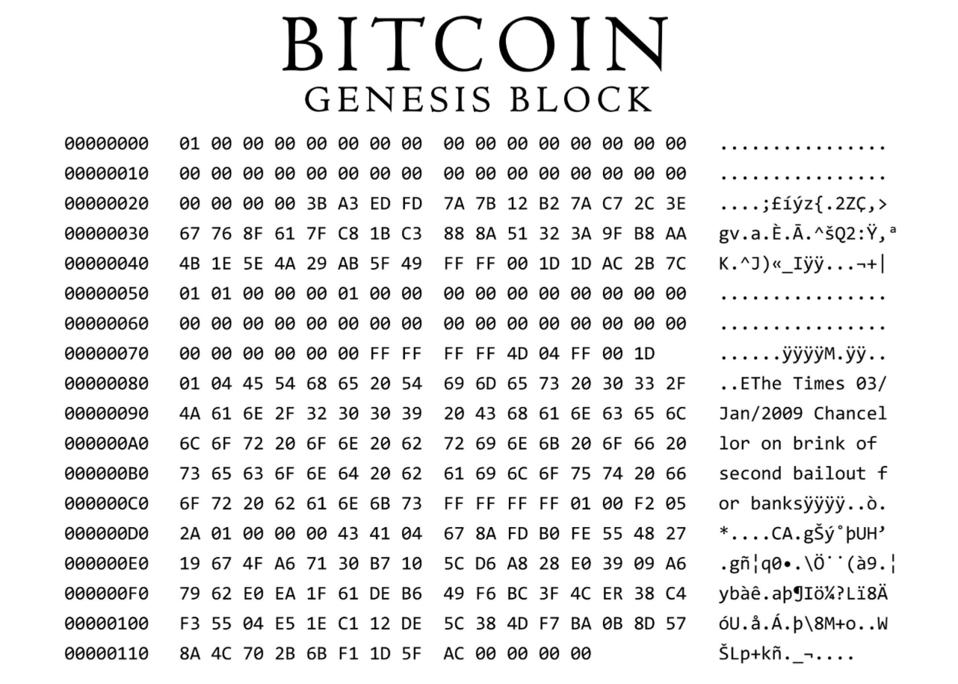

As we mark the 15th anniversary of Bitcoin's Genesis Block, we witness a defining chapter in financial history. In just a decade and a half, bitcoin has transformed from an experimental digital currency to a global asset, outperforming traditional assets. Its adoption rate, accelerating nearly twice as fast as the internet's, is a remarkable shift in mainstream finance.

As bitcoin continues to revolutionize finance, businesses are adopting a bitcoin standard. MicroStrategy leads the charge, with its strategic mastermind, Executive Chairman Michael Saylor, at the helm.

Their bold move into bitcoin has paid off and set a precedent, with a staggering $2 billion in returns. This is a clear signal to the business world: as we approach a bitcoin bull run. The transformative power of bitcoin is not just a future promise—it's today's reality, reshaping how companies operate and strategize in a digital economy.

This firm has integrated bitcoin as a critical component of its reserve assets. The bold move has resulted in substantial profits and enhanced their decision-making processes, reflecting a significant shift in corporate asset management strategies. MicroStrategy's success story, rooted in a long-term commitment to bitcoin, is a benchmark for other enterprises exploring similar paths.

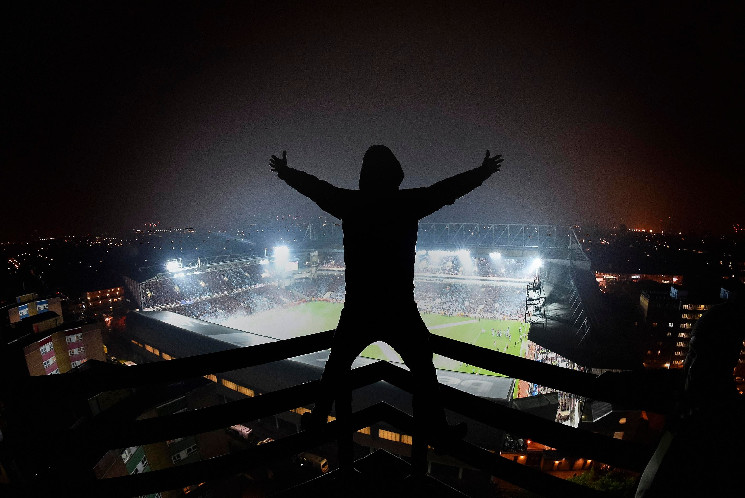

Real Bedford: Kicking Off a Bitcoin Revolution in Football

Real Bedford, excelling in both the Men's and Ladies' Leagues, is more than just a football club; it's a leader in integrating bitcoin into its core operations. Their strategy of utilizing bitcoin for sponsorships and fan engagement has established them as a unique 'bitcoin team' in football and a catalyst for a broader bitcoin-centric economic plan for the English market town of Bedford.

This initiative, injecting new life and financial vitality into the often-overlooked town, is the brainchild of Peter McCormack from the “What Bitcoin Did” podcast. McCormack suggests that all businesses should view bitcoin as a 'cheat code' for unlocking new customer bases. Real Bedford's success is a testament to how sports, intertwined with bitcoin, can play an important role in revitalizing local economies and communities.

By cautiously managing their exposure, Real Bedford allocates a small portion of their turnover to bitcoin, striking a balance between potential gains and risk minimization.This approach is similar to a strategic game where every move is calculated for long-term success.

The team is not just playing the game on the field; they're also modernizing the football business. By integrating bitcoin into their business model, they've unlocked new financial opportunities crucial for their ambition to climb the football league ladder. This approach focuses on securing sponsorships related to bitcoin, boosting fan involvement by appealing to bitcoiners, and establishing a distinctive 'bitcoin team' identity.

CoinCorner: Playing a Strategic Game in the Isle of Man

CoinCorner, an exchange and financial services company, is steered by Danny Scott as its co-founder and CEO. While concerns about bitcoin bans are prevalent worldwide, CoinCorner remains steadfast, thanks to its strategic location in the Isle of Man, UK. This advantageous positioning gives them a strong defence against fluctuating regulations and allows them to concentrate on their core business. Their business model demonstrates how an enterprise can survive under the regulatory scrutiny of an emerging asset class.

Since 2014, CoinCorner's decision to hold bitcoin on its balance sheet has been pivotal. This approach maintains its focus on bitcoin, steering clear of other cryptocurrencies and ensuring decisions resonate with their strong bitcoin ethos.

The company has established strong banking relationships and structured its business to pre-empt future regulations like the MiCA framework. There are concerns around regulation, which it is forcing smaller entities out of business and leading to concerns of a wave of industry consolidation and the loss of independent companies.

CoinCorner stays ahead by identifying key trends, such as the increasing use of bitcoin for cross-border business payments. They also focus on improving user bitcoin accessibility, leveraging AI to enhance internal efficiencies – a testament to their commitment to continuous innovation.

Coach Carbon Life: Health And Wealth With Bitcoin Principles

Coach Carbon Life, focusing on integrating bitcoin principles into health, wealth, and life, is led by Josias Carbon. Leveraging CoinCorner's versatile business account services, the company handles both fiat and bitcoin payments. This is made possible through the efficiency of CoinCorner's mobile checkout app and its integrated online payment systems, embodying a seamless blend of financial innovation and wellness services.

At the heart of Coach Carbon philosophy is understanding time preference, delayed gratification, and personal responsibility, concepts deeply rooted in bitcoin's culture. The ability to convert fiat sales and process bitcoin transactions is crucial to their financial strategy. This capability enables them to operate a dynamic business, adapting to the needs and preferences of their clientele.

Incorporating bitcoin fundamentals into its business model mirrors these bitcoin businesses' strategic and forward-thinking practices. This synergy bolsters operational efficiency and positions them at the forefront of embracing a global currency within health and wellness services.

Solidi: Establishing Solid Ground

Under CEO Jamie McNaught's leadership, Solidi steps into the spotlight as a UK FCA-regulated exchange, showcasing the importance of regulatory compliance in bitcoin trading. Their approach underscores the necessity of trust and security in digital currency transactions, setting a benchmark for future businesses.

With its unwavering commitment to the UK market, this company is uniquely positioned with an advantageous relationship with regulatory authorities. This rapport, born from an in-depth understanding of regulatory frameworks, empowers them to offer services that set them apart from other exchanges. Their ability to onboard clients without stringent ID requirements is a testament to their regulatory expertise and the trust they have established with the authorities. This proven relationship underscores Solidi's position as a leading, compliant, and innovative player in the UK.

Compliance and regulation in the UK might seem dry, but they're crucial. Solidi understands this and has forged a trustworthy platform amid regulatory challenges. They adhere to the highest compliance standards, earning them a reputation as a reliable and regulated destination for secure bitcoin trading in the UK.

New Financial Accounting Standards Board Rules For Bitcoin

New FASB rules mark a significant shift for bitcoin businesses. Previously, companies had to record bitcoin at the lowest price since buying it. Now, they can value it at its current market price. This change allows businesses like Real Bedford, CoinCorner, and Solidi to accurately report bitcoin's gains and losses. This move reflects bitcoin's growing acceptance in industry, encouraging more companies to adopt it.

Setting the Stage for Future Innovators

These companies represent more than just businesses adapting to the world of bitcoin; they are the front-runners of a broader movement. They demonstrate that bitcoin can be integrated into diverse business models, from sports to financial services. Their experiences offer valuable insights into embracing the potential for digital currencies and their hurdles.

These pathfinders are reshaping their sectors and laying the groundwork for future enterprises to explore bitcoin's possibilities. Their blend of innovation and strategic foresight is a blueprint for success. On the 15th anniversary of Bitcoin's Genesis Block, we see a reflection of its innovative essence in these leading companies, guiding the way for the next generation.

Similar to the impressive gains seen by MicroStrategy, companies like Real Bedford, CoinCorner, Coach Carbon Life, and Solidi demonstrate the transformative impact of integrating bitcoin with a practical and forward-thinking approach. As they continue to navigate, they pave the way for a new generation of businesses ready to harness the power and potential of bitcoin.

forbes.com

forbes.com