The First National City Bank of New York, Citi Bank, the banking arm of American multinational investment bank and financial service corporation, Citi Group, has been linked to a chart which says Bitcoin price will go bullish and hit $120,000 per unit value by the year 2021, the Chief Investment Officer of Altana Digital Currency, Alistair Milne, said in a recent statement.

Alistair Milne recently shared the chart on Twitter, According to Milne, the chart was sent through the Citibank’s FX Wire customer mailing list, hence associated with the First National City Bank of the US largest city.

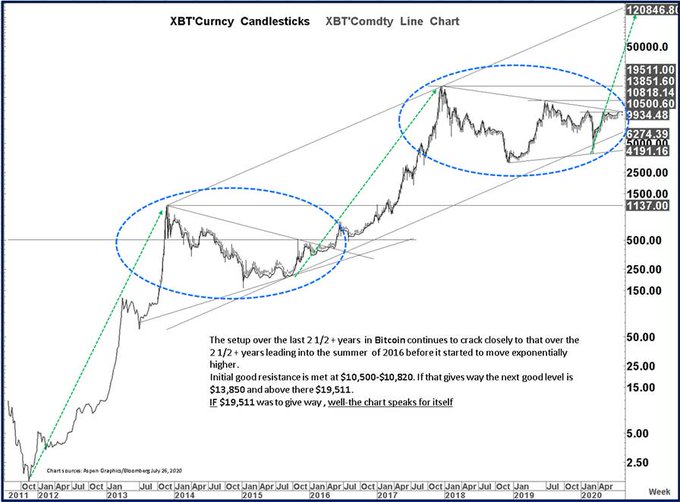

The Chart made reference to Bitcoin’s major break out in 4 years between 2011 and 2016, illustrating that the leading digital asset has high chances of rising beyond its previous high – $20,000 to reach a new high of $120,000 in less than 18 months.

It is important to mention that BTC has in a recent price rally has broken the past the $9,100 to $9,500 resistance levels, as well as the $10,000 psychological resistance level, reaching a new monthly high of $11,000 on the 27th of July. After rising high to around $11,300 yesterday, July 29, Bitcoin plummeted slightly, and it is priced around $10,900 at press time.

Citibank has in March integrated Ethereum-based blockchains into its trading platform, which is a likely indication that the financial firm has begun to take a strong interest in Cryptocurrency and technologies backing blockchain operation.

Added to that, Kris van Broekhoven, the Global Head for financial commodity trading for Citibank, attested that the bank has a keen interest in investing and keeping up to date with the benefits offered by blockchain technology to improve its financial services.

Bitcoin Price May Experience Massive Setback

In a similar development the Chief Executive Officer of the renowned on-chain analysis firm, Crypto Quant, Ki Young-Ju, has in a recent statement opined the growth of Bitcoin in the last few days is quite unusual for a sustainable Bitcoin rise.

He said the surge went too fast and some whales are also of the same opinion.

Ju illustrated with a chart that an increase the inflow of Bitcoin to exchanges was seen July 27, to a tune of about 5,000 BTC. However, he linked the high inflow to Bitcoin’s surge.

Several Bitcoin enthusiasts in the crypto space also agreed with Ju’s claim with the belief that a massive setback may be witnessed in BTC price if Bitcoin’s inflow to exchanges is maintained.