A Senior Bloomberg Strategist says Bitcoin has entered what he calls a “do-or-die” moment.

Bitcoin has managed a mild recovery, but it still faces heavy pressure after several weeks of losses. Notably, this downtrend began after the crash on Oct. 10 and picked up again on Oct. 27.

From its Oct. 6 price of $123,519, Bitcoin fell nearly 20% to a new low of $98,898 on Nov. 4 before rebounding. Even after climbing back to the current price of $106,200, it remains roughly 14% lower than earlier in the month.

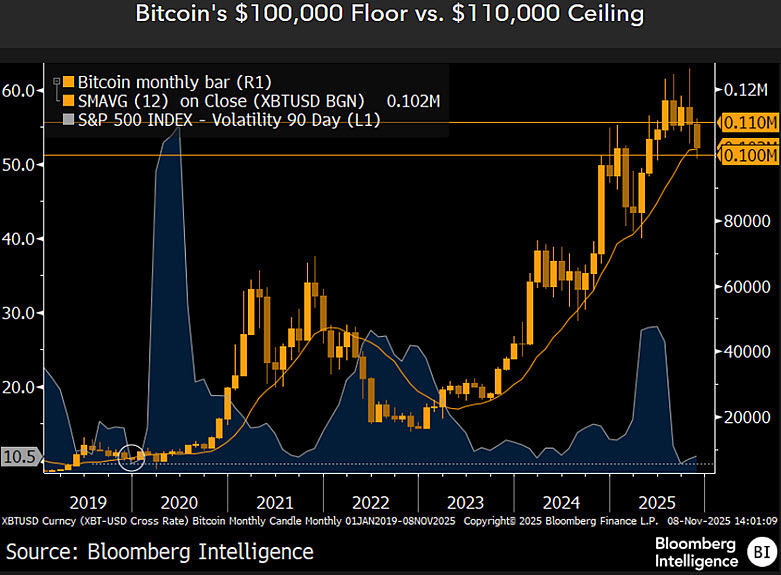

McGlone’s chart gives context to this view. Specifically, data confirms that Bitcoin started a strong rally in 2023, breaking past old resistance zones and reaching a new all-time high of $126,272 on Oct. 6.

From then on, buying momentum faded, and the candles on the chart began to show long upper wicks, an early sign of sellers overpowering buyers near the top. The 12-month simple moving average (SMAVG), which had been climbing steadily, started to flatten, showing that the bullish drive was weakening.

Today, Bitcoin trades between $100,000 and $110,000, a narrow band that McGlone calls the “make-or-break” zone. A move back above $110,000 could reignite market confidence and restore the uptrend, but slipping under $100,000 could lead to deeper losses.

Analysts Identify Bitcoin Critical Position

Other market analysts have also identified this critical position. For instance, Michaël van de Poppe, a well-known trader and analyst, noted that Bitcoin now faces strong resistance between $108,000 and $110,000.

Crucial resistance coming up for #Bitcoin.

The government shutdown is nearly over, which would be an ideal signal for the markets to turn back into bull mode.

To be honest, if $BTC breaks through $110K, we'll likely see a rally towards the ATH.

I do expect #Altcoins to… pic.twitter.com/5j0UEAkq3S

— Michaël van de Poppe (@CryptoMichNL) November 10, 2025

He said that breaking through this range could set the stage for a rally toward the all-time high, especially as the U.S. government shutdown nears its end. Van de Poppe added that if the rally resumes, altcoins could outperform Bitcoin during that bullish phase. This would likely lead to the much-anticipated altcoin season.

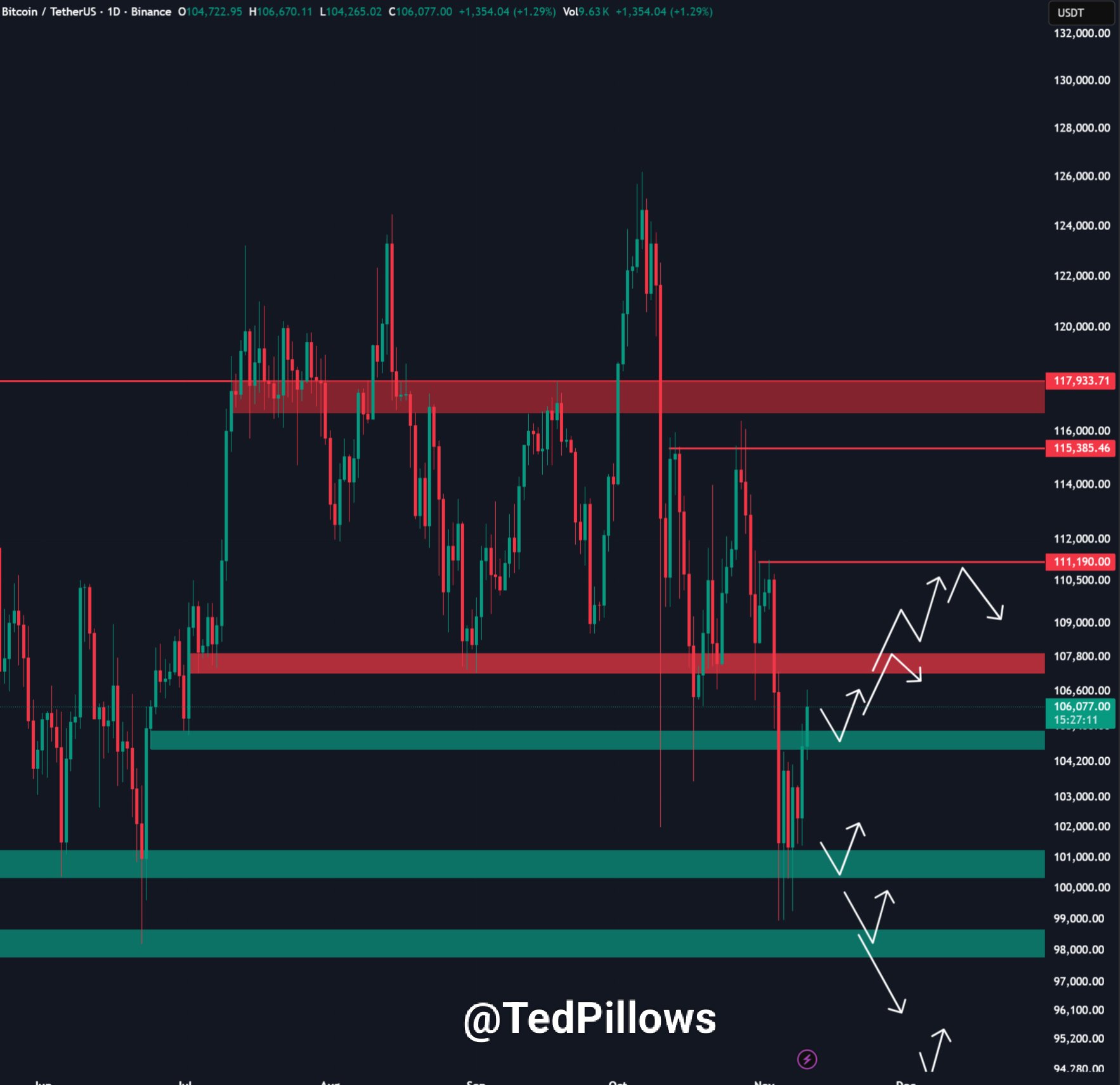

Another analyst, Ted Pillows, also identified the same price range. He noted that Bitcoin has regained support around $104,000, which currently serves as a short-term floor.

Pillows said that if Bitcoin reclaims the $108,000 to $109,000 zone, it could make a move toward its May 2025 highs. However, if it faces rejection, he expects the price to fall back to $104,000 to fill the CME gap left open in previous trading.

Meanwhile, institutions remain confident despite the uncertainty. Notably, Michael Saylor’s Strategy announced another purchase of 487 BTC worth $49.9 million today, bringing its total holdings to 641,692 BTC.

thecryptobasic.com

thecryptobasic.com