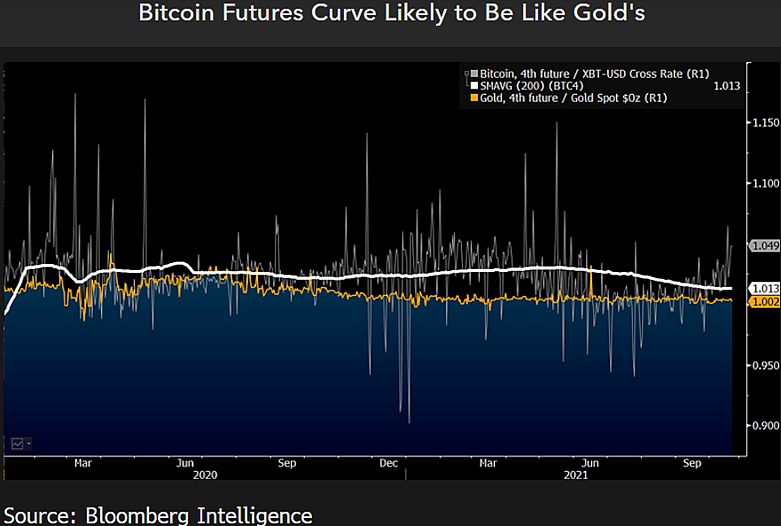

“Strong inflows for the new ProShares Bitcoin Strategy (BITO) ETF show pent-up demand and quantitative traders targeting arbitrage opportunities, which are likely to narrow spreads and pressure volatility.

We see Bitcoin on track to trade like gold.”

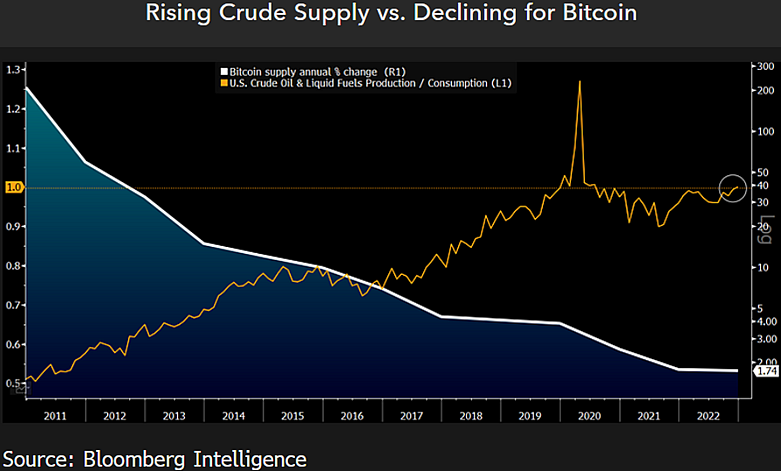

The strategist says Bitcoin is in a supercycle and predicts the largest crypto asset will outperform commodities next year.

dailyhodl.com

dailyhodl.com