Key highlights:

- Ethereum is up by a whopping 25% over the past week as it sits above $3,100

- The cryptocurrency has now burnt a total of around 21,570 ETH

- Against Bitcoin itself, Ethereum has dropped from the ₿0.0708 high to trade at ₿0.0688

| Ethereum price | $3,150 |

|---|---|

| Key ETH resistance levels | $3,155, $3,200, $3,400, $3,500, $3,650 |

| Key ETH support levels | $3,100, $3,000, $2,875, $2,800, $2,655 |

*Price at the time of publication

Ethereum is up by a very strong 25% over the past week of trading as the cryptocurrency battles to break above resistance at $3,155, provided by a bearish .5 Fib Retracement.

The coin has been surging ever since it rebounded from $1,710 earlier in July. It was trading inside an ascending price channel but has since broken above the channel to turn parabolic. However, the resistance at $3,155 seems quite significant, and the buyers have failed to close above here over the past three days of trading.

The talk of the town is the London upgrade that happened 5 days ago. The network upgrade introduced EIP-1559, a new fee calculation system that will burn ETH and make it a deflationary asset. So far, around 21,570 ETH has been burned, according to ultrasound.money.

According to Etherchain, the base fee burn rate is around 3 ETH per minute. Using this data, analysts have estimated around 1.57 million ETH being burnt per year, which is approximately $5 billion at today’s prices.

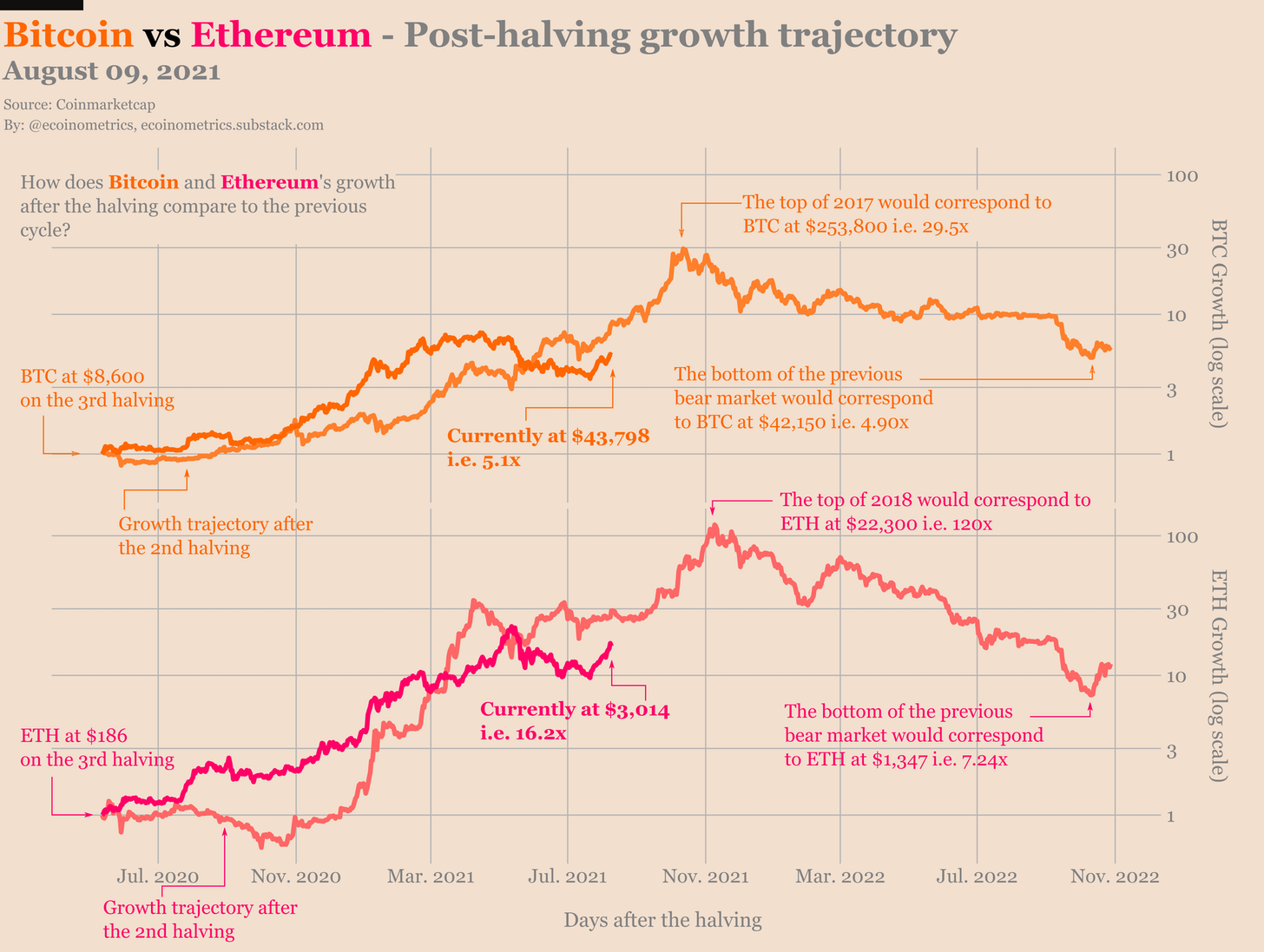

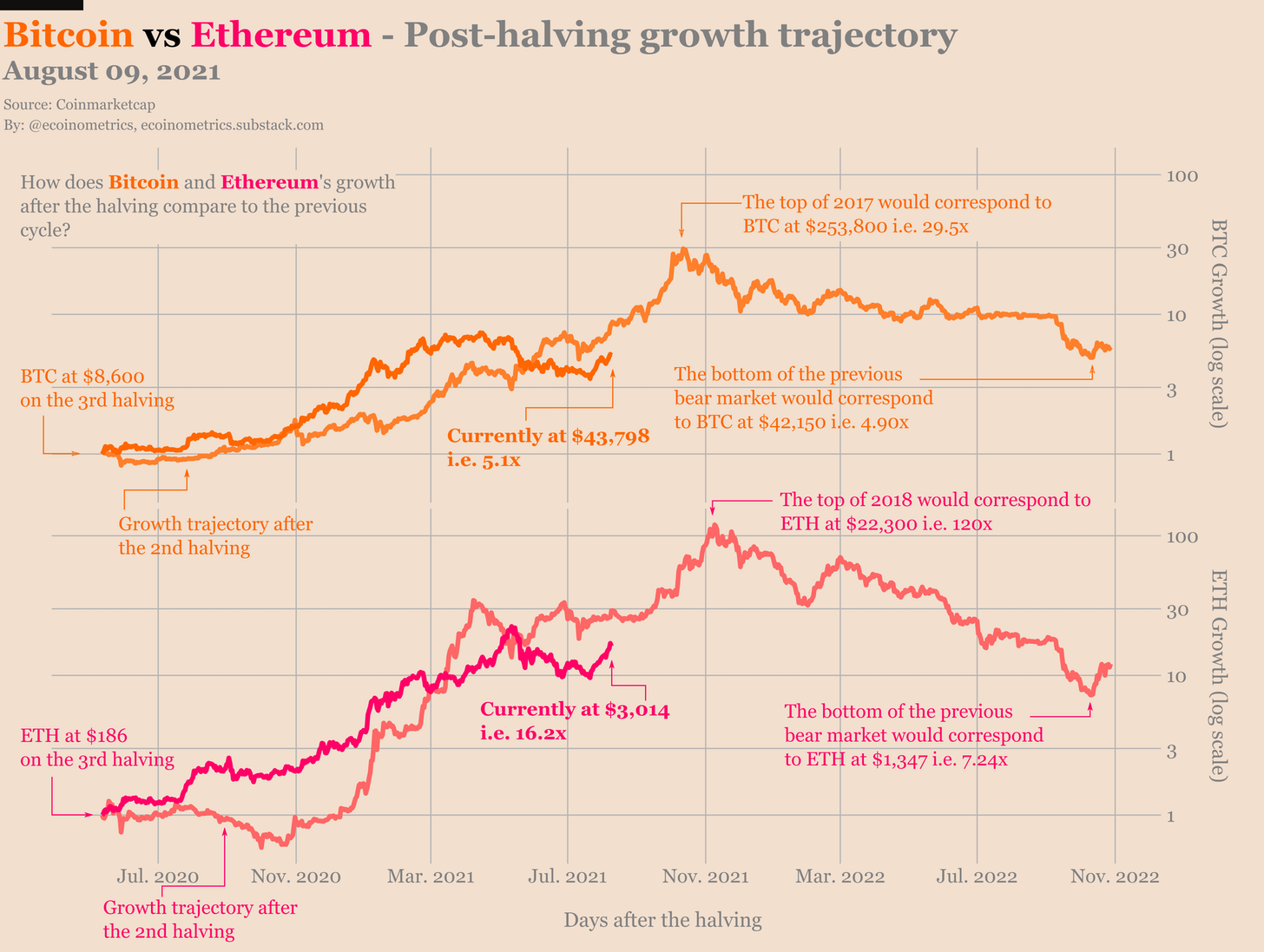

The Ethereum network upgrade has allowed ETH to break out against BTC after leaving a consolidation pattern. However, what is important to note is that both BTC and ETH remain below the growth trajectory of the previous bull market

The graph above shows that both of these assets still have much room to continue to run higher if the post-halving growth trajectory is to be believed.

In other news, macro analyst and former Goldman Sachs exec Raoul Pal, believes that Ethereum is the greatest trade in history. In an interview, Pal believes that more ETH holders will start to stake ETH in the ETH 2.0 contract, leading to a great supply shock in the market as ETH will be leaving exchanges. This would mean that there would be less ETH to purchase and is likely to drive prices higher.

. @RaoulGMI discusses the latest edition of Global Macro Investors & a section called "The Greatest Trade." What is it?

— Real Vision (@RealVision) August 6, 2021

Watch ?

https://t.co/qg8yXSE5He pic.twitter.com/NMNPV79lxp

The recent price surge allowed the ETH market cap to hit $366 billion.

Ethereum price analysis

What has been going on?

Taking a look at the daily chart above, we can clearly see the ascending price channel forming after the market broke above a descending wedge toward the second half of July. ETH surged inside the price channel until the weekend when it surged above the upper angle and turned parabolic.

Since breaking the channel, ETH pushed higher to meet the resistance at $3,155, provided by a bearish .5 Fib Retracement level. Although it has spiked above this resistance, it is still yet to close a daily candle above here as the bulls struggle to pass the level.

The Ethereum hard fork has been quite significant for the market and has injected a strong wave of optimism. However, this resistance at $3,155 must be broken for the buyers to continue higher toward the $4,000 level.

Importantly, the momentum is overbought as the RSI sits above 75. This indicates that a small retracement might be necessary for the short term before ETH breaks $3,155.

Ethereum price short-term prediction: Bullish

ETH is certainly bullish right now. The coin would now need to drop beneath $2,600 (200-day EMA) to turn neutral. It would have to continue further beneath $2,000 before being in danger of turning bearish in short term.

If the sellers do push lower, the first strong support lies at $3,100. This is followed by support at $3,000, $2,875 (.236 Fib Retracement), $2,650 (.382 Fib Retracement), $2,600 (200-day EMA), and $2,295 (.618 Fib Retracement).

Where is the resistance toward the upside?

On the other side, if the bulls can break the $3,155 resistance, higher resistance lies at $3,400. This is followed by $3,500 (bearish .618 Fib Retracement), $3,650 (1.272 Fib Extension), $3,800, $3,865 (1.414 Fib Extension), and $4,000 (bearish .786 Fib Retracement).

ETH/BTC price analysis

What has been going on?

Ethereum is also performing well against Bitcoin, but is starting to show signs of weakness. The coin had surged inside an ascending price channel since the end of July as it broke above a symmetrical triangle and reached the resistance at ₿0.0708.

It has since rolled over from this resistance to break back beneath ₿0.07 and trade at the current ₿0.0685 level.

For ETH to continue a bullish run, it must push back above ₿0.07 against BTC and go on to head back toward the June highs at around ₿0.078.

ETH/BTC price short-term prediction: Neutral

The break above the July high has turned ETH bullish. However, it must continue beyond ₿0.07 to sustain this bull run. A drop beneath ₿0.066 (200-day EMA) would turn the market neutral, with a further drop beneath ₿0.06 turning the market bearish.

If the sellers push lower, the first support lies at ₿0.067 (.382 Fib Retracement). This is followed by ₿0.0651 (.5 Fib Retracement), ₿0.0632 (.618 Fib Retracement), ₿0.062, and ₿0.06 (.786 Fib Retracement).

Where is the resistance toward the upside?

On the other side, the first resistance lies at ₿0.069 (bearish .618 Fib Retracement). Above ₿0.07, resistance lies at ₿0.0708, ₿0.0727 (bearish .786 Fib), ₿0.075, ₿0.076, ₿0.0776, and ₿0.079.

Keep up to date with the latest ETH price predictions here.

coincodex.com

coincodex.com