Key highlights:

- Bitcoin is now handling 62% more in transaction volume than PayPal on a quarterly basis

- In 2021, Bitcoin has averaged a transaction volume of $489 billion per quarter

- However, BTC is still far behind Visa and Mastercard in terms of transaction volume

Bitcoin is handling 62% more transaction volume than PayPal

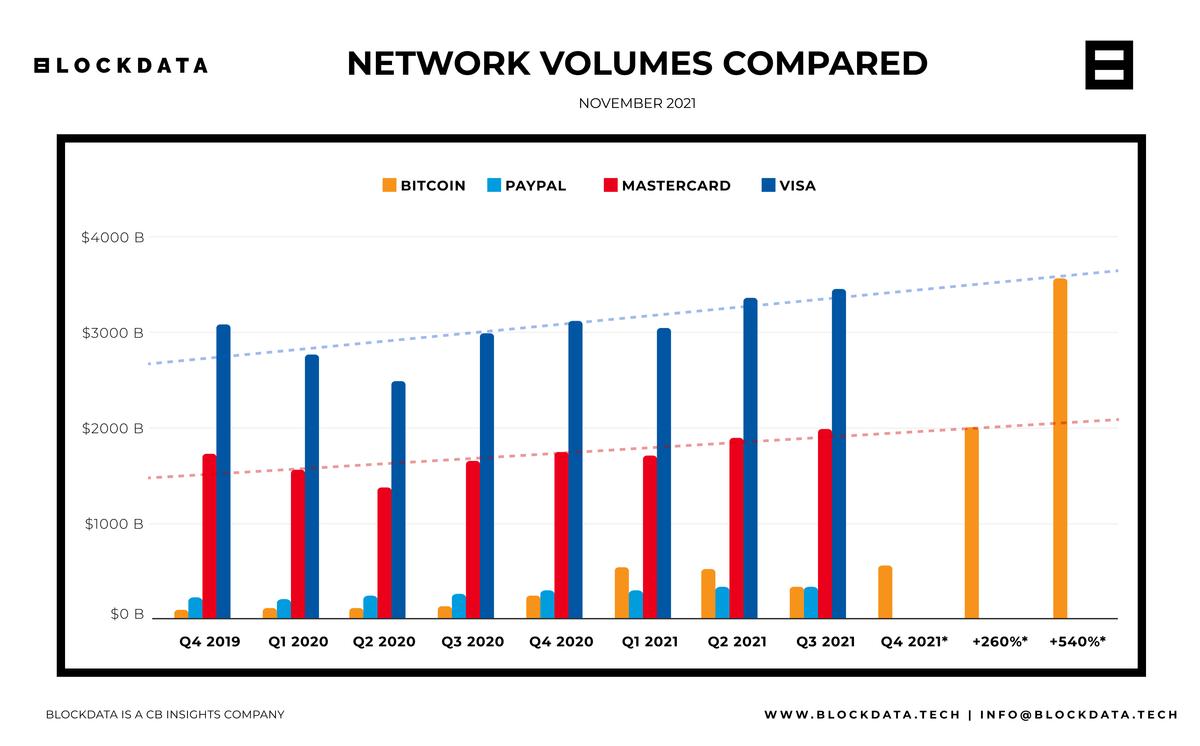

Bitcoin is now a trillion-dollar asset, and the network is processing an impressive volume of transactions that’s gradually beginning to rival some of the largest financial networks and services on the planet. Blockchain research platform Blockdata recently published a report comparing Bitcoin’s transaction volumes with PayPal, Visa and Mastercard.

In terms of transaction volume, Bitcoin is already surpassing PayPal. Blockdata points out that in 2021 so far, Bitcoin’s average quarterly transaction volume has been $489 billion, while PayPal has handled $302 billion worth of transactions on average per quarter this year. This means that Bitcoin’s transaction volume is roughly 62% larger than PayPal’s.

We should take the direct transaction volume comparison between Bitcoin and PayPal with some reservations. While payments certainly are one of Bitcoin’s use cases, BTC is also commonly used as a speculative asset or store of value. Deposits and withdrawals from cryptocurrency exchanges represent a significant amount of Bitcoin transaction volumes. Still, comparing Bitcoin with large financial networks gives us some idea of the scale that Bitcoin has achieved in just a little over a decade since its launch.

BTC has still a long way to go to catch up with Visa and Mastercard

When comparing Bitcoin with Visa and Mastercard, we can see that Bitcoin is still far away from handling a comparable transaction volume. This year, Visa has been processing $3.2 trillion worth of transactions, while Mastercard’s figure is at $1.8 trillion.

Blockdata points out that there are three scenarios that would allow Bitcoin to reach or surpass these transaction volumes. These would be a rise in the number of Bitcoin transactions, a rise in the average amount of BTC sent per transaction, or a rise in the price of BTC itself.

Due to Bitcoin’s scalability limitations, expecting an increase in the number of transactions to carry Bitcoin’s transaction volume growth seems unlikely, at least on the Bitcoin mainnet. With the help of scalability solutions like the Lightning Network, however, Bitcoin is effectively able to handle a much larger number of transactions.

If the Bitcoin network were to maintain the same number of transactions but the average amount of BTC per transaction increased by 260%, Bitcoin’s transactions volume would be equivalent to the Mastercard network. To match the Visa network’s transaction volume, there would need to be 540% more BTC sent per transaction on average. The Blockdata report says that this is not a likely scenario, as the number of BTC sent has actually decreased in the last year, which is connected to the rising price of Bitcoin.

If the transaction count and average amount of BTC per transaction stayed the same, the only way for Bitcoin’s transaction volume to grow would be a rise in the price of BTC. Here’s how much Bitcoin would have to be worth in this scenario to match the transaction volumes of Visa and Mastercard:

“Alternatively, if bitcoin were to rise in price by ~260% today, to $245k, then the Bitcoin network would theoretically be processing an equivalent in volume to the Mastercard network on a daily basis. To be at the volume level of Visa, it would need to rise by 540%, or around $435k.”

Bitcoin transaction volumes compared to PayPal, Visa and Mastercard. The Q4 2021 figure displayed for Bitcoin transaction volumes is an estimate. Image source: Blockdata

coincodex.com

coincodex.com