Pantera Capital analysts have released a new report examining the outlook for Bitcoin (BTC) price growth. They suggest that the price of the cryptocurrency will rise to as much as $148,000 by mid-2025.

The main reason for the bull market will traditionally be the upcoming Bitcoin halving, meaning a halving of the reward for miners for creating a block. This event will take place in the spring of 2024. Let’s analyze the situation in more detail.

Is the Bottom In?

Bitcoin price dynamics strongly depend on halving cycles, experts believe. According to Pantera Capital analysts, it is possible to determine the peak of the next bull market by extrapolating previous upward trends, meaning transferring the growth rate of assets, taking into account their current value.

After each halving, Bitcoin reaches the bottom and top of the cycle around the same time. According to the analyst’s calculations:

“Historically, BTC bottomed out 477 days before the halving, gained in price prior to the event itself, and then the main rally began. The halving rally lasted an average of 480 days.”

It is worth noting that past results do not guarantee future results. They only allow you to imagine the scale of the industry’s growth in the future. So, following various predictions reaching hundreds of thousands of dollars in the case of Bitcoin’s rate is definitely not the best idea.

The same theory suggests that the bottom of the current bearish trend has already been reached. This happened in November 2022 when the FTX exchange collapsed. Experts state:

“We expected the Bitcoin price to bottom out before Dec. 30, 2022, in this scenario:

In December 2022, the price of Bitcoin fluctuated in a horizontal channel, and only in January did the cryptocurrency start to grow again. By the day of the halving, BTC could be worth around $35,000, Pantera analysts suggest.

Pantera Analysts Share Their Bitcoin Price Predictions

The most interesting price action should happen in the period up to 480 days after the halving. During this time, Bitcoin should increase to $148,000. According to calculations, investors should wait for July 2025 because the market should reach its new peak this month.

“The next halving will take place tentatively on April 20, 2024. Since most Bitcoins are already in circulation, each halving results in a 50% reduction in new supply. If history repeats itself, the next halving will increase to $35,000 before the halving and $148,000 after it.”

It should be noted that earlier Pantera analysts have already made favorable predictions. For example, in December 2022, the head of the platform, Dan Morehead, made it clear that the collapse of FTX did not mean the collapse of the reputation of the entire digital asset industry.

Many altcoins were hitting their lows then, so Morehead’s version was difficult to accept. Now, however, we can talk about its validity.

Readers should note that predicting a long-term market peak for cryptocurrencies is nearly impossible. However, such expert statements somehow shape cryptocurrency holders’ expectations for the next bull market. And since their mass sale will lead to another crash after reaching the top, such comments from analysts can prove to be important.

How Are Crypto Investors Reacting to the Current Price Dip?

So far, the situation of crypto investors leaves much to be desired. Such conclusions are indicated by the data of IntoTheBlock analysts, who analyzed the situation of token holders of the most popular decentralized finance (DeFi) projects.

Click here to learn about the top six DeFi lending platforms.

It turned out that almost 93% of Compound (COMP) platform investors are at a loss, meaning they bought the COMP token for more than its current price.

Nearly 72% of holders of UNI – the native token of the well-known decentralized exchange Uniswap – also have to wait for an increase before they can break even. And with holders of Maker (MKR), almost every second investor is in the red.

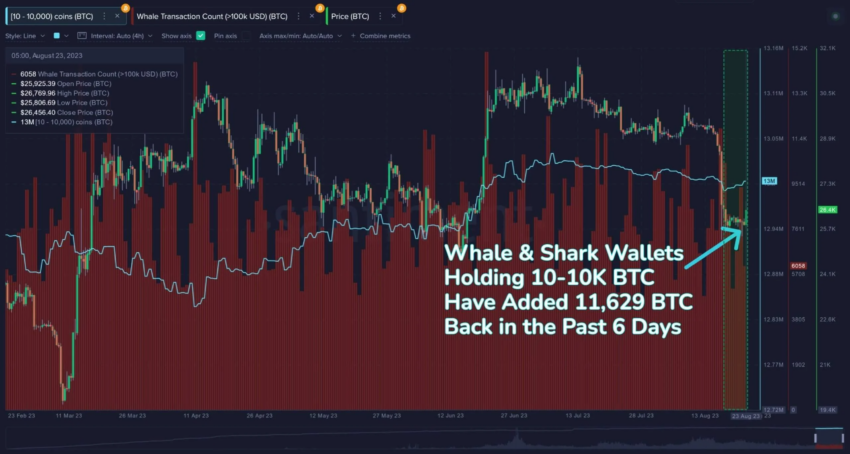

Despite this, experienced investors continue to accumulate coins and increase their number. On the night of Aug. 17-18, Bitcoin fell to $25,000, which seriously scared market participants. However, holders of wallets with more than 10,000 BTC took the opportunity to make more purchases.

According to the Santiment platform, they have since purchased an additional 11,629 Bitcoin worth $307 million.

At the same time, Ethereum (ETH) enthusiasts are actively staking their holdings to make a passive income. On Thursday, the cryptocurrency volume in Ethereum staking exceeded 26 million ETH for the first time.

The reasons for such investor activity are obvious: they expect a significant increase in the market during the next bull market. The current forecast of experts from Pantera Capital also supports this.

beincrypto.com

beincrypto.com