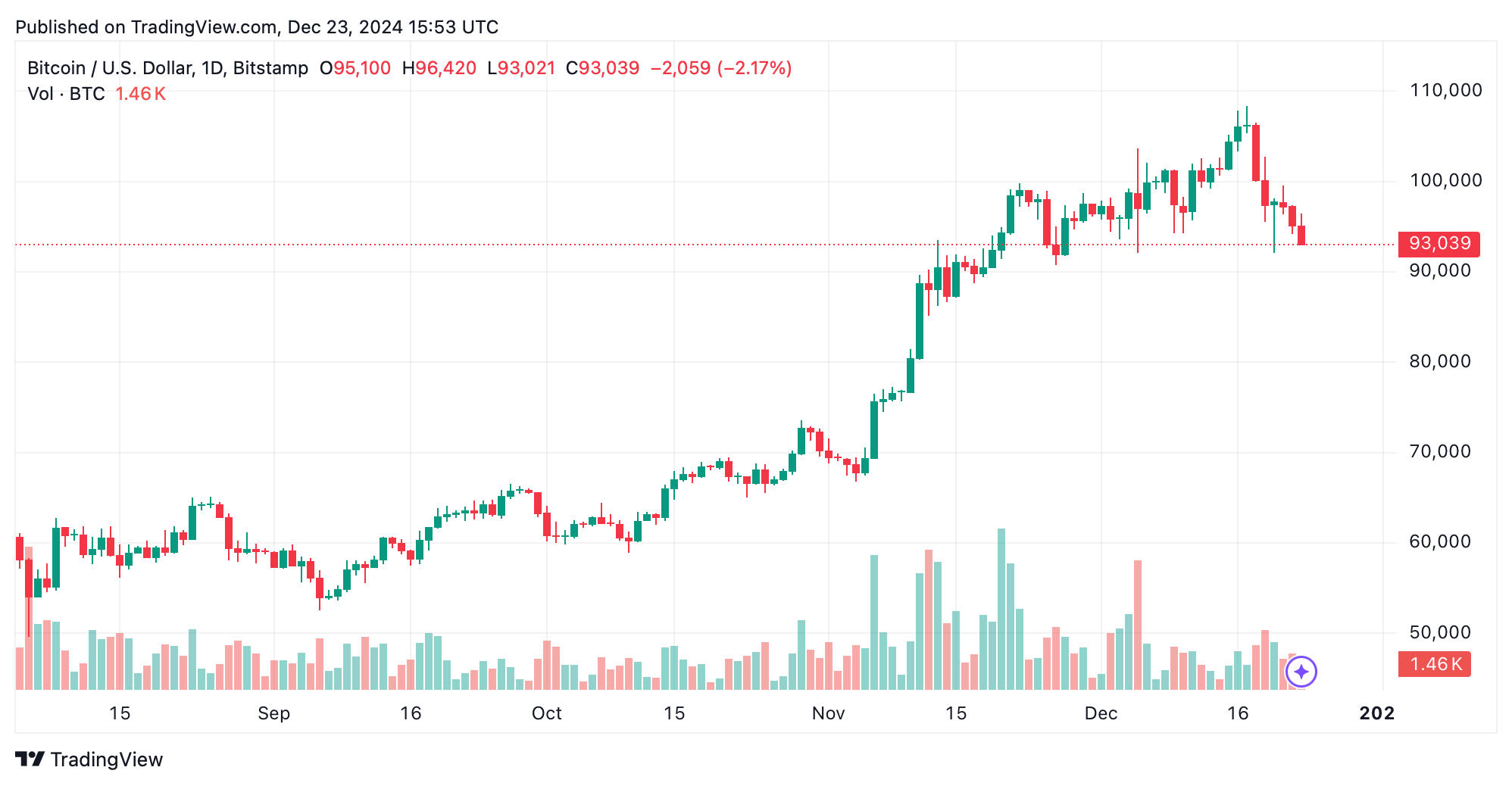

Bitcoin’s value slid early Monday, dipping beneath the $94,000 mark. In the past 24 hours, a combined $271.22 million in crypto positions—both short and long—have been cleared out.

Bitcoin Slides Into the Red—South Korea’s Premium Returns

The leading digital asset, bitcoin (BTC), has dropped 2.1% against the U.S. dollar as of Dec. 23, marking an 11.5% decline over the past week. On Monday, BTC’s market cap hovers at $1.84 trillion, making up 57% of the $3.24 trillion global crypto market. The 2.1% dip shaved approximately $3,000 off BTC’s price.

Activity remains calm, likely reflecting the start of the holiday week, with bitcoin’s Monday morning trading volume settling at $57 billion. Across the crypto market, global trade volume has reached $155 billion. Key trading pairs for BTC include tether (USDT), USD, FDUSD, USDC, and KRW.

At 10:45 a.m. ET on Monday, bitcoin trades at $93,235. However, on South Korea’s Upbit exchange, BTC is priced at $97,729 per coin. Around 1.77% of BTC trades in the past 24 hours have been carried out in Korean won. Meanwhile, the crypto derivatives market has witnessed $271.22 million in positions liquidated.

Bitcoin led the liquidation tally, with $63 million worth of positions wiped out in the past day. Of that, $44.4 million represented long bets. Ethereum derivatives also saw significant action, with $60 million liquidated, including $40 million in long positions. Overall, longs accounted for $183.78 million of the $271.22 million cleared across the market.

Crypto enthusiasts are buzzing with questions about the market’s next move. Etoro analyst Simon Peters shares the curiosity, posing the same query in a market note to Bitcoin.com News. “The question now is if we’ll continue to see a deeper retracement in crypto markets as the comments from Powell at last week’s conference continue to be absorbed,” Peters said. “Or if investors will see this as an opportunity to ‘buy the dip’ and remain bullish on the longer term outlook for crypto markets.”

news.bitcoin.com

news.bitcoin.com