With the majority of the cryptocurrency market dragging its feet in recent weeks, it is no surprise that its second-largest asset by market cap, Ethereum (ETH), is doing the same. However, the hope remains it could hit the high price level of $5,000 sometime in the future.

As it happens, Ethereum managed to get close to this mark on November 9, 2021, when it reached its all-time high (ATH) of $4,815.01, climbing by 168.25% from the $1,794.97 where it stood on July 21, 2021, which is close to its price at present and suggests a very real possibility of repeating this success.

With this in mind, Finbold has analyzed the main factors that could (but do not necessarily have to) lead Ethereum closer to the $5,000 price level and eventually overtake it – either by themselves or together with other influences.

Mass adoption of Ethereum-based applications

With Ethereum being the most popular blockchain choice to build a wide range of decentralized applications (dApps) on, such as in the sector of decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming, it could help its cryptocurrency grow further in price, thanks to the growing demand.

For instance, one of the major companies building on the Ethereum blockchain is PayPal (NASDAQ: PYPL), which has recently announced the launch of its own ERC-20 United States dollar-pegged stablecoin PayPal USD (PYUSD), issued by crypto firm Paxos Trust Company, as Finbold reported on August 7.

Improved scalability

With the launch of the better-performing, more accessible ‘Ethereum 2.0,’ the network has improved its scalability, helping it handle more transactions per second and making it more attractive to users and developers. If this trend continues, it could lead to growing demand for Ethereum and its higher price.

Indeed, the Ethereum development team has been working hard on boosting the network’s usability, the work that also brought a shift from the proof-of-work (PoW) to the proof-of-stake (PoS) model with an aim to reduce energy waste and transaction times, as well as improve scalability.

Institutional adoption

On top of that, more institutional investors recognizing Ethereum’s potential and buying more ETH could drive the price higher simply by following the rules of supply and demand – the more desirable an asset is, the higher its price, and institutions can have the power to contribute in shaping market trends.

Furthermore, Ethereum’s advance could also happen under the influence of the Tesla (NASDAQ: TSLA) and X (formerly Twitter) CEO, Elon Musk, supporting the bold prediction on the future of the crypto market that could see both Ethereum and Bitcoin (BTC) surge massively.

Regulatory environment

Amid increased regulatory pressure, particularly in the US, which has culminated in multiple lawsuits against some of the industry’s largest representatives, the cryptocurrency market as a whole can feel its effects, which is why positive regulatory developments and favorable regulations for digital assets could help drive their prices, including Ethereum.

One example of such positive developments is the refusal of the British financial services minister, Andrew Griffith, to agree with the Treasury Committee’s recommendation to regulate retail trading and investing in unbacked crypto assets as gambling in late July and his support of their treatment as other financial services.

Market sentiment

Finally, the atmosphere in the wider crypto and macroeconomic landscape can often influence the price of particular assets, including cryptocurrencies like Ethereum, for instance, with positive (or negative) developments and news coverage about the industry.

Indeed, the above factors could contribute to the bullish sentiment, and when people are feeling bullish about digital assets in general, they are more likely to invest in them, and the positive sentiment could affect the price of ETH, which is more likely to increase.

Ethereum price analysis

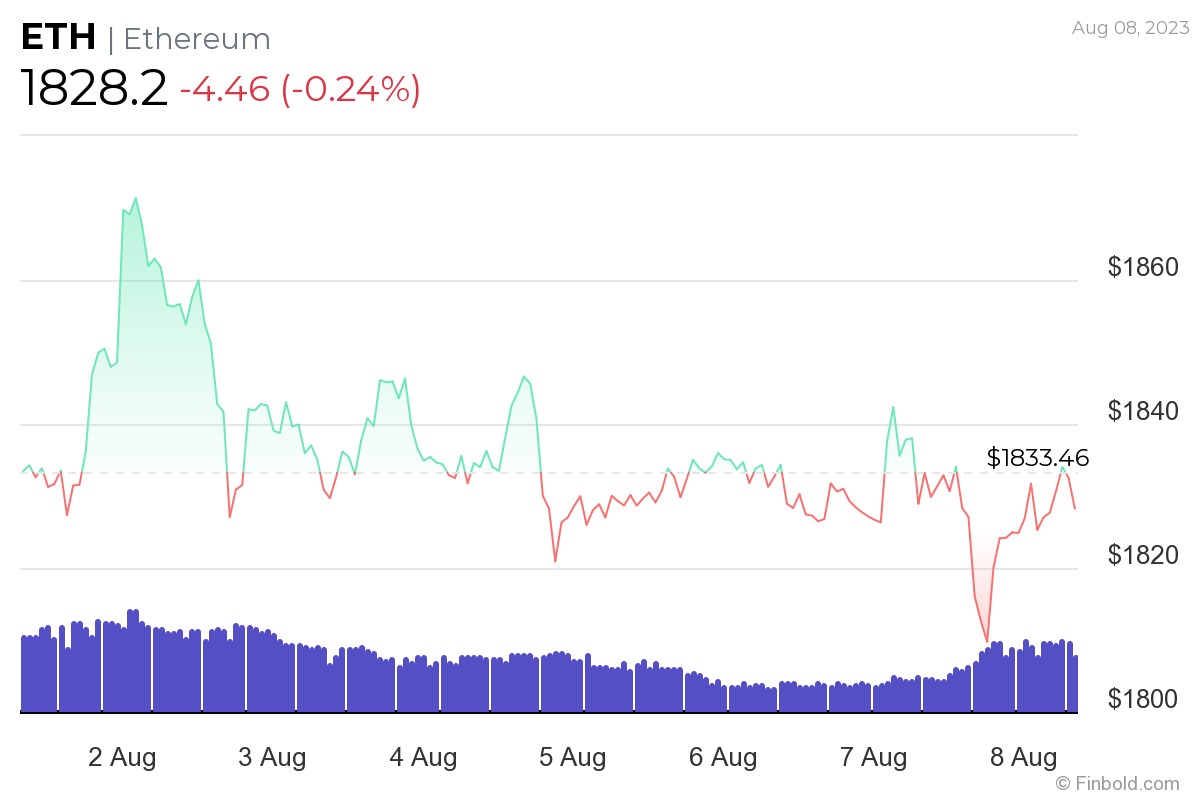

Meanwhile, Ethereum was at press time changing hands at the price of $1,828.2, the same as the day before, in addition to losing 0.29% in the last week and declining 2.05% on its monthly chart, as per the latest information retrieved on August 8.

In conclusion, time will tell if the above factors are truly powerful enough to push the price of Ethereum toward $5,000. But one thing is for certain – they could, indeed, contribute to its strengthening and, in time, possibly reaching this coveted price level.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com