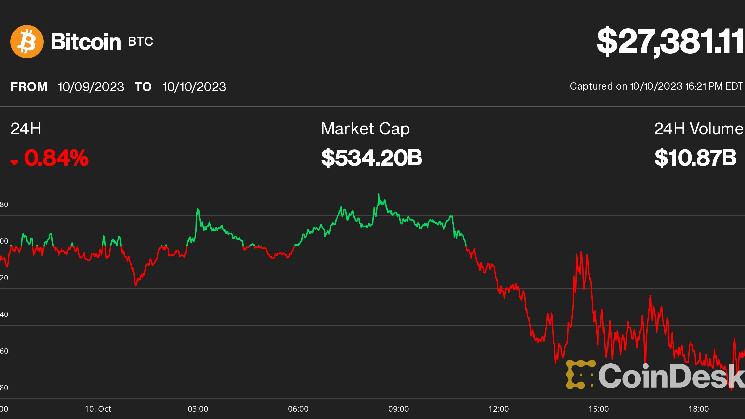

Bitcoin (BTC) finished the U.S. market day above the $27,000 mark as markets remain generally unaffected by the war in Gaza.

The crypto was down 0.73% over the past 24 hours and was changing hands at $27,395 towards the close of business U.S. East Coast time. Ether (ETH) was down 0.96% and trading at $1,546. The CoinDesk Market Index (CMI) was lower by 0.9%. CoinDesk Indicies’ Bitcoin Trend Indicator shows a significant uptrend predicted for bitcoin’s price while the ether trend indicator is forecasting a significant downtrend.

In equities markets, the S&P 500 and Nasdaq rose a bit more than 0.5%, ignoring for a second day the possible negative effects from the Israel-Hamas conflict.

Speaking with CNBC on Tuesday, Mark Newton of Fundstrat anticipates a buying opportunity, saying there’s a “good likelihood” the bottom is in for stocks. Newton expects a short-lived market decline due to geopolitical events to be followed by a rebound.

Big Week for Unlocks

Aptos (APT), and Ape Coin (APE) are all scheduled to undergo large token unlocks in the next week.

Token unlocks can temporarily depress crypto prices, but when liquidity freed represents over 100% of daily volume, prices rebound briefly before falling further within two weeks, according to research by The Tie previously reported by CoinDesk.

Aptos is scheduled to unlock 4.54 million (APT) on Wednesday, worth around $22.2 million based on current market prices. APT is down 2.2% on day and 9% on week.

Meanwhile, Ape Coin is going to unlock 15.6 million (APE) $15.88 million later this week, and its token is down 1% on-day and 11.3% on-week.

Rising BTC dominance

Meanwhile, bitcoin’s grip on the overall cryptocurrency market has been rising relentlessly. The (BTC) market cap dominance metric rose above 51%, its highest reading since July, according to TradingView data.

“Despite the recent global turmoil, bitcoin has demonstrated exceptional strength, securing its position as the top-performing asset over the past 30 days relative to the US Dollar,” Joel Kruger, market strategist at LMAX Group, noted in an email. He attributed BTC’s rising dominance to the second-largest crypto asset ETH’s stronger correlation with risk sentiment and its increasing token supply after reverting to being inflationary, making bitcoin more attractive for investors.

(ETH) this week has dropped to a fresh 15-month low relative to BTC amid slumping blockchain activity on Ethereum and dismal investor interest for newly listed futures-based ETFs in the U.S.

K33 Research noted in a Wednesday market report that traders on the derivatives market anticipate that ETH will keep underperforming.

“The explanation can simply be that BTC as digital gold in a risk-off environment, sprinkled with the potential of spot bitcoin ETFs soon, is more enticing than the DeFi and NFTassociated ETH,” K33 analysts wrote. “Sticking to BTC until there is clear proof of a spark in ETH is likely the safest exposure for the time being.”

coindesk.com

coindesk.com