Bitcoin and Ethereum have been struggling as October came to an end, triggering fear, doubt and uncertainty among large holders.

Bitcoin (BTC) dropped 1.75% in the past 24 hours and is trading at $68,500 at the time of writing. Its market cap is currently sitting at the $1.35 trillion mark with a daily trading volume of $23 billion.

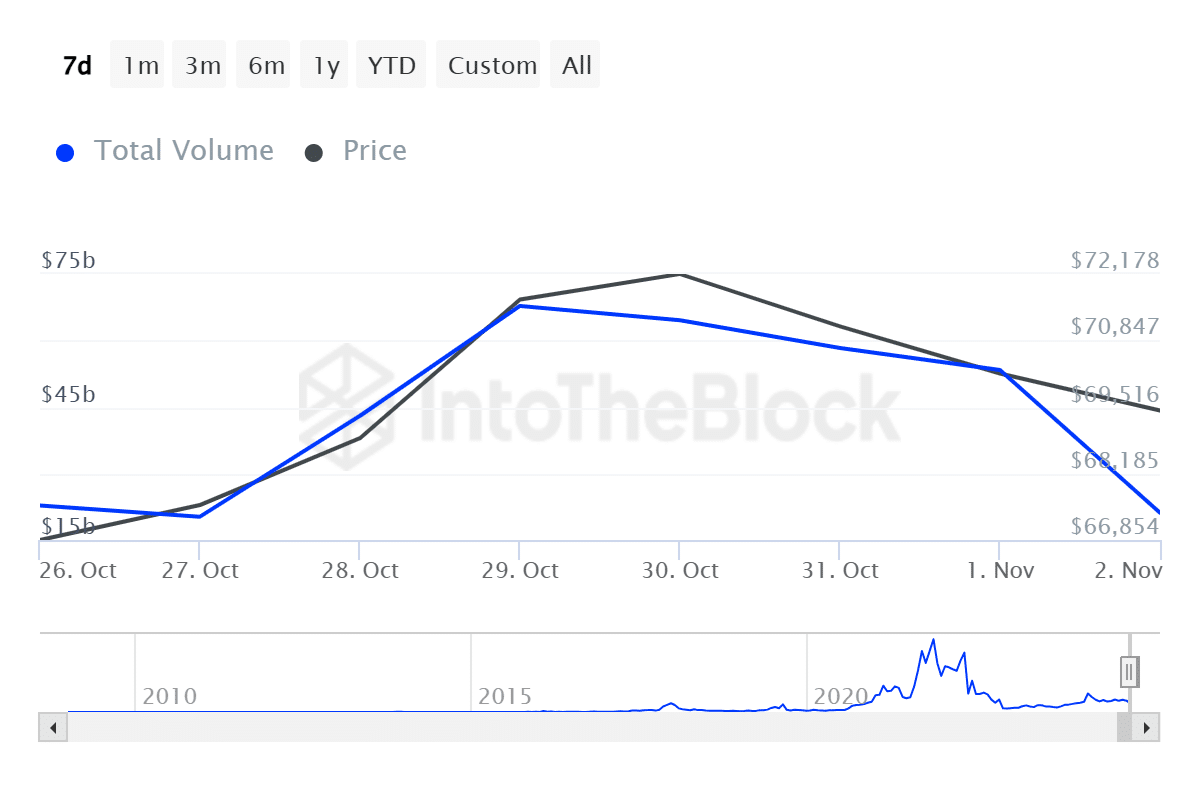

According to data provided by IntoTheBlock, the daily amount of whale transactions, consisting of at least $100,000 worth of BTC, have started to decline with the asset’s price fall—plunging from $67.8 billion on Oct. 29 to $21.1 billion on Nov. 2.

Ethereum (ETH), the leading altcoin, recorded a similar momentum to Bitcoin. ETH declined 2.2% over the past day and is changing hands at $2,450 at the reporting time. Its market cap is hovering close to the $300 billion mark.

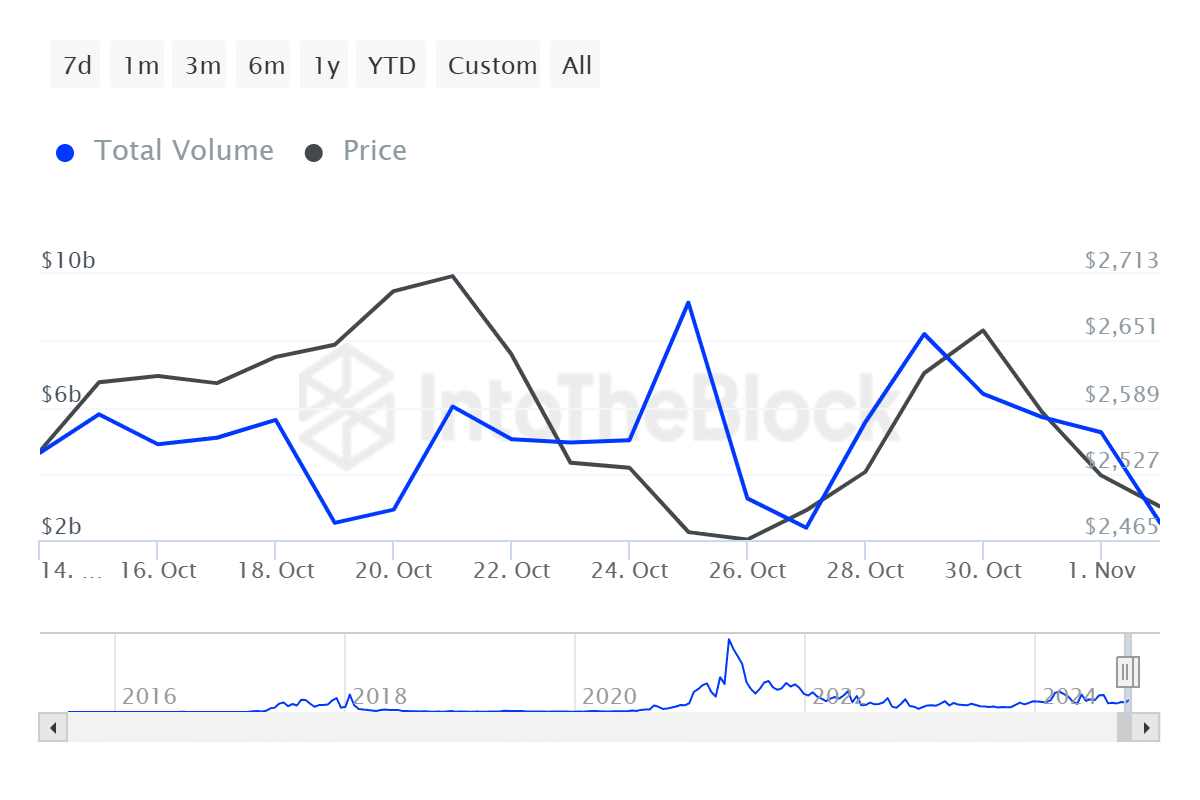

Large Ethereum transactions also plunged from $8.1 billion on Oct. 29 to $2.5 billion yesterday.

Sharp declines in whale activity usually hint at FUD and market-wide panic.

Two main reasons

One of the reasons behind the fall is the uncertainty surrounding the U.S. presidential elections, scheduled for Nov. 5.

According to a Friday report, Ryan Lee, the chief analyst at Bitget Research, told crypto.news that the crypto “market is anticipating that the future administration, whether led by [Donald] Trump or [Kamala] Harris, might adopt a friendlier stance toward the cryptocurrency sector.”

Another reason could be the start of spot BTC exchange-traded fund outflows on Nov. 1. Per a crypto.news report, these U.S.-based investment products saw a net outflow of $54.9 million on Friday.

Spot ETH ETFs in the U.S. also saw a net outflow of $10.09 million on the same day.

The spot BTC ETF outflows came after seven consecutive days of inflows. Notably, these ETFs saw a net inflow of over $5 billion in October.