Bitcoin is nearing $85K amid rising long positions and MetaPlanet’s $26M BTC acquisition. Will this push the BTC price to $92K?

Bitcoin is trading at $84,949, recovering from a 1.83% pullback on Sunday. At the time of writing, it had started the week with an intraday gain of 1.49%.

With a 24-hour high of $85,496, Bitcoin is testing key resistance. A successful breakout could fuel momentum toward $92,000.

Bitcoin Nears Critical Resistance at $85K

On the daily chart, Bitcoin shows a strong rebound from the 50% Fibonacci retracement near $75,500, breaking through a long-standing descending resistance trendline. This movement ends the recent short-term pullback and the start of a potential bullish reversal.

After surpassing the 61.8% Fibonacci level around $82,000, Bitcoin is now testing the 200-day Exponential Moving Average (EMA), a key technical barrier. Reclaiming $85,000 convincingly would confirm bullish intent.

However, the 50-day EMA is still trending downward due to the recent correction, hinting at a potential “death cross” if it converges with the 200-day EMA. Despite this, the breakout has triggered a bullish crossover in the MACD and signal lines, supported by growing bullish histogram bars — signaling potential trend reversal.

The ongoing V-shaped recovery may face a retest of the broken resistance trendline near the 61.8% Fib level. A decisive 24-hour candle close above the 200-day EMA would significantly improve the chances of a continued rally.

Rising Long Positions Hint at Breakout Rally

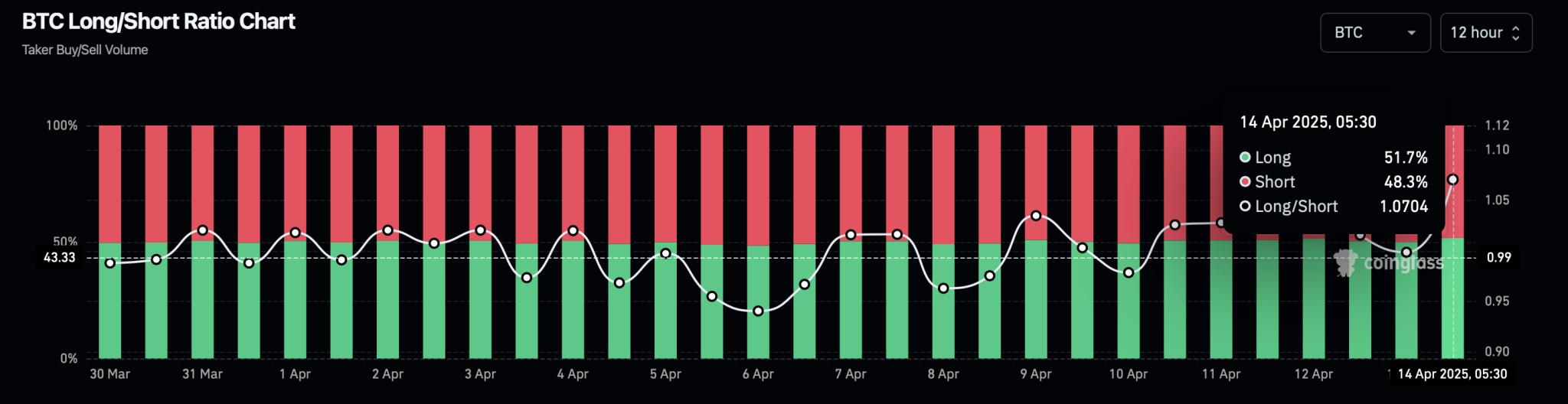

As BTC tests crucial resistance, the derivatives market is seeing a notable rise in long positions. According to Coinglass, the Bitcoin long/short ratio has increased to 1.0704, with long positions accounting for 51.7% in the last 12 hours.

This uptick in long positioning has pushed Bitcoin’s open interest to $55.73 billion, indicating strong participation and anticipation of a bullish breakout.

According to the Binance Bitcoin liquidation map, a price surge to $85,565 will liquidate $91.5 million of short positions. Meanwhile, a pullback to $83,825 could potentially lead to a steeper correction, with $104.64 million worth of long liquidations.

The next key support lies at $82,925, protecting $286.10 million in long positions.

Long-Term Holders Buy the Dip

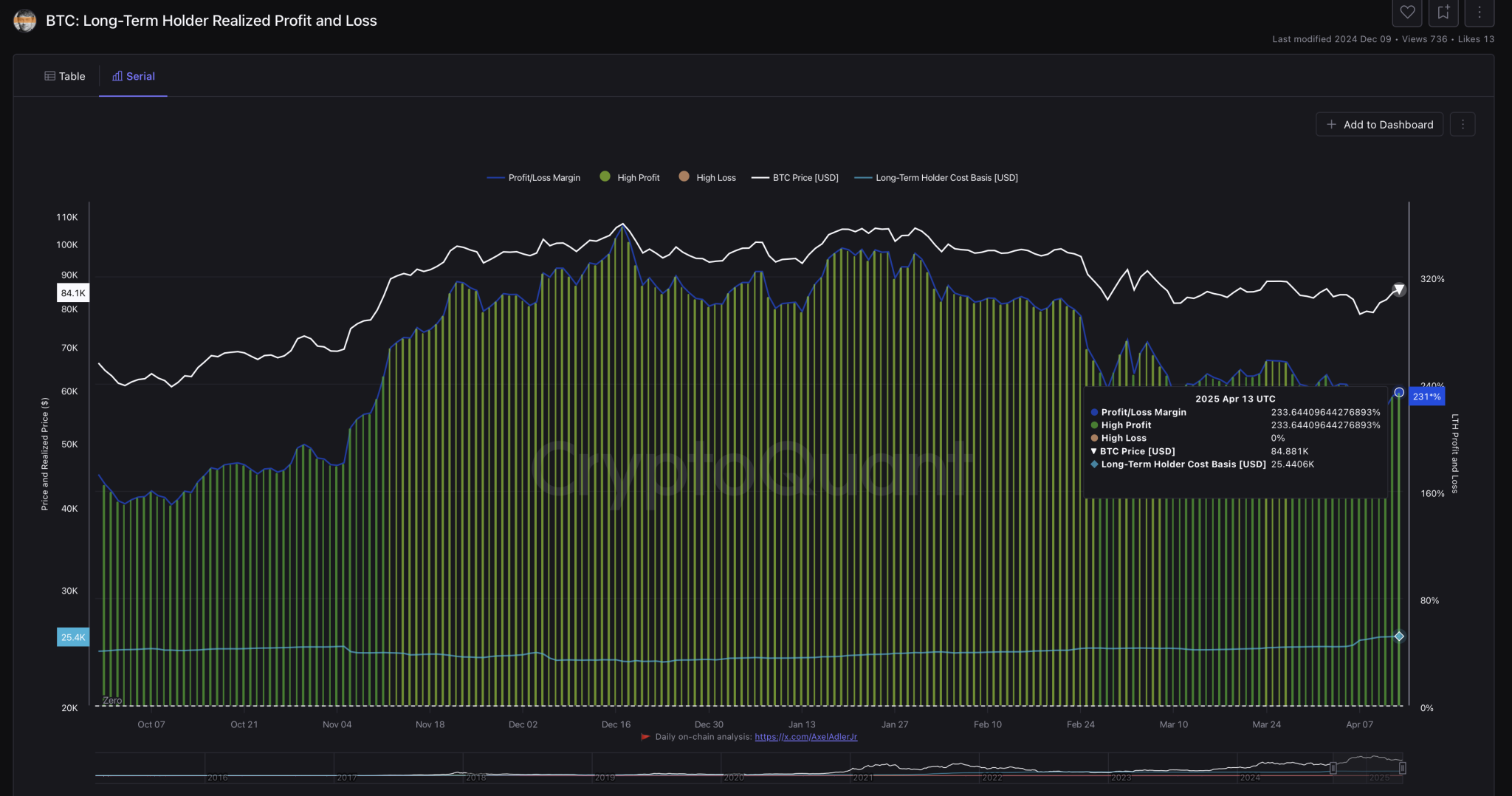

Confidence among long-term holders is growing. On April 13, the long-term holder (LTH) net position change was positive for the eighth consecutive day, rising by 266.57K BTC.

While realized profits among LTHs have dropped from a Q1 peak of 341% to 231%, their average cost basis has increased to $25.44K. This suggests strong conviction and continued accumulation, which could support further upside in BTC.

MetaPlanet Adds 319 BTC, Total Holdings Exceed 4,500 BTC

Amid market uncertainty, Japan-based MetaPlanet has doubled down on Bitcoin. The firm recently acquired 319 BTC for $26 million at an average price of $82,549, bringing its total holdings to over 4,525 BTC.

MetaPlanet has set a goal to accumulate 10,000 BTC by the end of 2025, reinforcing its long-term bullish stance.

Conclusion

Bitcoin is currently at a critical juncture, facing resistance at the $85,000 level — which aligns with the 200-day EMA. A bullish close above this zone could open the door to a rally toward $92,000, near the 78.6% Fibonacci retracement level.

On the downside, key support rests around $82,000, close to the 61.8% Fibonacci level. As long as this support holds and long positions keep building, Bitcoin remains poised for a bullish continuation.

thecryptobasic.com

thecryptobasic.com