For the first time in five years, the Russell 2000 Index (IWM) is hitting record highs while bitcoin BTC$92,578.55, which usually tops in tandem, is out of sync and remains 27% below October's record. History suggests the largest cryptocurrency and cryptocurrencies more broadly are likely to catch up.

The Russell 2000, a gauge of U.S. small-cap equities, printed a record on Thursday, as did measures for bigger companies like the Dow Jones Industrial Average (DJIA) and the S&P 500 Index. The Nasdaq 100 is just below its all-time high and metals, led by silver, are also hitting peaks.

Since 2020, new highs in the Russell 2000 have typically coincided with new highs in bitcoin BTC$92,578.55. This alignment was evident in November 2021, when bitcoin peaked at $69,000. It appeared again in early November 2024, when bitcoin moved above $90,000, and again in mid October when it surged to $126,000. Both bottomed on Nov. 21.

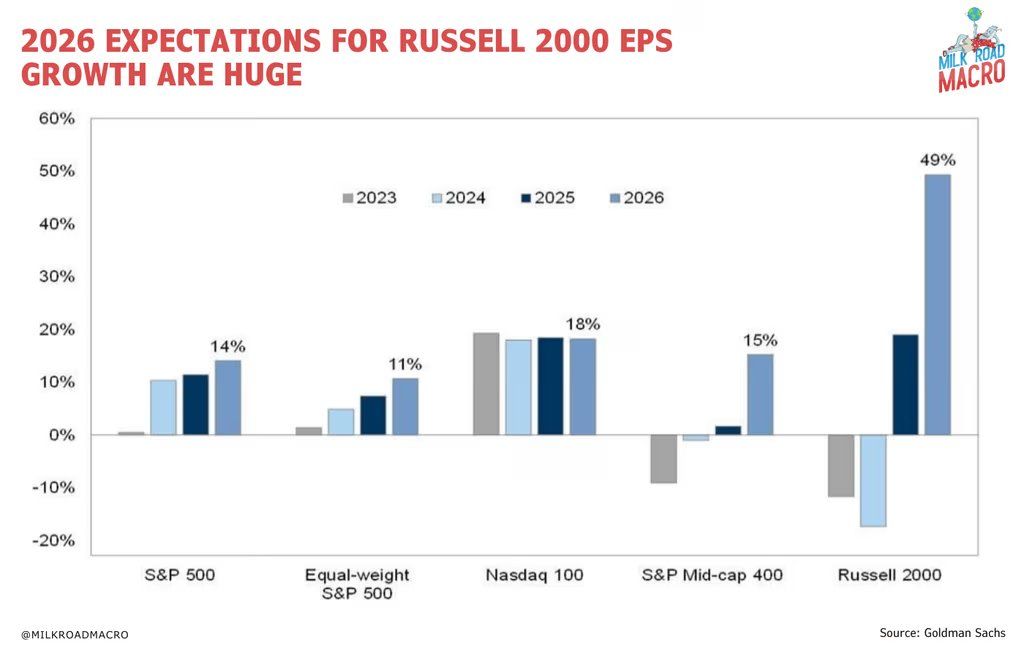

Milk Road Macro noted on X that smaller, more risky companies are more sensitive to interest-rate changes than large megacap stocks. This sensitivity is particularly important following the Federal Reserve’s 25 basis-point reduction on Wednesday. Expectations for 2026 Russell 2000 earnings-per-share growth are exceptionally strong at around 49%, according to Goldman Sachs.

Meantime, another 50 basis points-worth of rate cuts are currently priced into the market for the next 12 months, according to the CME Fed Watch Tool. Those would provide a further boost for riskier assets, like cryptocurrencies.

Fed Starts Treasury Bill Buying

Another source of liquidity is the start of the Fed's Treasury-bill purchase program. That begins later Friday, according to ZeroHedge, starting with $8.2 billion as part of its reserve management program.

The buying is part of a broader $40 billion Treasury bill purchase plan running from Dec. 12 alongside reinvestment of maturing agency securities, signaling a renewed liquidity injection into money markets.

coindesk.com

coindesk.com