MUFG Bank currency analyst Lee Hardman says stablecoins are proving to be a more practical form of money than volatile cryptocurrencies such as Bitcoin.

In a recent market note, Hardman explained that stablecoin growth is drawing more attention because these assets function as a digital form of cash.

Unlike Bitcoin and many other cryptocurrencies, stablecoins maintain a stable value, usually pegged 1:1 to major currencies like the U.S. dollar, euro, or pound, or in some cases to commodities such as gold.

Stablecoins such as $USDC and $USDT are built to avoid the sharp price swings that limit Bitcoin’s usefulness as everyday money. This stability has made them central to crypto markets. Around 80% of all trades on centralized exchanges are executed using stablecoins, highlighting their role as the backbone of crypto liquidity.

Key Points

- MUFG Bank analyst Lee Hardman says stablecoins work better as money than volatile Bitcoin.

- Dollar-pegged tokens like $USDT and $USDC now power about 80% of crypto exchange trades.

- Stablecoin market cap tops $310B, with nearly 99% tied to U.S. dollar-backed digital tokens.

- Hardman says stablecoins better meet money’s three roles, offering price stability and fast, low-cost payments.

Stablecoins Dominate Crypto Liquidity

Hardman noted that $USDT, issued by Tether, remains the largest and most widely used stablecoin globally. It is pegged to the U.S. dollar and backed by cash and U.S. Treasury bills. $USDT dominates liquidity across Asia, Latin America, and other emerging markets.

It is commonly used for savings, cross-border remittances, DeFi activity, and as a base trading pair across crypto platforms, accounting for more than 70% of stablecoin trading volumes.

Market Cap Surpasses $310 Billion

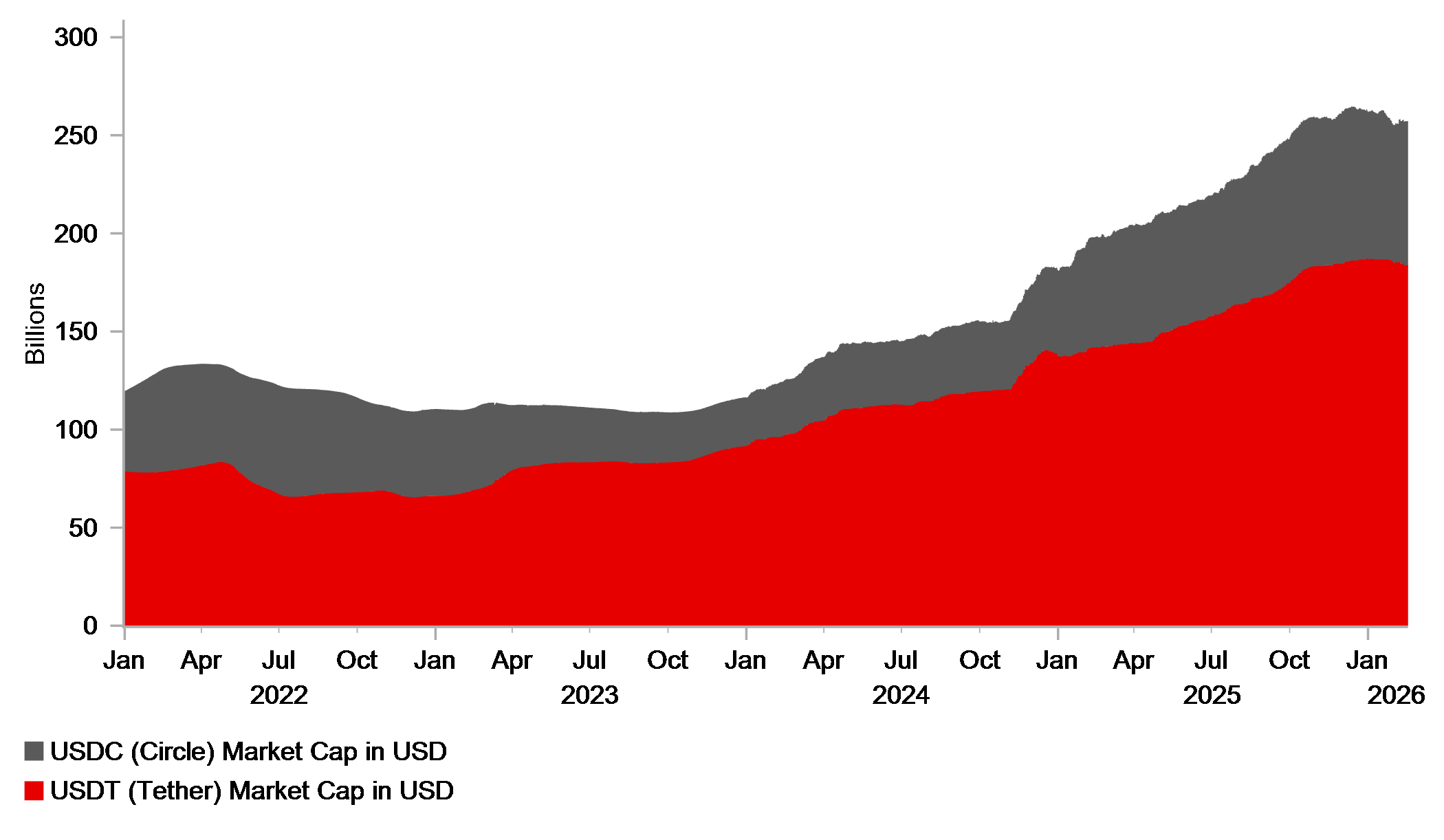

The total market capitalization surpassed roughly $310 billion earlier this year, with nearly 99% of that value tied to U.S. dollar-pegged tokens. $USDT alone stands at about $184 billion in market cap, while $USDC is near $74 billion.

Stablecoins now represent around 13% of the total crypto market, a share Hardman expects to rise over the next decade. Some estimates suggest the sector could grow to between $2 trillion and $4 trillion by 2030.

-

Chart by MUFG Bank

Chart by MUFG Bank

Fulfilling the Three Functions of Money

According to Hardman, stablecoins are better positioned than Bitcoin to fulfill the three main functions of money: a medium of exchange, a unit of account, and a store of value.

Their price stability makes them easier for merchants and users to accept, as there is less risk of value loss during transactions. They also enable near-instant global payments, operate 24/7, and typically carry lower fees than traditional banking or card networks.

As a result, stablecoins have become the preferred medium of exchange within digital environments, widely used for trading, lending collateral, and payments.

Hardman added that their appeal could be even stronger in high-inflation economies, where access to stable, dollar-linked digital cash can offer a practical alternative to weakening local currencies.

thecryptobasic.com

thecryptobasic.com