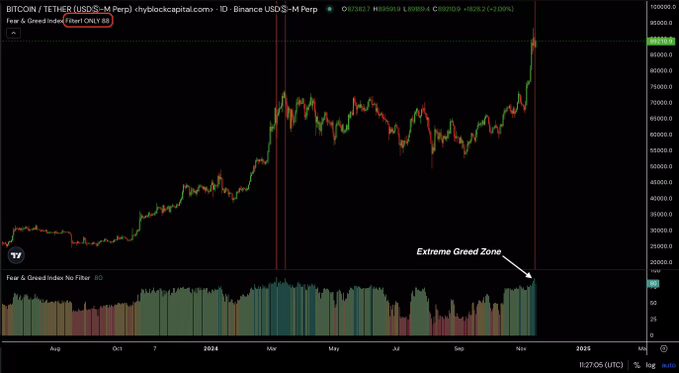

Bitcoin recently entered what many refer to as the “Extreme Greed” zone, as observed on the Fear and Greed Index.

Historically, this zone signals a heightened level of investor optimism, often driven by expectations of continued upward price movement.

In the last week, the index hit starkly high levels, marked by dark-green column bars, indicating an intense accumulation phase.

Bitcoin prices responded by surging to new highs, flirting with price points previously seen as lofty aspirations.

The climactic rise stirred speculation among traders and analysts about an impending correction.

This pattern is not new; similar spikes in the index have typically led to pullbacks as traders take profits and the market re-calibrates.

With the index peaking, the community is on edge, anticipating whether Bitcoin will sustain its bullish momentum or succumb to a sell-off, triggered by profit-taking and market jitters.

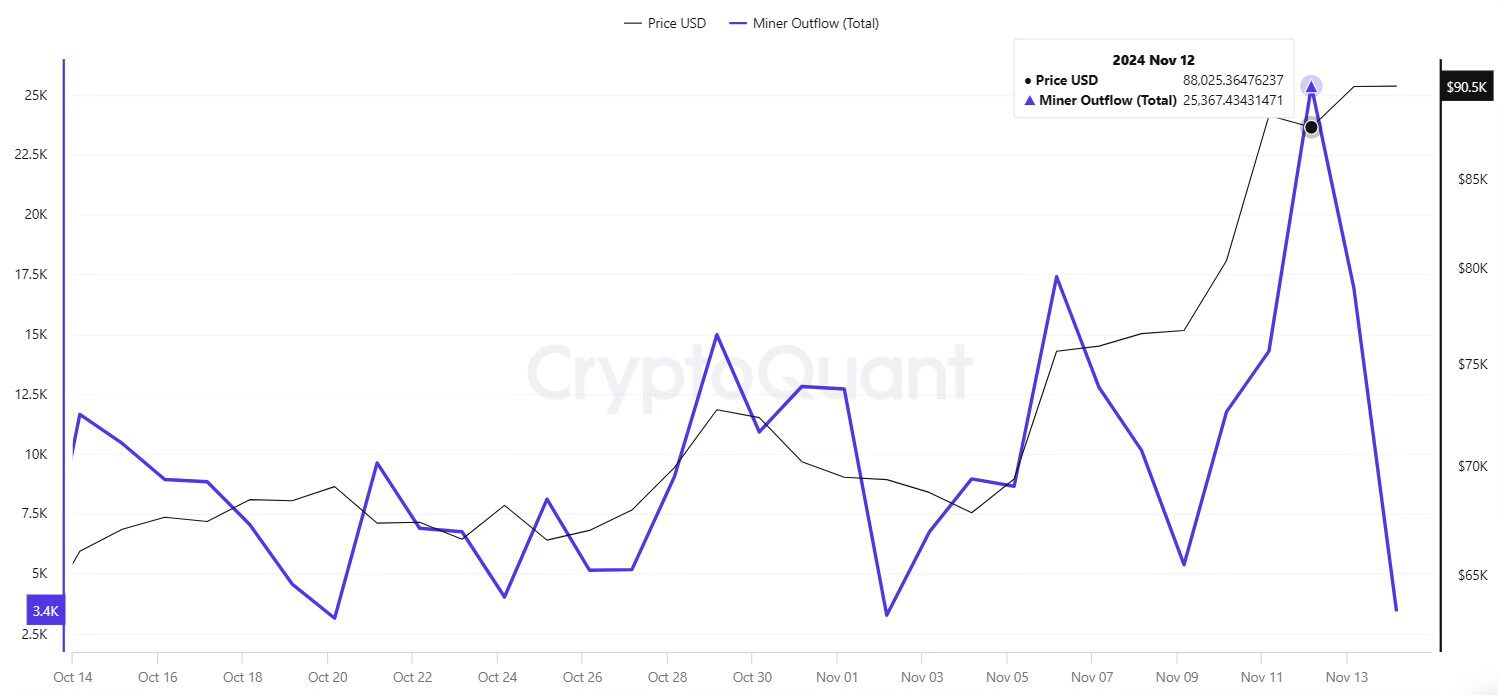

A look at trends of Bitcoin Miners and Long-Term Holders

Additionally, Bitcoin miners who appear to be selling off their holdings as Bitcoin’s price remains robust.

In the past week alone, miner outflows spiked significantly, coinciding with Bitcoin’s price reaching $88K, marking a clear signal that miners are taking profits ahead of potential Bitcoin peak.

Historically, such sales often prelude significant market movements, suggesting we could be nearing a market top.

Despite this sell-off, the broader sentiment in the Bitcoin market remains bullish. Long-term holders of Bitcoin, seen as the backbone of market stability, have offloaded around 300,000 BTC.

This figure is substantially lower than the sell-offs witnessed in March 2024, which saw nearly a million BTC being sold.

The reduced scale of this selling suggests that while the market is experiencing some pressure from sellers, the intensity is much less severe than in previous cycles.

This could indicate continued bullishness, as the selling pressure is not as overwhelming despite rising prices.

The current dynamics suggest a cautious optimism, with an undercurrent of strategic profit-taking by miners tempered by a strong holding pattern among long-term investors.

More On-Chain Buying of BTC

However on-chain Bitcoin holders have been accumulating, with a significant number of addresses showing intense buying activity around the $89.2K price level.

According to IntoTheBlock, over 307,000 addresses bought Bitcoin at this price, suggesting a robust demand zone.

As Bitcoin’s price currently teeters just below this critical threshold, this level could potentially serve as a pivotal support or resistance point in the near future.

The data further showed that there was also considerable accumulation at lower price levels, which might act as foundational support if the price dips.

However, the large cluster of buying at $89.2K suggested that many investors are anticipating higher prices, positioning this level as a battleground between bears and bulls in the market dynamics.

The interest at these levels not only reflects investor sentiment but also hints at potential strategic moves in the market.

If this zone will indeed turn into resistance, potential decline, otherwise, if a breakthrough occurs, it will propel it to new highs, driven by positive investor sentiment and strategic large-scale buys.

thecoinrepublic.com

thecoinrepublic.com