Volatility is rampant in the cryptocurrency market, wiping many overleveraged Bitcoin traders.

Bitcoin Wipes Out Overleveraged Traders

Bitcoin staged a 9,500-point turnaround in the past six days, gaining nearly 19% in market value.

According to Willy Woo, the impressive upswing seemed quiet as it lacked any significant liquidations. Such market behavior was odd since speculators do not usually profit “without being a little bit rekt.”

“This is like walking into a forest and noticing the birds just stopped tweeting,” said Woo.

Market makers seem to have heard Woo’s wise words as Bitcoin took a sudden 5.20% nosedive after peaking at a high of $59,920. Data from Bybt shows that $663,007,804 worth of leveraged positions were liquidated over the past four hours.

The largest single liquidation order happened on the Seychelles-based cryptocurrency exchange Huobi, at a value of $14,680,000.

Despite the massive losses incurred within such a short period, independent researcher and investor PlanB maintains that the recent downswing was part of a “stop-loss hunt” needed for Bitcoin to now march towards $60,000 or higher.

Beautiful stop loss hunting .. again. Now that all leveraged longs are liquidated, we finally have room for breaking $60K in April. pic.twitter.com/PgSVXUSAuA

— PlanB (@100trillionUSD) March 31, 2021

Technicals Highlight Further Losses Incoming

From a technical perspective, Bitcoin looks bound for further losses.

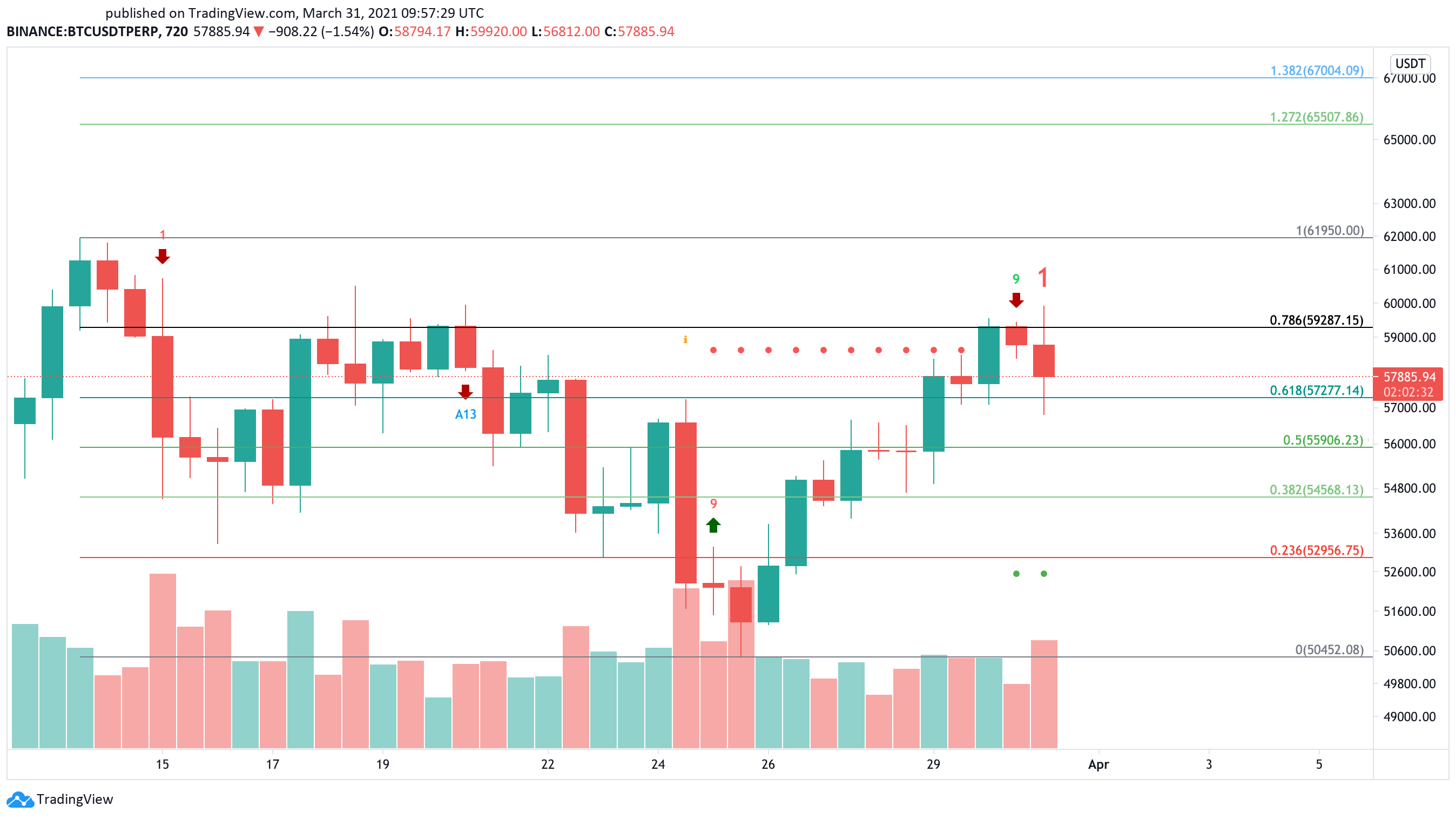

The Tom DeMark (TD) Sequential indicator presented a sell signal on the 12-hour chart. The bearish formation developed as a green nine candlestick, which is indicative of a one to four 12-hour candlestick correction.

A further spike in selling pressure could see Bitcoin drop towards the 38.2% Fibonacci retracement level at $54,600 before the uptrend resumes.

Given the strength of the 78.6% Fibonacci retracement level at $59,300, only a 12-hour candlestick close above this resistance barrier could invalidate the bearish outlook.

If this were to happen, Bitcoin would likely advance towards the recent all-time high of nearly $62,000 or higher.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

cryptobriefing.com

cryptobriefing.com