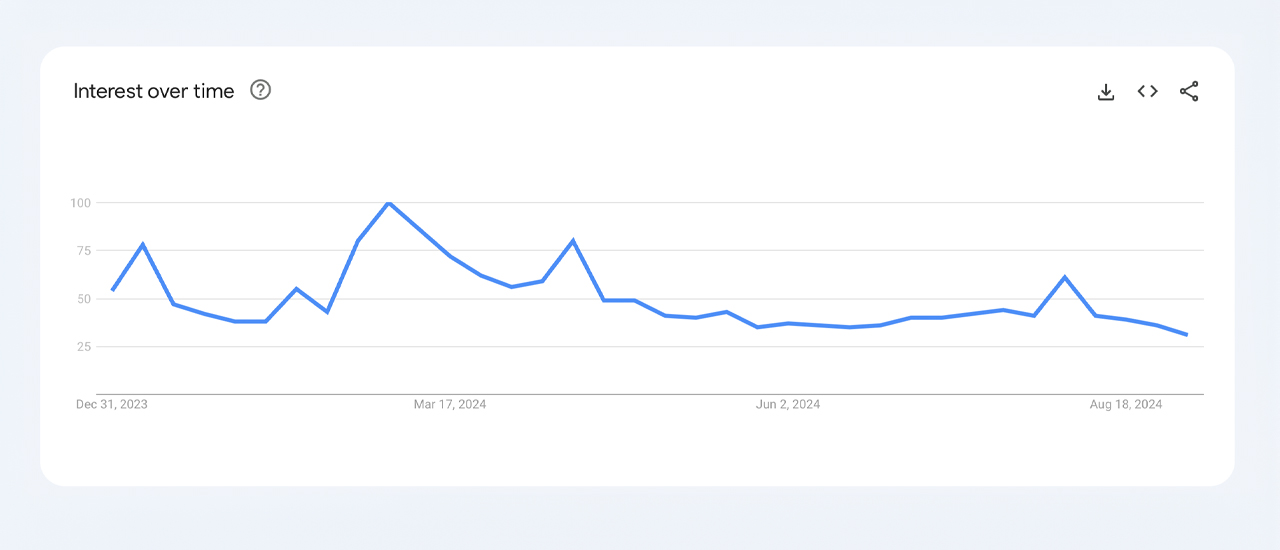

As bitcoin prices slipped under $60,000 in early September, the once-electric excitement around bitcoin seems to have dimmed, as reflected in Google Trends data. Back on Jan. 1, 2024, the search term “bitcoin” was coasting along with a score of 57 out of 100, but fast forward to now, and it’s plunged to 32. When you zoom out and look at the long-term data over the past five years, it’s clear that interest in bitcoin through web searches has hit a bit of a lull.

Bitcoin’s Global Search Interest Dips as Market Enthusiasm Softens

While bitcoin (BTC) might still be riding the wave of a bull market cycle, retail enthusiasm seems to be taking a backseat, as reflected in Google Trends data, where interest appears rather tepid. Looking at worldwide year-to-date (YTD) statistics, this week the search term “bitcoin” scored a 32 out of 100. That’s a 43.85% drop from where it stood in the first week of 2024. During the week of March 3-9, however, when BTC hit its all-time high above $73,000, the term “bitcoin” hit a flawless score of 100.

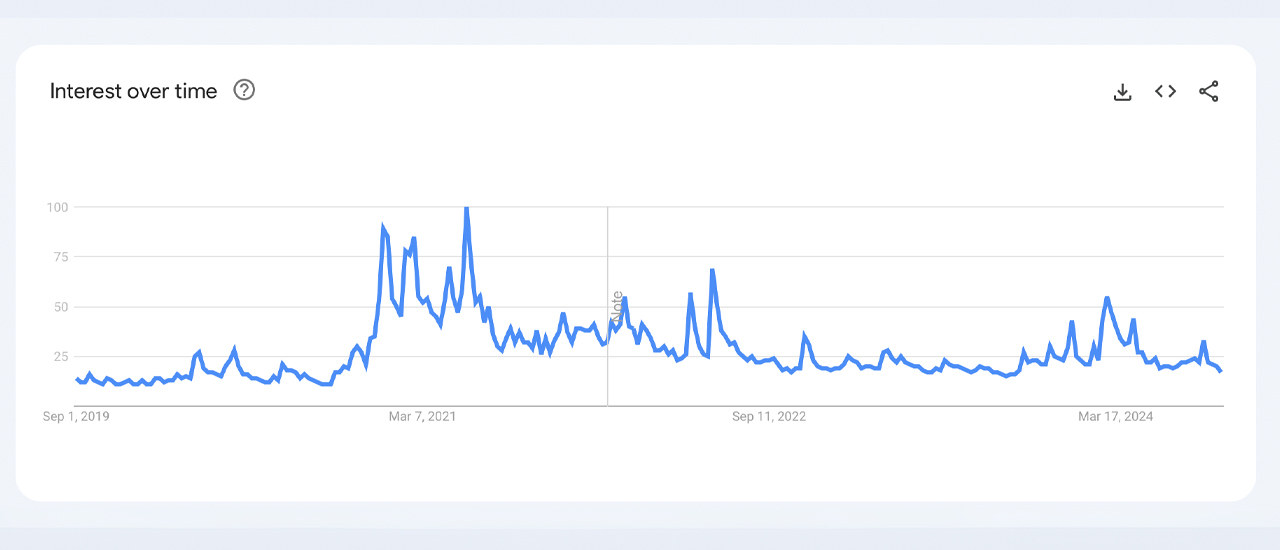

According to YTD data on Google Trends (GT), El Salvador leads the world in interest for the search term “bitcoin,” with Nigeria, Switzerland, Austria, and the Netherlands following close behind. While YTD metrics are somewhat positive, the broader five-year view worldwide, as per GT metrics, is far less impressive. For example, over the past five years, the last time interest hit a perfect 100 was during the week of May 16-22, 2021.

Fast forward to this year using the five-year span, the week of March 3-9 registered a 51 out of 100, but now, in the first week of September, that score has dropped to just 16. Interestingly, the same five countries continue to lead the charge in searching for the term “bitcoin” worldwide using the 60-month timeframe.

The decline in search interest, despite bitcoin’s perceived ongoing bull market, suggests a shift in public perception. While certain countries maintain strong curiosity, the broader, waning interest could indicate a maturing market or the need for fresh catalysts to reignite widespread enthusiasm. This lull in attention may foreshadow more tempered engagement from market participants moving forward.

news.bitcoin.com

news.bitcoin.com