Crypto asset manager Grayscale has made a strategic move by transferring 3,443.1 Bitcoin, amounting to over $175 million, to an address associated with the Coinbase exchange.

The latest move was executed in five separate transactions to Coinbase Prime, a platform designed to cater to the liquidity needs of institutions.

According to Arkham, at 22:12 UTC+8 on February 23, Grayscale transferred 2,669.31 BTC to the address of Coinbase Prime Deposit, worth approximately US$136 million;it transferred 773.79 BTC to a new address, which is suspected to be Grayscale's new custody address.…

— Wu Blockchain (@WuBlockchain) February 24, 2024

The transfer has sparked significant interest within the financial and cryptocurrency communities, as Grayscale has been known to influence market dynamics significantly. The firm’s decision to move such a large amount of Bitcoin to a liquid exchange for potential sale comes at a time when the cryptocurrency market is experiencing a mix of volatility and growth.

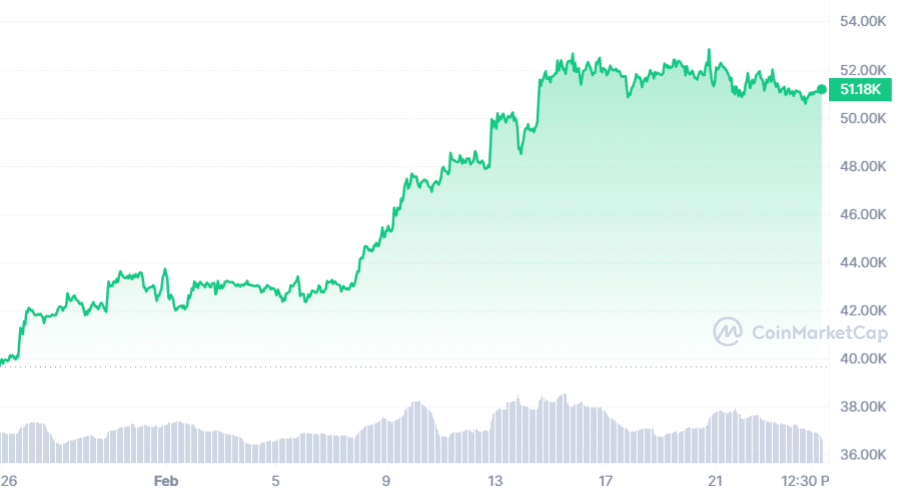

Bitcoin’s price has recently seen a 20% increase this February, despite a slight 2.65% drop over the past three days, maintaining its value above the $50,000 mark.

Speculations abound regarding the reasons behind Grayscale’s latest transactions. Some market observers suggest that the move could be part of a strategy to capitalize on recent market gains. This theory gains weight considering the prolonged period investors have had their investments locked in the fund, making the current market surge, especially after having a tempting opportunity for liquidation.

You might also like: Grayscale: Ethereum’s Dencun upgrade driving price upward

The timing of Grayscale’s actions also coincides with discussions around management fees within the digital asset management sector. Grayscale’s Bitcoin Trust (GBTC) is known for its relatively high management fee of 1.5%, in stark contrast to competitors like BlackRock’s IBIT, which currently charges a fee of 0.12%—although plans are underway to increase this to 0.25% within the next 12 months.

The disparity in fees plays a crucial role in investors’ decisions, as lower fees typically lead to higher net returns over time.

Some commentators have linked the increased outflows from Grayscale to the activities of Genesis, suggesting that the latter’s sale of GBTC for Bitcoin could be influencing market dynamics.

The perspective offers a less bearish outlook on Grayscale’s future market impact, proposing that the effects of these transactions might balance out due to the nature of the sales being in Bitcoin.

Following this significant transfer, Grayscale’s holdings now stand at 449,834 Bitcoin, valued at over $23 billion. The firm’s portfolio extends beyond Bitcoin, with Ethereum (ETH) and Livepeer (LPT) as its second and third-largest holdings, respectively.

Grayscale’s total asset under management exceeds $31 billion, encompassing other notable tokens like Uniswap (UNI), Chainlink (LINK), and Avalanche (AVAX).

Read more: Grayscale CEO: Most spot Bitcoin ETFs will not survive