Key highlights:

- Bitcoin is down by a sharp 24% over the past week as the coin currently trades beneath $45,000.

- Elon Musk is back at it again as his Tweets start to inject confusion within the market.

- The latest price drop caused BTC to spike to lows not seen since early February 2021.

Buy Bitcoin on Binance

| Bitcoin price | $44,917 |

|---|---|

| Key BTC resistance levels | $47,000, $48,000, $50,000, $50,860, $52,915 |

| Key BTC support levels | $42,800, $42,165, $40,765, $40,000, $39,165 |

*Price at the time of writing

Bitcoin is down by a steep 24% over the past week of trading as the coin reached as low as $42,165 during today’s trading session. The coin has been falling ever since it broke beneath a rising wedge in the first fortnight of May and ended up breaking beneath the April lows at $47,000 over the weekend.

Last week, the price fall started when Elon Musk announced that Tesla would stop accepting Bitcoin payments in exchange for their electric vehicles. Musk cited that Bitcoin mining used too much dirty energy, and it was unsustainable for the environment.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

The news caused BTC to drop from around $58,000 as it crashed beneath $50,000. Over the following days after his Tweet, BTC continued to crash, reaching the support at $47,000 (.5 Fib Retracement & the April lows).

Since the Tweet, it seems that Bitcoiners are starting to turn on Musk with his market-moving antics. In a series of Tweets, Musk alluded to the fact that he might be about to sell his Bitcoin and double down on Dogecoin itself.

The first Tweet that started the cascade of sell-off was just one word from Musk. A crypto user stated that Bitcoiners would “slap themselves” when Tesla dumps its Bitcoin holdings next month after the total amount of hate that Musk was receiving. To this, Elon replied, “Indeed”:

Bitcoiners are going to slap themselves next quarter when they find out Tesla dumped the rest of their #Bitcoin holdings.

— Mr. Whale (@CryptoWhale) May 16, 2021

With the amount of hate @elonmusk is getting, I wouldn’t blame him…

Later, Peter McCormack created a Tweet thread in which he stated his concern about not being able to tell if Elon Musk was trolling or not:

1/ Dear @elonmusk. The perfect troll is one where people don't know whether it is a troll or not. Your recent poorly informed criticism of #bicoin + support for Doge may be the perfect troll...or you might actually believe this (God I hope not).

— Peter McObnoxious (@PeterMcCormack) May 16, 2021

He continued the thread by stating that Dogecoin investors are the ones that are likely to get rekt from Musk’s antics after explaining that Doge is a joke coin that has no real developers and little purpose beyond ‘coin-flipping.’

McCormack finished the thread by stating that it might be fun and games for Musk, but the impact on others is real:

19/ It might be all fun and games for you but the impact on others is real.

— Peter McObnoxious (@PeterMcCormack) May 16, 2021

Basically, you are being a bit of a dick mate.

It is a relatively long thread and deserved a read. However, it seems that Musk was not pleased with this attack and replied with the following;

Obnoxious threads like this make me want to go all in on Doge

— Elon Musk (@elonmusk) May 16, 2021

Fast forward to today, Bitcoin was down almost 20% as it hit a low price of around $42,165. It was here when Elon Musk Tweeted again to confirm that Tesla had not sold any Bitcoin:

To clarify speculation, Tesla has not sold any Bitcoin

— Elon Musk (@elonmusk) May 17, 2021

The market cap for Bitcoin has continued to sink further beneath $1 trillion as it currently sits at $843 billion.

Let us take a quick look at the markets and see where we might be heading.

Bitcoin Price Analysis

What has been going on?

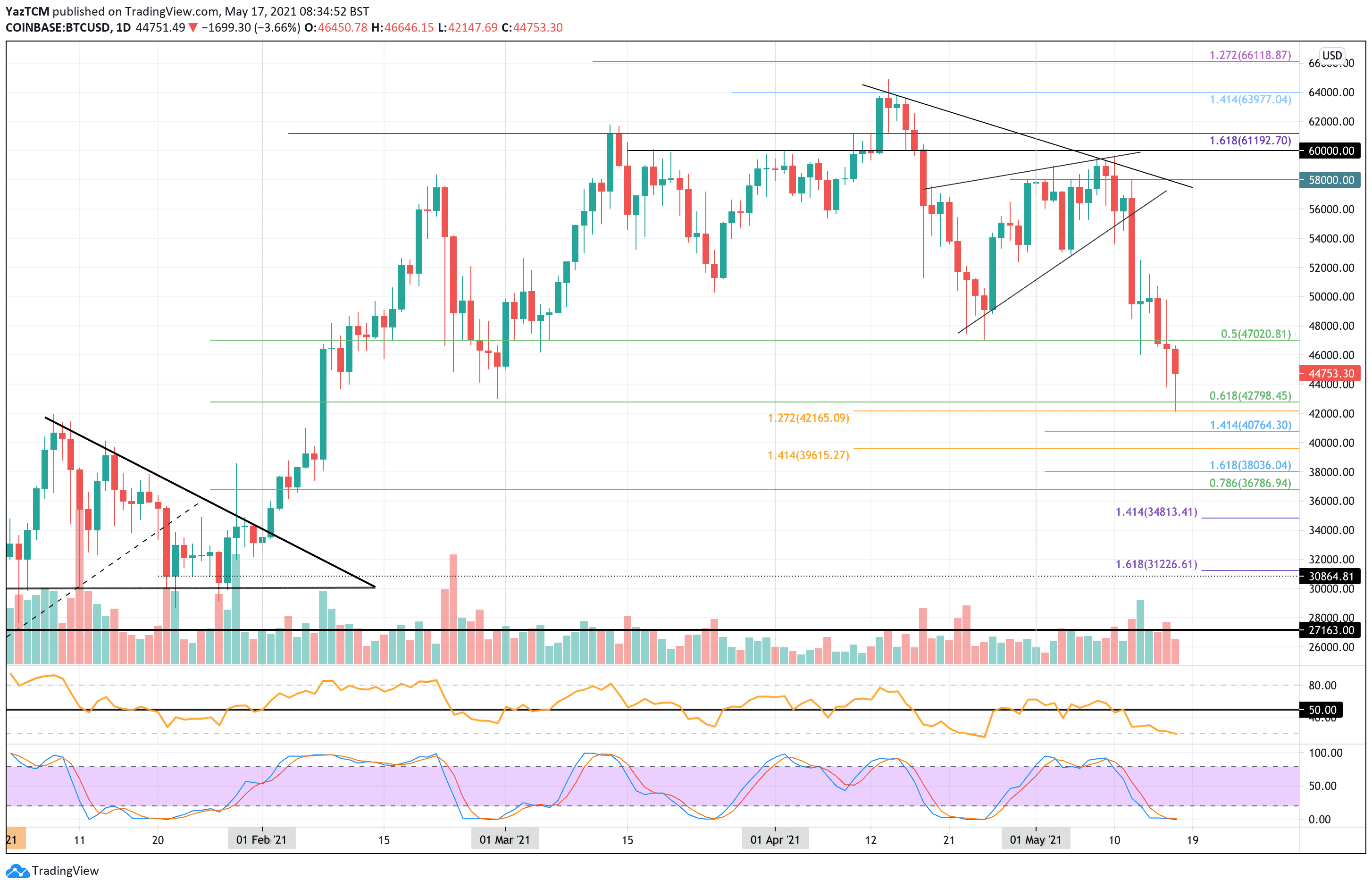

Taking a look at the daily chart above, we can see that Bitcoin has been trading lower since setting the ATH price toward the middle of April. It had dropped as low as $47,000 during April, where it met support at a .5 Fib Retracement level and rebounded higher.

In the first few days of May, Bitcoin struggled to break above $58,000. It did briefly spike higher above the resistance but could not continue upwards of $59,000.

Last week, we can see BTC breaking toward the downside of the wedge that it was trading inside. The coin did manage to hold the support at $47,000 (.5 Fib & April lows), but this support was penetrated over the weekend as BTC started to slide.

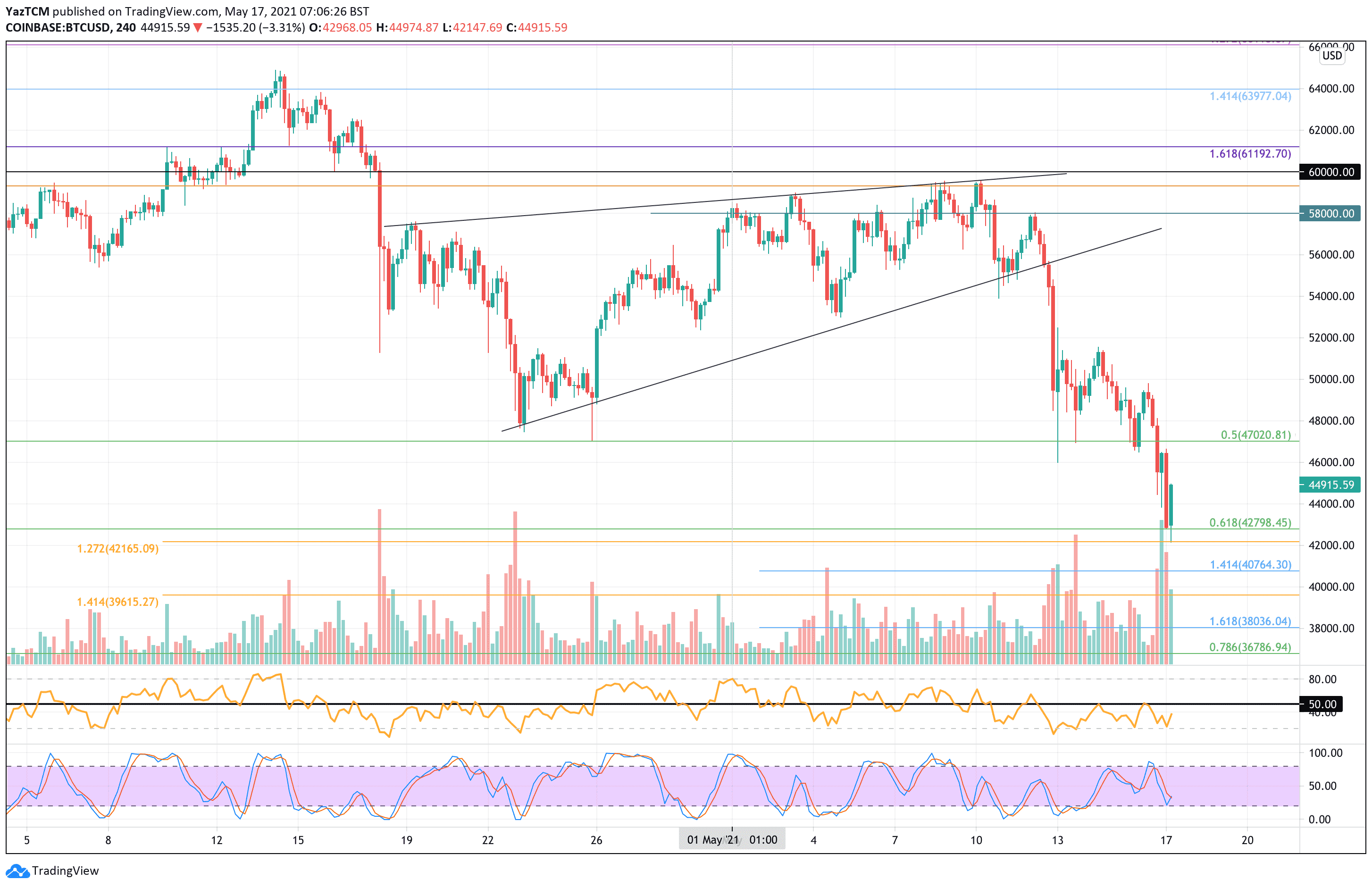

Today, we can see that the fear created by Musk has caused Bitcoin to reach a new low that has not been seen since early February at $42,165 (downside 1.272 Fib Extension). More specifically, the market found solid support at $42,800 - provided by the .618 Fib Retracement. You can see this clearer on the 4-hour chart.

Bitcoin price short-term prediction: Bearish

Bitcoin has now created a lower low after breaking beneath the April lows and has to be considered as bearish in the short term. A break back above $47,000 would turn the market neutral again, but BTC would have to push further north of $60,000 to turn bullish.

If the bears push the market lower again, the first level of support lies at $44,000. This is followed by $42,800 (.618 Fib Retracement), $42,165 (downside 1.272 Fib Extension), $40,765 (downside 1.414 Fib Extension - blue), and $40,000.

If the bears continue to push BTC beneath $40,000, added support lies at $39,615 (downside 1.414 Fib Extension), $38,000 (downside 1.618 Fib Extension - blue), and $37,786 (.786 Fib Retracement).

Where Is The Resistance Toward The Upside?

On the other side, the first level of strong resistance lies at $47,000. This is followed by $50,000, $50,860 (bearish .5 Fib Retracement, $52,000, $52,915 (bearish .618 Fib Retracement), $44,840 (bearish .786 Fib Retracement), $58,000, and $60,000.

Where Are The Technical Indicators Showing?

The RSI is now back at extremely oversold conditions, indicating that the bears might be exhausted. If it started to turn upward from here, this would indicate that the bearish momentum is starting to lose steam again.

Additionally, the Stochastic RSI is primed for a bullish crossover signal that should help to send the market higher.

Keep up-to-date with the latest Bitcoin Price Predictions here.

Previous BTC analysis

At CoinCodex, we regularly publish price analysis articles focused on the top cryptocurrencies. Here's 3 of our most recent articles about the price of Bitcoin:

- Bitcoin Sees Sharp Drop Beneath 100-days EMA As Tesla Pulls U-Turn On BTC Payments - More Pain Incoming? (Neutral)

- Bitcoin Sees 7% Price Drop And Breaks Beneath 50-day EMA, Are We Heading Back To $50,000? (Bullish)

- https://coincodex.com/article/11183/bitcoin-dominance-analysis-btc-dominance-trading-in-long-term-ascending-triangle-is-altseason-20-being-pushed-further-back/ (Bullish)

coincodex.com

coincodex.com