Crypto could stave off the U.S. debt crisis, according to Former House Speaker Paul Ryan in his recent op-ed published in the Wall Street Journal. Ryan argues that America’s $35.46 trillion and rising debt threatens the U.S. dollar’s status as a global reserve currency. Stablecoins could delay the crisis as they emerge as purchases of U.S. debt.

Table of Contents

Stablecoins as a source of demand for U.S. debt

Dollar-backed stablecoins like USDT (USDT) and USD Coin (USDC) hold over $95 billion in U.S. Treasury bills, per their recent reserve reports. As stablecoins continue to grow, providing fiat on-ramp to traders and driving crypto adoption, they could absorb U.S. debt through consistent demand for treasury bills.

China, a traditional buyer of America’s debt and the second-largest holder of treasury bills after Japan, reduced its exposure from $1.27 trillion in 2013 to under $1 trillion since April 2022. Experts have cited geopolitical concerns and changing trade policies as a key cause for China’s reduction of U.S. debt holdings.

The emergence of stablecoin issuers as purchasers of treasury bills reduces the dependence on traditional buyers and alleviates the concerns of reduction in their holdings amidst geopolitical instability and the shifting political climate post the U.S. presidential election.

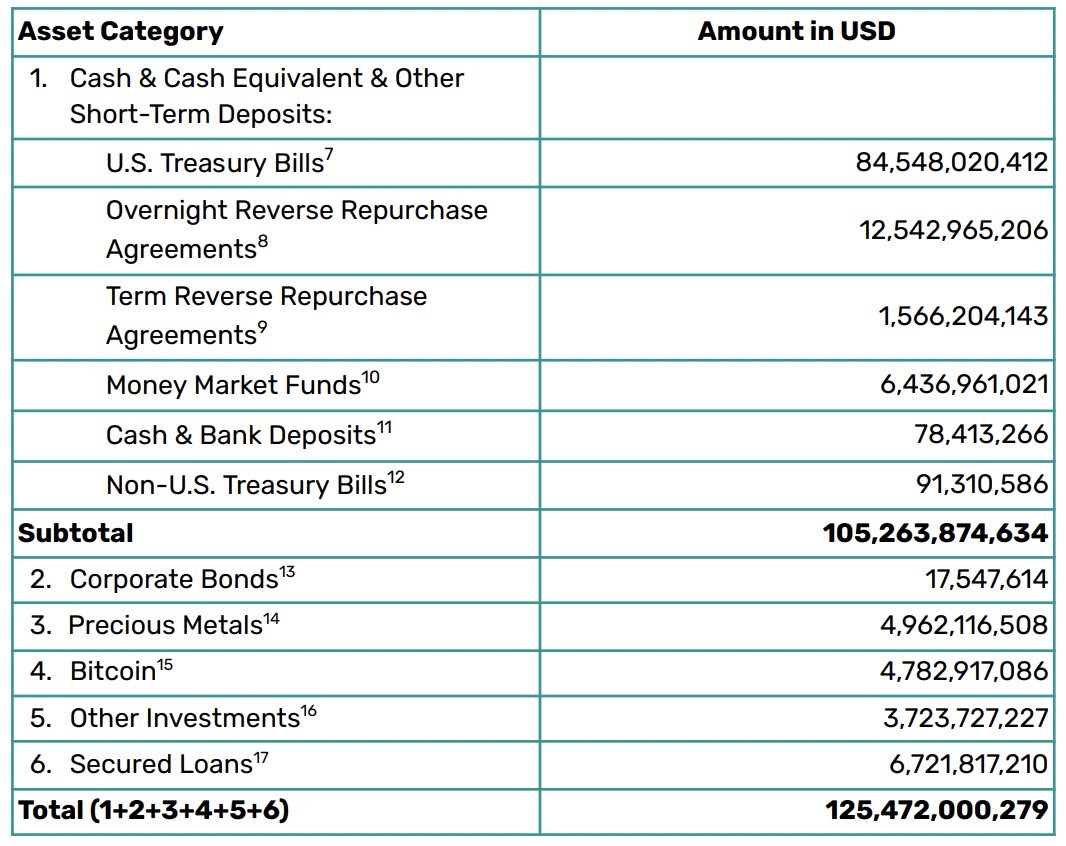

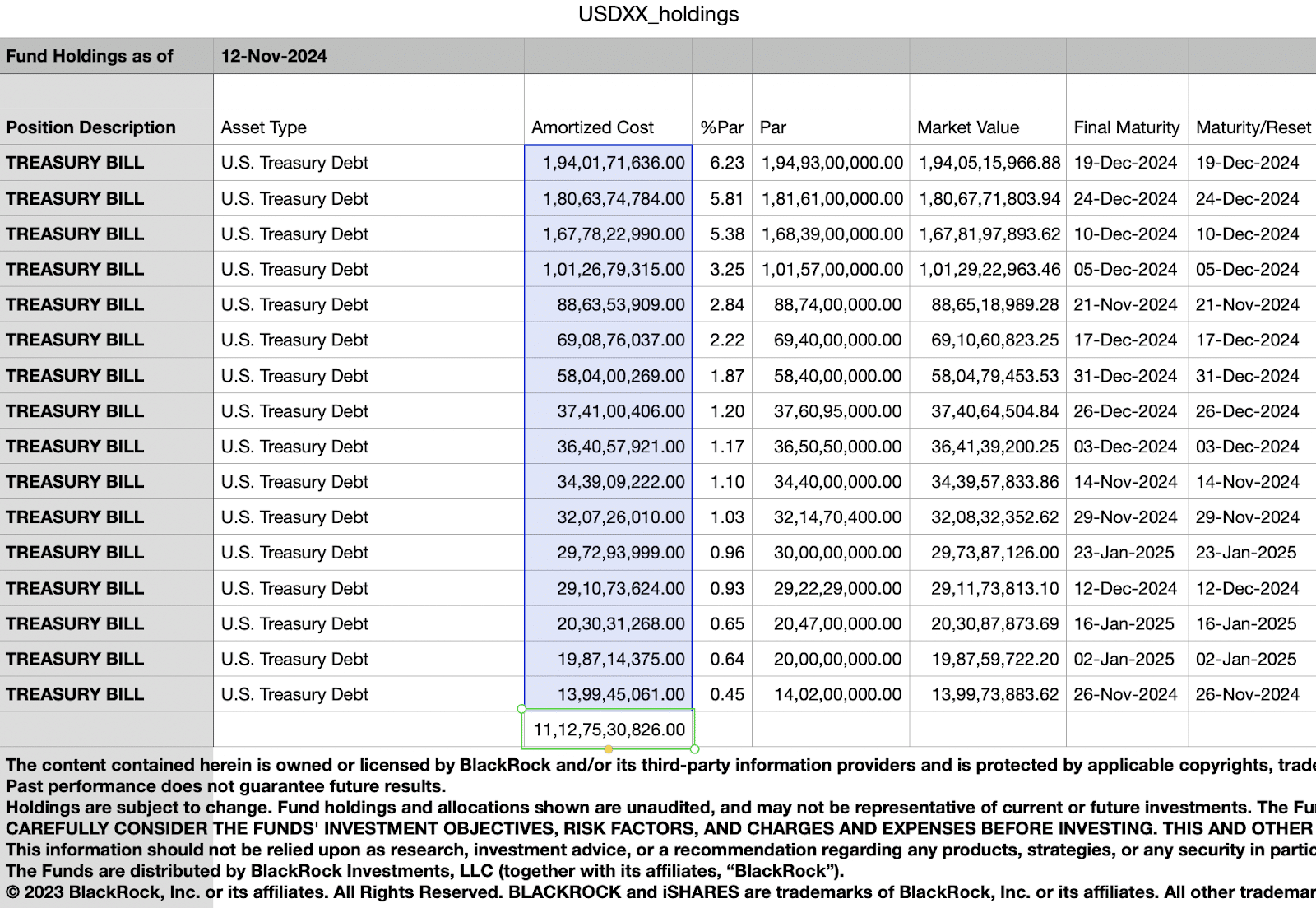

Tether’s October 31, 2024 report shows that the stablecoin issuer holds $84.548 billion in U.S. government debt, and Circle’s November 12 report, sourced from BlackRock, shows $11.127 billion in treasury bill holdings.

Ryan acknowledges that the dollar’s status as a global reserve currency is at risk due to dwindling foreign interest, which could negatively affect the U.S.’s ability to borrow cheaply and maintain its economic influence.

Stablecoins could emerge as a potential alternative to stabilize the situation until further measures are taken to alleviate the crisis.

Hoover Institution report suggests the U.S. should lead the digital currency space

One sticky argument against the acceptance of stablecoins and their integration in the legacy financial system is the loss of the ability to impose sanctions and control the flow of funds globally.

Dollar-backed stablecoins are issued on a public, permissionless blockchain, and they have the American values of freedom and openness, unlike China’s digital financial infrastructure.

The Hoover Institution’s report titled, “Digital Currencies: The U.S., China, And The World At A Crossroads,” highlights China’s first mover advantage with the launch of its central bank digital currency and its impact on global rules and standards for digital finance.

The report does not advocate the creation of a digital dollar, instead it stresses an urgent need for the authorities to develop standards to counter the growing Chinese influence. The U.S.’s transition to the digital economy would be better served by stablecoins, and it will take time to write the necessary regulations and implement the infrastructure to ensure the success of that transition.

The report identifies the steps in the process, like coordination with G7 nations and other democratic partners on the principles and standards for a system of global digital finance that enhances, rather than diminishes, privacy, accountability, security, and the rule of law.

With the necessary regulatory framework and policies in place, stablecoins could pave way for America to regain its economic influence as a superpower.

Could Bitcoin solve the U.S. national debt problem?

U.S. Senator Cynthia Lummis officially introduced the Bitcoin Act in July 2024. Sen.Lummis recommended the creation of a national Bitcoin reserve with 1 million BTC tokens to serve as a store of value to bolster America’s balance sheet.

While Sen. Lummis claimed that the U.S. would be debt-free within 20 years after taking profits on the sale of the Bitcoin, mathematical facts and statistics point out that it is less likely to occur. The U.S. national debt stands at $35.46 trillion, and Bitcoin’s market capitalization is $1.739 trillion.

For a million Bitcoin tokens to pay off the national debt, each BTC would have to be valued at $35.46 million. With its limited supply, Bitcoin has 21 million tokens and a market capitalization that is higher than Silver as of November 15. It is less likely for the market capitalization to grow faster than the combined value of world assets like Gold, Silver, and stocks.

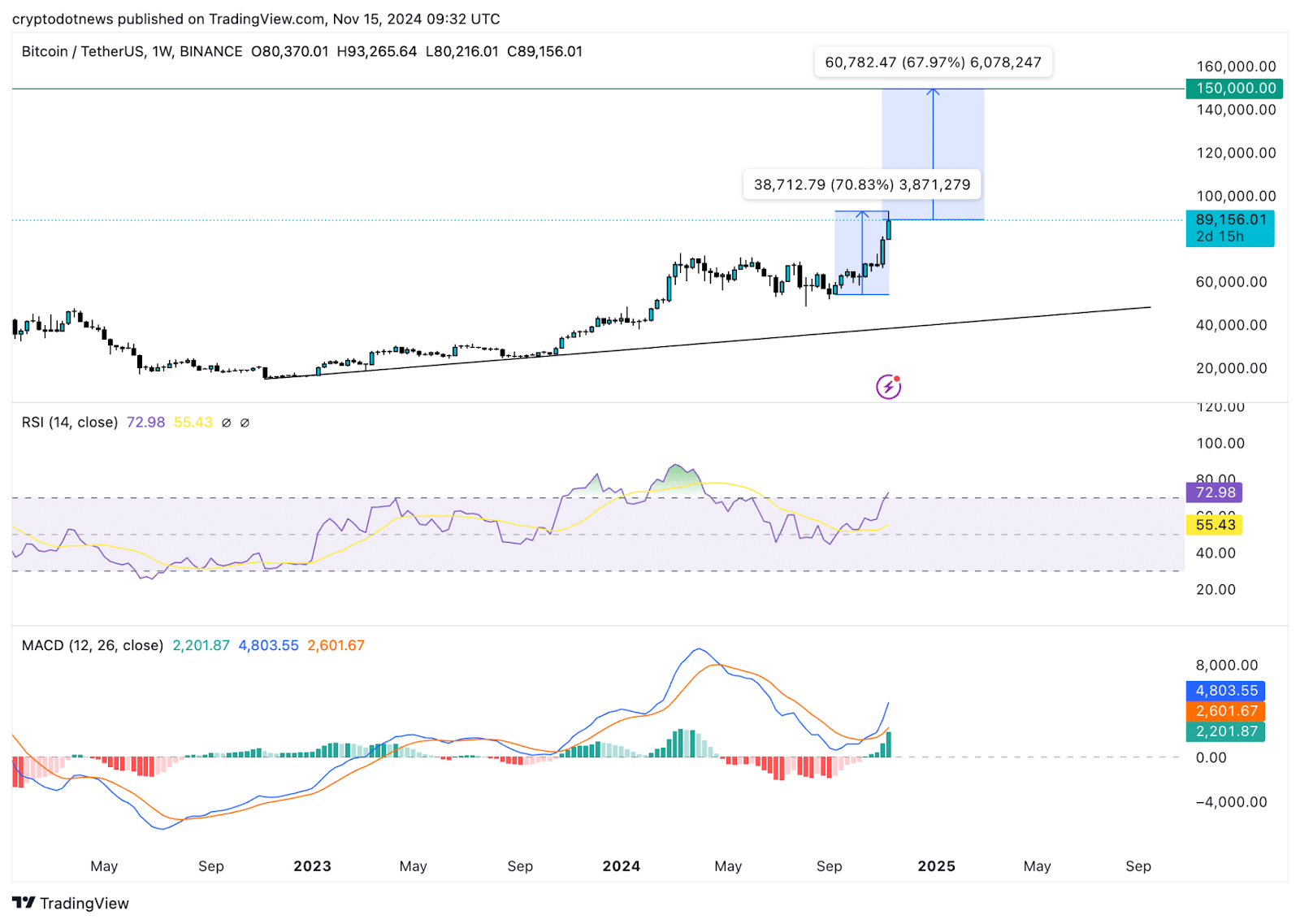

Bitcoin’s march to $93,265 on Wednesday, Nov. 13, has fuelled investor confidence in a run to $100,000 by year end. Between September and Nov. 13, Bitcoin gained 70%. Another 70% rally could push BTC towards a $150,000 target.

Technical indicators on Bitcoin’s weekly price chart show underlying positive momentum in BTC price trend. Moving average convergence, divergence flashes green histogram bars above the neutral line.

Traders need to be careful when opening a long position in Bitcoin as the relative strength index reads 72 and signals that BTC is overvalued. Typically, this is considered a sell-signal or a sign of an impending correction in the token.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.