The price of Ethereum jumped 4.7% overnight, per CoinGecko data, as the second-largest cryptocurrency approaches its much-anticipated Shapella upgrade on April 12.

Notably, Ethereum’s price action has also outpaced Bitcoin's increase of 1.3% during the same period.

Next week’s upgrade will enable ETH withdrawals from the staking contract, lowering the risk of holding staked Ethereum (stETH), also known as liquid staking derivatives (LSDs) via platforms like Lido Finance.

As such, governance tokens linked to various liquid staking platforms have also enjoyed a hefty rise in price. These platforms emerged to let Ethereum holders stake their ETH and earn a liquid staking token in return. This token could then be reused throughout the world of DeFi to earn additional yield.

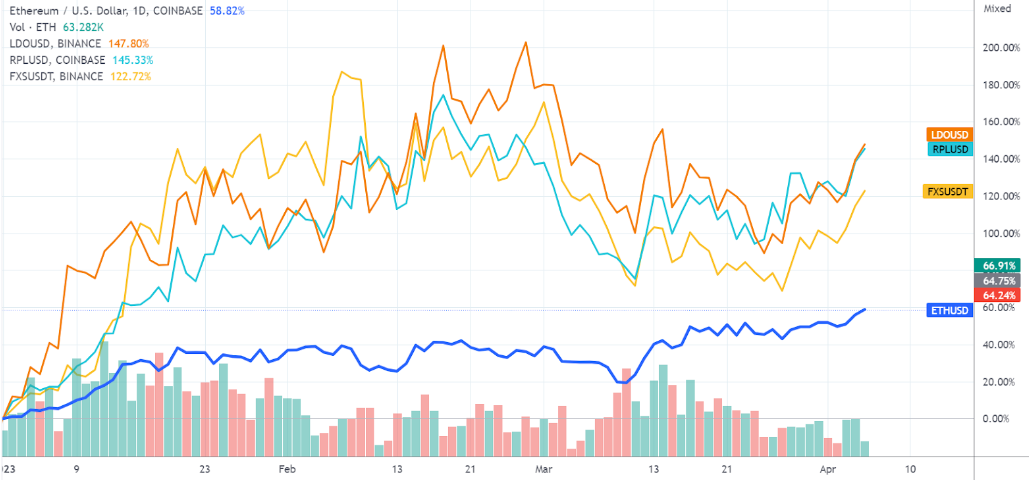

The governance tokens of top liquid staking platforms in Lido DAO (LDO), Rocket Pool (RPL), and Frax Shares (FXS) enjoyed double-digit percentage gains in the last 24 hours.

Overall, these LSD tokens have yielded higher percentage gains, at least twice that of ETH in 2023. The top LSD tokens have recorded up to 150% compared to Ethereum's near 65% gains year-to-date.

Currently, decentralized liquid staking platforms account for 33.3% of the total staked ETH. Lido DAO is a clear leader within this space, with a 93.79% share.

Shapella is the most important Ethereum upgrade since the network’s merge event last September when the protocol moved from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism.

decrypt.co

decrypt.co