Bitcoin (BTC) is pushing to regain its six-figure valuation following a period where it risked falling below $90,000 support zone. However, on-chain data suggests a new record high could be on the horizon amid the recent volatility.

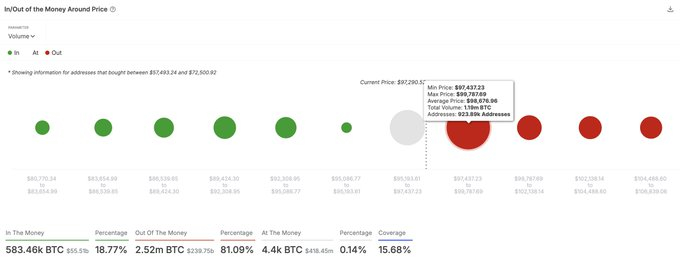

Specifically, data indicates that Bitcoin is currently hovering near a critical price range between $97,500 and $99,800, where over 924,000 addresses previously purchased more than 1.19 million BTC.

To this end, prominent on-chain cryptocurrency analyst Ali Martinez identified this zone as a ‘brick wall’ due to the magnitude of Bitcoin accumulated at these levels, he said in an X post on December 21.

“Bitcoin faces a brick wall between $97,500 and $99,800. <…> If BTC can manage to break above this level, we could see new all-time highs soon,” Santana noted.

A breakdown of the data shows that wallets holding approximately 583,460 BTC are currently profitable, representing 18.77% of the market. On the other hand, 2.52 million BTC, or 81.09%, is held at higher levels, awaiting price recovery, while a minimal 4,400 BTC is sitting at breakeven.

Generally, a break above the $97,500-$99,800 range would signal strong bullish momentum and possibly trigger ‘Fear of Missing Out’ (FOMO) from investors on the sidelines.

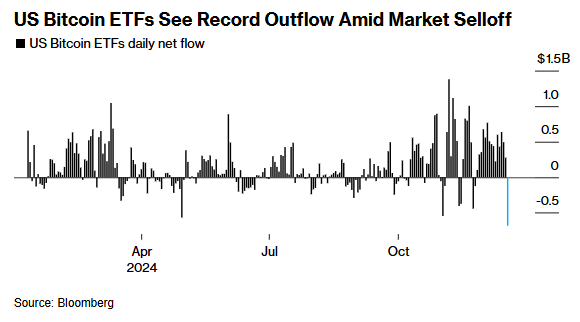

This projection comes after Bitcoin briefly dipped to $92,000 before rebounding as the cryptocurrency market experienced sustained volatility. Notably, these conditions were triggered by the Federal Reserve, which signaled the possibility of fewer interest rate cuts in 2025.

Indeed, this scenario saw the market record significant outflows that also impacted spot exchange-traded funds (ETF). To this end, on December 19, Bitcoin ETFs recorded a $680 million outflow, the largest in their history.

What next for Bitcoin?

Following the recent price movement, cryptocurrency trading expert Alan Santana stressed in a TradingView post on December 21 that the recent drop is not cause for concern.

Santana stated that the drop to $92,000 should be considered a healthy correction. The cryptocurrency has already rebounded to $97,000, reinforcing its bullish momentum.

The expert highlighted that $90,000 level, aligning with the 55-day Exponential Moving Average (EMA) on the daily chart, is a critical support level that remains untested—a sign of market strength.

While $100,000 was temporarily breached, it remains within reach for another attempt. Santana noted that longer-term projections point to key Fibonacci extension levels at $113,968, $138,794, and $163,620 as Bitcoin advances.

Overall, he attributed the shakeout to profit-taking by major investors as part of a broader bullish trend that continues to unfold. Santana suggested that the next primary growth phase could pick up speed by late February, while periods of consolidation and altcoin expansion provide interim opportunities.

“Bitcoin won’t move overnight, it takes time to grow. We are looking at two months, late February, for maximum speed and maximum growth. But we can experience some high, some sideways, some consolidation while the Altcoins grow,” he said.

Bitcoin price analysis

Bitcoin was trading at $98,510 by press time, rallying over 3.5% in the last 24 hours. On the weekly chart, BTC is down 3%.

As things stand, Bitcoin’s technical setup is pointing to a continuation of renewed bullish momentum, with the asset well positioned above its 50-day simple moving average ($91,185) and the 200-day SMA ($69,891).

Despite this, market sentiment is bearish, though the Fear & Greed Index sits at 73 (Greed), reflecting investor confidence. The 14-day Relative Strength Index (RSI) at 50.65 indicates neutral momentum.

Overall, attention is on bulls to sustain the ongoing momentum and help Bitcoin establish its price above $99,000 for a possible stab at a new record high.

Featured image via Shutterstock

finbold.com

finbold.com