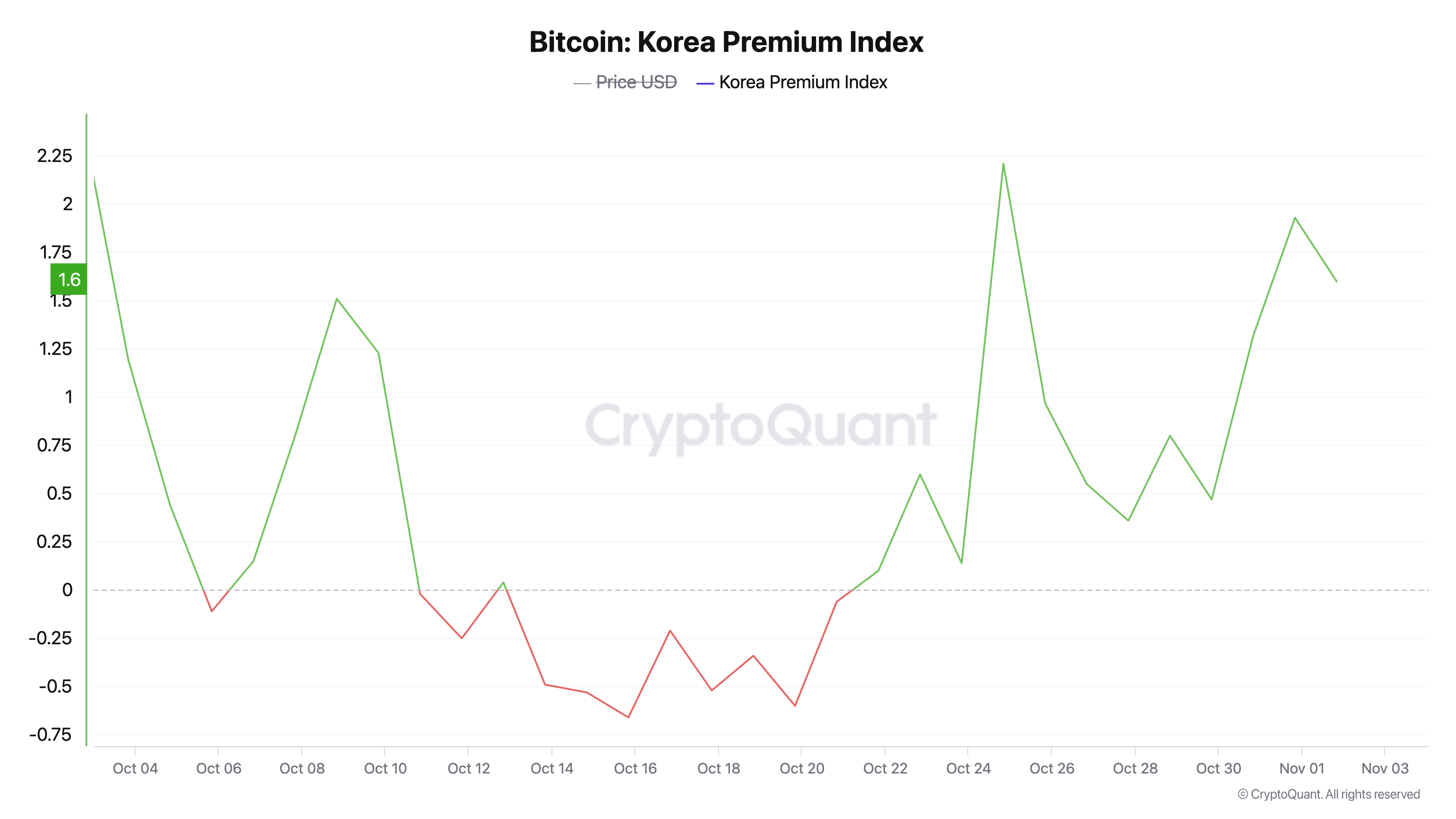

Although bitcoin dipped below $70,000 earlier this week, South Korean markets still show a notable premium. On Oct. 24, the premium climbed as high as 2.21%, with today’s rate only slightly lower.

South Korea’s Bitcoin Premium Bounces Back After October’s Brief Dip

As of 4:45 p.m. EST, bitcoin is priced at $69,058, following a push by bulls that nudged it back above the $69K range. Over the past hour, BTC has ticked up 0.79% against the U.S. dollar. Data from Upbit at the same 4:45 p.m. mark shows bitcoin trading at a premium on the platform, where BTC sits at $69,895—1.21% or $837 higher. Bithumb follows closely, listing BTC at $70,085 per unit.

From Oct. 12 to Oct. 20, 2024, metrics from cryptoquant.com reveal BTC trading at a discount in South Korea below the global average. But after the 20th, it shifted to a premium, hitting 2.21% by Oct. 24. By Halloween—Oct. 31—Satoshi’s white paper anniversary—the premium on South Korean exchanges was recorded at 1.93%. For years, bitcoin has often traded at a higher price in South Korea compared to global markets.

This trend is largely due to local regulations and capital controls. Additionally, South Korean demand for cryptocurrencies is strong. Throughout the year, the South Korean won consistently ranks as the second most-traded fiat currency with BTC, just behind the U.S. dollar. Currently, the won is fifth in BTC trading pairs, following USDT, USD, FDUSD, and USDC. The dollar makes up 17.75% of BTC trades, while the won accounts for 3.99% of today’s BTC trade volume. Trailing the won, the euro represents 1.06% of BTC trades over the past 24 hours.

South Korea’s premium is a clear mix of strong local demand and the nation’s regulatory landscape, pointing to unique regional factors in bitcoin adoption. As bitcoin’s value shifts, this premium showcases how market-specific forces create price differences, highlighting how regional enthusiasm can shape global valuation trends—a long-standing reality in South Korea. Generally, a premium signals continued bullish sentiment in this market. As Sunday’s trading rolls into Monday, the price is beginning to reveal some shifts and fluctuations.

news.bitcoin.com

news.bitcoin.com