In the ever-evolving world of cryptocurrency, Bitcoin continues to hold its place as the pioneer and the most discussed asset. As we enter 2024, various experts have made bold predictions about its future trajectory, offering insights ranging from technical analyses to macroeconomic trends influencing its price. This article consolidates the viewpoints of leading figures and institutions, presenting a comprehensive overview of Bitcoin’s outlook for the year.

Robert Kiyosaki Calls out Bitcoin to $100K

Robert Kiyosaki, the celebrated author of “Rich Dad Poor Dad,” has projected an ambitious target for Bitcoin, suggesting it could reach $100,000 by mid-2024. His prediction is based on Bitcoin’s potential as an inflation hedge amidst growing concerns over global economic instability and the potential crises in banking and stock markets.

However, this is not the first time he has shown his evangelism for Bitcoin. Kiyosaki advocates for Bitcoin alongside gold, silver, and real estate as essential assets for investment portfolios, highlighting its resilience against macroeconomic uncertainties.

Bernstein Anticipating a Record-Breaking Year

Analysts at Bernstein, a research division of AllianceBernstein’s $726 billion asset management firm, predict that bitcoin’s price may reach a new record later this year. They believe that Bitcoin is poised for a significant rally driven by ETFs and the fear of missing out (FOMO) among investors. The report highlights that the launch of spot bitcoin exchange-traded funds (ETFs) last month, coupled with the anticipated effect of bitcoin’s halving and the surge in inflows into these new funds, were not fully accounted for in bitcoin’s pricing.

Consequently, the total market value of cryptocurrencies has recently surpassed $2 trillion, reflecting a renewed confidence in bitcoin. The halving event expected in April will reduce the amount of bitcoin entering the market, potentially increasing demand and price due to its deflationary impact.

Bernstein analysts also note that the majority of investors in crypto ETFs are individual investors who have been seeking a mainstream investment vehicle for Bitcoin. They anticipate that “new Bitcoin enthusiasts” and “curious investors” will join the existing base in the near future, further driving up demand and prices. The success of spot bitcoin ETFs launched by financial giants like BlackRock and Fidelity, with BlackRock’s product surpassing 100,000 bitcoin holdings and the 21Shares ETF from Ark Invest alongside Fidelity’s ETF holding over $1 billion in assets, underscores the growing interest and optimism in the cryptocurrency market.

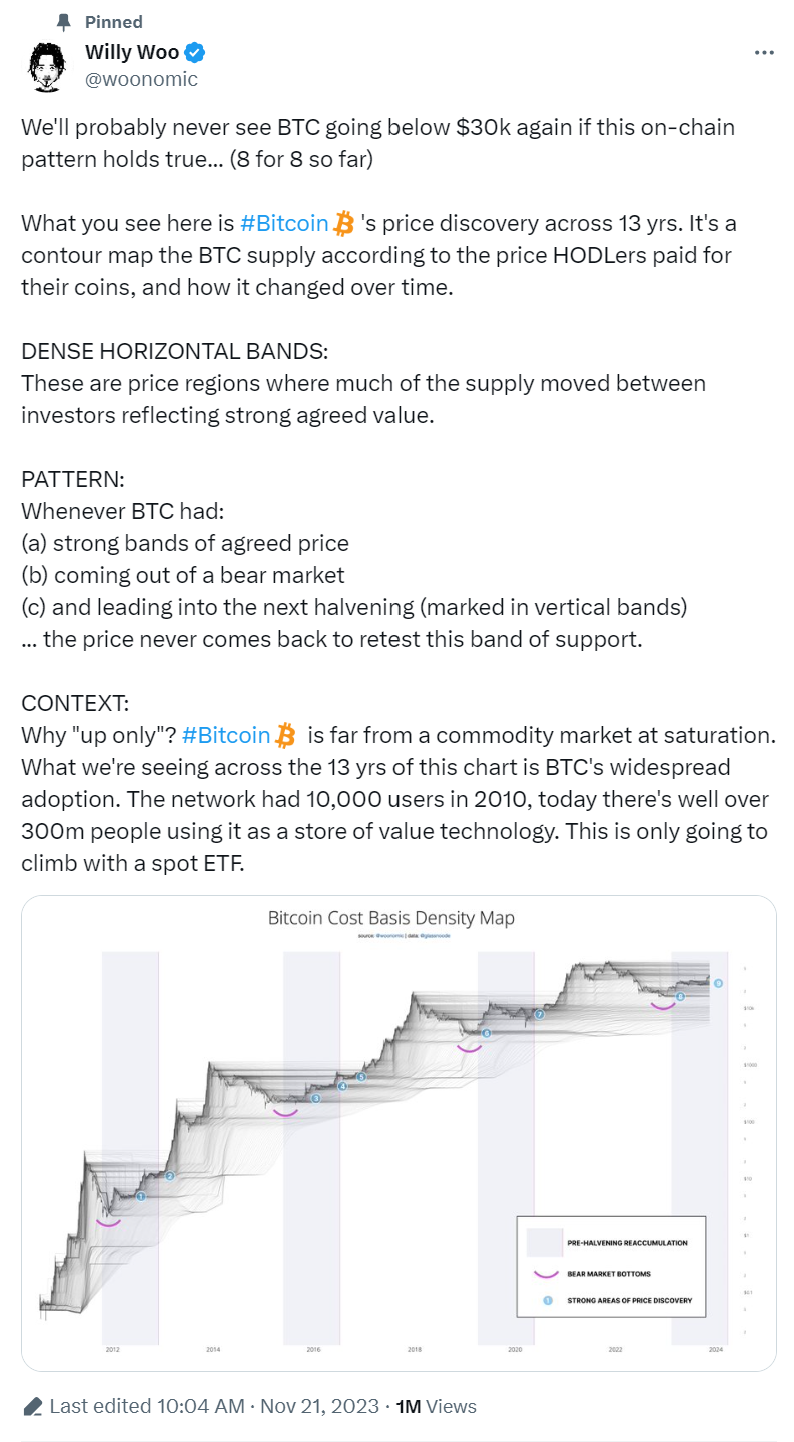

Willy Woo: Never Going Below $30K Again

Willy Woo, a prominent figure with a million followers on Twitter, offers a unique on-chain analysis of Bitcoin’s price evolution over 13 years. He highlights a pattern of solid price support bands emerging from bear markets and leading into halving events, suggesting that Bitcoin’s price is unlikely to fall below $30,000 again. Woo’s analysis points to Bitcoin’s increasing adoption, moving from 10,000 users in 2010 to over 300 million today, a trend that he believes will continue to rise, especially with spot ETFs.

A Promising Yet Uncertain Future

Across these expert opinions, two themes emerge. These are Bitcoin’s potential to reach new highs and its role as a hedge against economic uncertainty. While predictions vary in specificity, the consensus leans towards significant growth driven by institutional adoption, technological advancements, and a growing recognition of Bitcoin’s utility as a store of value.

Kiyosaki’s emphasis on Bitcoin as part of a diversified investment strategy, Forbes’ acknowledgment of its boundless potential, Bernstein’s anticipation of ETF-driven rallies, and Woo’s on-chain evidence of sustained support levels collectively paint a picture of optimism for Bitcoin in 2024.

While expert predictions provide valuable insights, the volatile nature of cryptocurrencies means that both opportunities and challenges will likely mark Bitcoin’s journey in 2024. The combined effects of macroeconomic factors, regulatory developments, and technological advancements will influence its trajectory.

Investors and enthusiasts will do well to monitor these trends closely, balancing optimism with caution. As Bitcoin continues to navigate the complex interplay of market dynamics and investor sentiment, its role in the broader financial ecosystem is poised for further evolution.

In sum, the outlook for Bitcoin in 2024 is a mosaic of expert predictions, each highlighting different facets of its potential. From unprecedented price targets to its utility as an economic hedge, the narrative around Bitcoin remains as dynamic and compelling as ever.

cryptonews.net

cryptonews.net