Bitcoin ownership underwent a pronounced realignment in 2025, with institutions absorbing the circulating supply while individual investors reduced their exposure.

According to the latest ownership study from River Financial, this change isn’t just a market cycle; it’s a major turning point in Bitcoin’s ownership history.

Key Points

- Corporations, funds, and governments collectively acquired nearly 829,000 $BTC in 2025, reshaping market control.

- Individual wallets shed almost 700,000 $BTC, providing liquidity for institutional buying.

- While individuals still hold about 66.7% of the Bitcoin supply, institutional influence is expanding, potentially altering liquidity and market dynamics.

Corporations Lead Institutional Buying

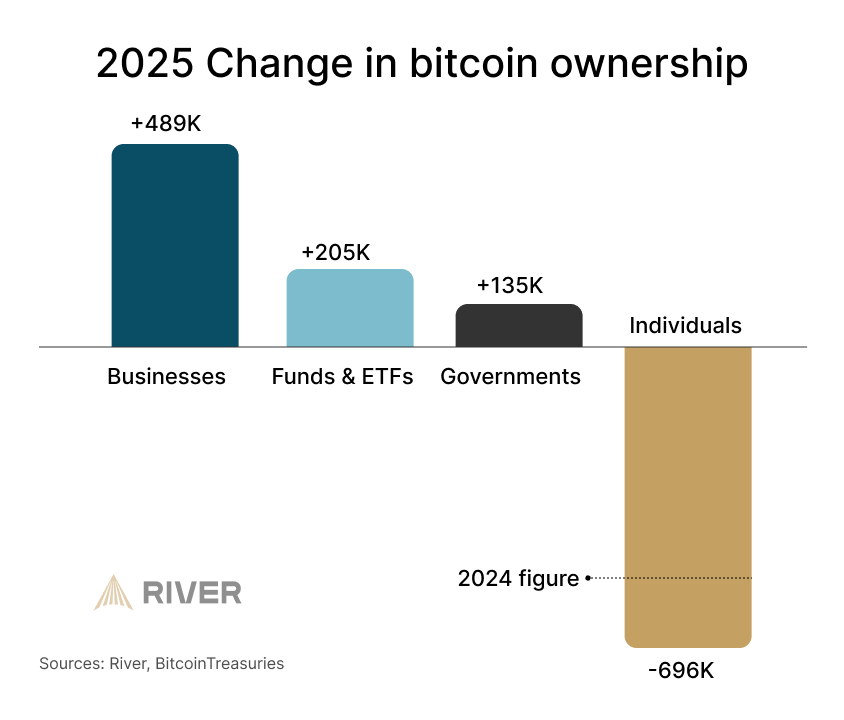

To begin with, corporate buyers led the institutional surge. Businesses added roughly 489,000 $BTC over the year, the largest net increase among tracked categories. Much of this growth stemmed from treasury allocation strategies, with companies increasingly treating Bitcoin as a reserve asset. As adoption spread, corporate balance sheets absorbed a meaningful share of circulating supply.

Investment vehicles expanded in parallel. Funds and exchange-traded vehicles added 205,000 $BTC in 2025, signaling rising demand for regulated, structured exposure. Governments followed suit, with public-sector wallets recording net purchases of 135,000 $BTC. The report links this activity to increasing state-level engagement with digital assets.

Collectively, corporations, funds, and governments accumulated 829,000 $BTC over the year, thereby shifting a substantial portion of the supply into institutional and professionally managed portfolios.

Retail Investors Reverse Course

While institutional ownership expanded, individual holders moved toward net distribution. River estimates that balances in personal wallets declined by 696,000 $BTC — the largest annual reduction on record for retail participants.

The data suggest that much of the liquidity enabling institutional purchases originated from individual sellers. This marks a notable reversal from prior cycles, when retail investors were typically net accumulators. The shift materially altered the balance of ownership between private and institutional participants.

Distribution Snapshot Highlights Structural Shift

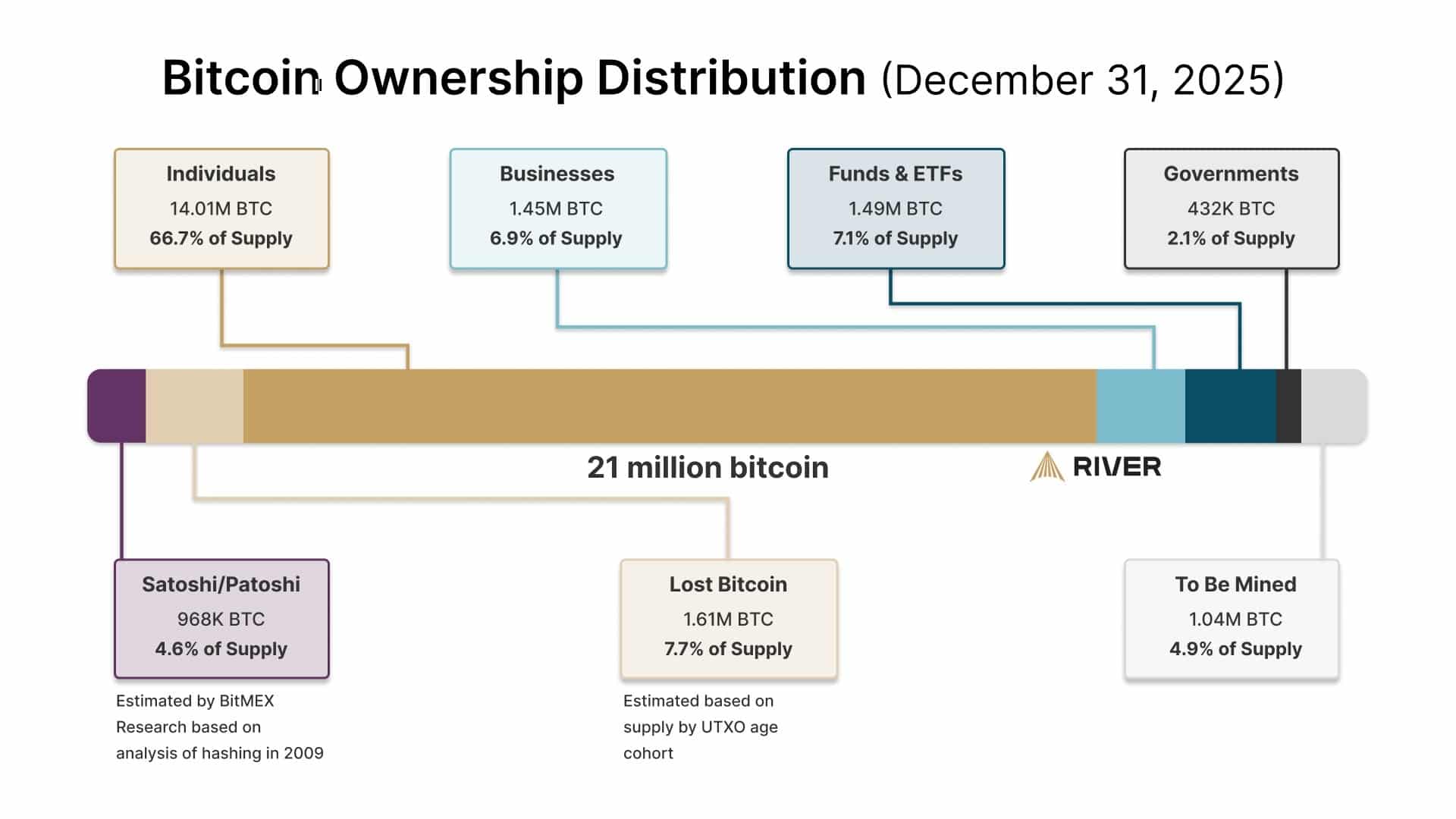

Despite the pullback, individuals remain Bitcoin’s largest ownership group. Personal wallets collectively hold about 14.01 million $BTC, roughly 66.7% of the fixed 21 million supply.

However, institutional shares continue to expand. Funds and ETFs account for approximately 1.49 million $BTC (7.1%), while corporate treasuries control about 1.45 million $BTC (6.9%). Government holdings total roughly 432,000 $BTC (2.1%).

River further estimates that wallets associated with Satoshi Nakamoto contain 968,000 $BTC (4.6%), whereas approximately 1.61 million $BTC (7.7%) are likely lost. Moreover, another 1.04 million $BTC, roughly 4.9% of the total supply, remains to be mined.

Overall, the 2025 data illustrate a clear redistribution of Bitcoin supply. Although individuals still dominate in absolute terms, institutional players are gaining ground — a development that could influence liquidity patterns, governance dynamics, and market structure in the years ahead.

thecryptobasic.com

thecryptobasic.com