Bitcoin’s price surge toward the $100,000 mark on December 20 appeared bittersweet for investors in the US spot Bitcoin exchange-traded funds (ETFs). While Bitcoin briefly exceeded $99,000 earlier in the day, the positive price movement contrasted sharply with the net outflows from Bitcoin spot ETFs, which saw a significant drain of capital.

Monday began on a positive note for Bitcoin (BTC) investors, with the cryptocurrency’s price rising from around $101,000 to surpass $108,000 by Tuesday, marking a new all-time high. Expectations were high for a potential rise toward $110,000, especially following the US rate cut on Wednesday. However, Bitcoin’s momentum quickly stalled, and the cryptocurrency began retracing its gains.

Bitcoin first dropped below $100,000, and the selling pressure continued as the price fell further, reaching a three-week low of $92,000 on Friday. This prompted speculation about whether the market was undergoing a normal correction or if it was the end of the ongoing bull run.

Record outflows and price pressures

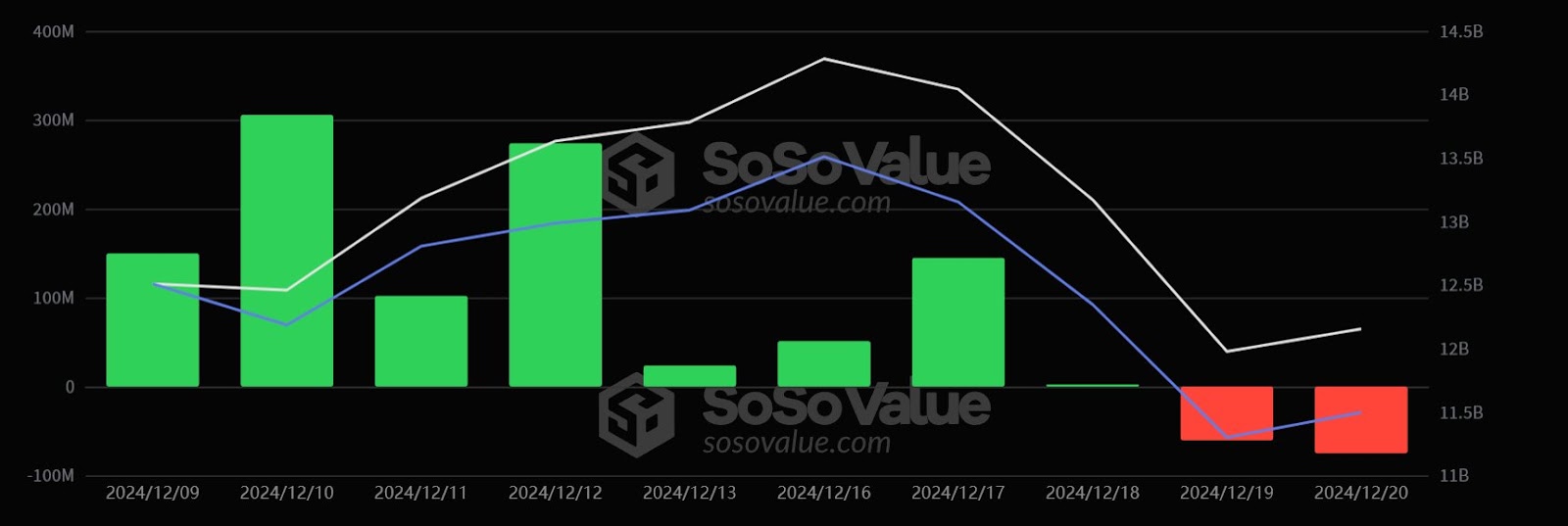

On December 20, Bitcoin ETFs experienced a net outflow of $277 million, as reported by several sources, including Farside Investors. The iShares Bitcoin Trust (IBIT) faced its largest net outflows on record, shedding $72.7 million. Meanwhile, Grayscale’s Bitcoin Trust (GBTC) saw a net outflow of $57.36 million.

According to Sosovalue data, the total net asset value of Bitcoin spot ETFs stood at $109.7 billion by the end of the day, a notable decrease from the $121.7 billion recorded on December 17.

This decline in BTC ETF assets followed a particularly tough day for the sector on December 19, when Bitcoin ETFs logged an astonishing $671.9 million in net outflows, the largest single-day outflow of the year.

The outflows were led by Grayscale’s GBTC, which lost $208.6 million, followed by ARK Invest’s ARKB, which saw a decrease of $108.4 million. These outflows coincided with BTC’s price dipping to around $96,409, exacerbating the market downturn, which saw over $1 billion in liquidations within 24 hours.

Ethereum ETFs also experience outflows

Ethereum’s ETF performance mirrored Bitcoin’s struggles on December 20, with Ethereum spot ETFs facing a net outflow of $75.12 million. As reported by Colin Wu, the total net asset value of Ethereum ETFs stood at $12.16 billion, with cumulative net inflows reaching $2.33 billion.

Ethereum spot ETF had a total net outflow of $75.1159 million on December 20, and the total net asset value of Ethereum spot ETF was $12.155 billion. The historical cumulative net inflow has reached $2.328 billion. https://t.co/Tvs2oCSxTg pic.twitter.com/accHR00Ko3

— Wu Blockchain (@WuBlockchain) December 21, 2024

While Ethereum’s price suffered during the market-wide crash, it showed signs of recovery by mid-week. Ethereum dropped to $3,300 but rebounded to hover near $3,500, marking a 6% daily increase.

Buyers return to the market

Bitcoin’s downward spiral slowed towards the end of Friday, and buyers returned to the market, leading to a resurgence in price. On December 20, Bitcoin made an impressive rebound, surpassing $99,000 before stabilizing at around $98,500.

The rebound in BTC’s price can be attributed, in part, to renewed buying activity, particularly on the largest US exchange, Coinbase. After a period of sell-side pressure, buyers began to step in, helping to halt BTC’s freefall.

“Coinbase buying a lot since lows,” noted popular trader Exitpump on X, who pointed to the contrast between buying volumes on Coinbase and Binance. This influx of buying support helped buoy Bitcoin’s price and reversed its recent downward trend.

Altcoins recover as the market turns green

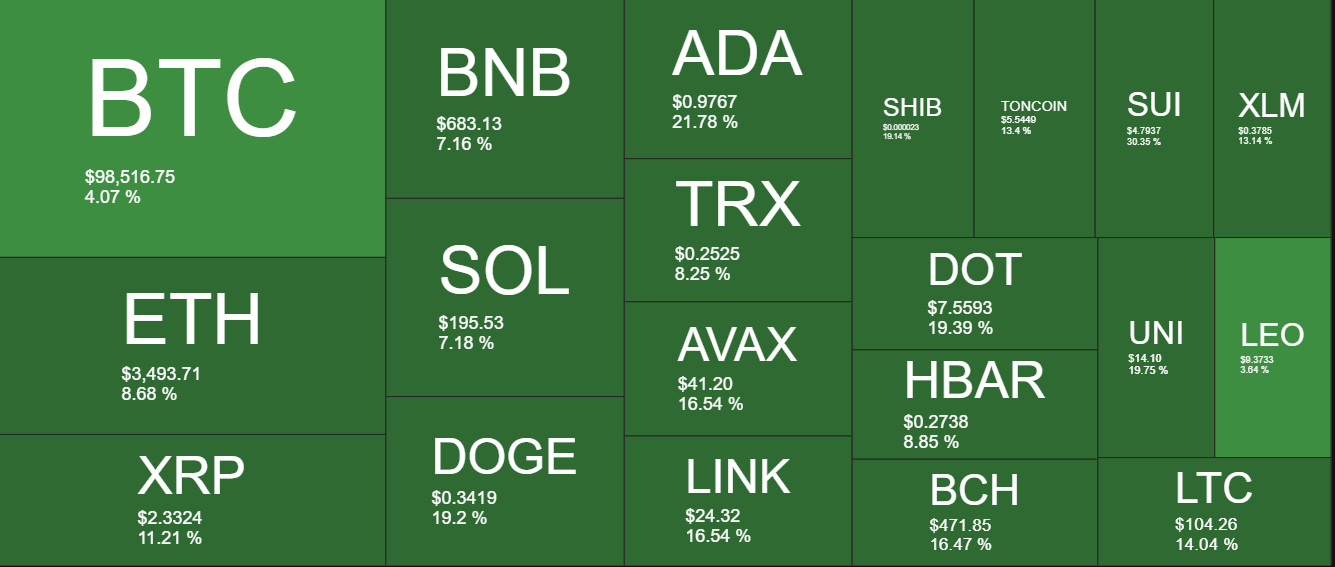

The broader cryptocurrency market, which had been rocked by the sharp downturn earlier in the week, saw altcoins begin to recover. Several altcoins that had taken significant hits during the market-wide crash started to gain ground.

BNB, SOL, TRX, and HBAR each posted daily increases of 5-6%. More substantial gains were seen from the likes of DOGE, ADA, AVAX, LINK, SHIB, TON, and DOT, which saw double-digit increases.

As the market steadied, many altcoins were recovering their losses, offering a glimmer of hope for investors after a turbulent period. The significant rebound of Ethereum and other top altcoins signaled potential stabilization for the broader cryptocurrency sector, though BTC’s performance remained the key focus for market participants.

With BTC’s price still hovering near $98,500, traders and investors are closely monitoring the asset’s next moves, hoping it will regain and maintain levels above $100,000.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan

cryptopolitan.com

cryptopolitan.com