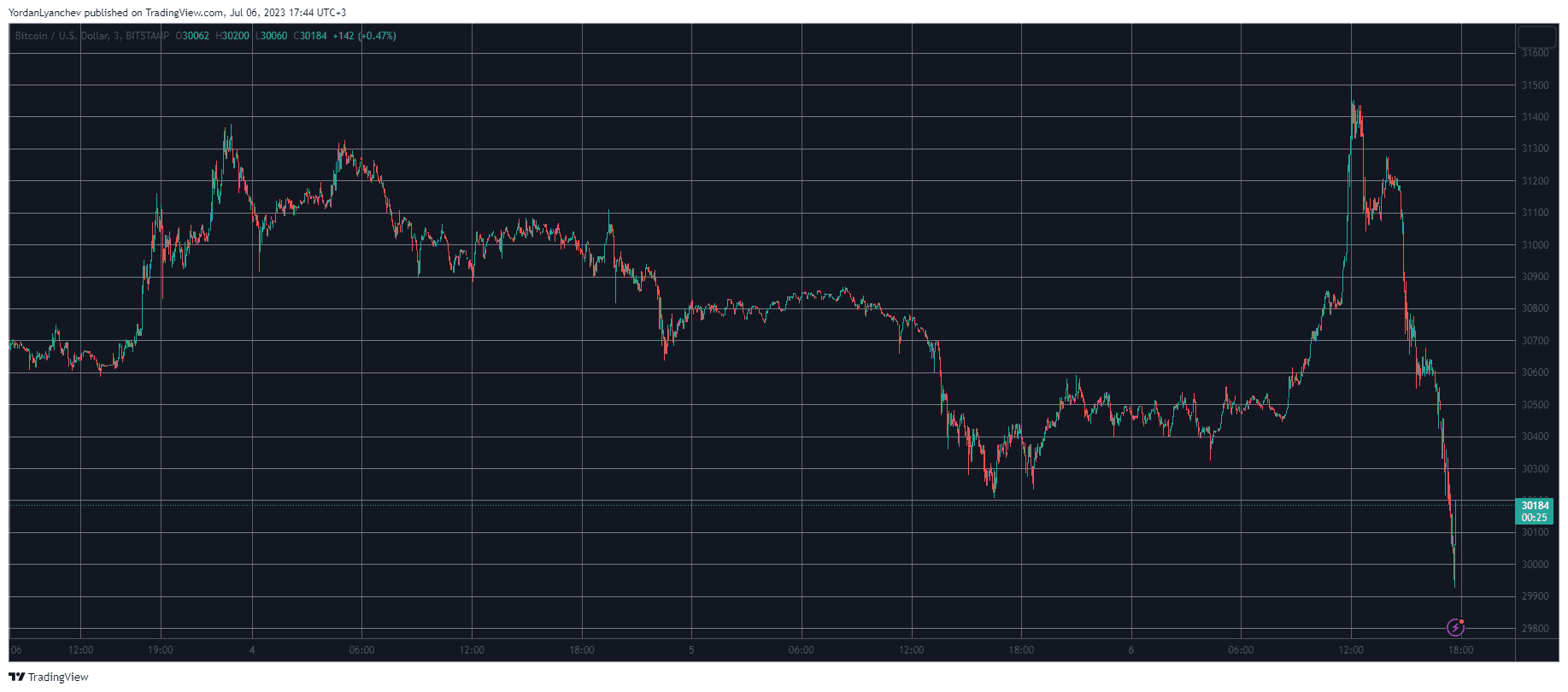

Bitcoin charted a new 13-month high at precisely $31,500 earlier today but was sharply rejected at that point and pushed down hard by $1,500.

This has resulted in a lot of pain for over-leveraged long traders, as the total value of liquidations has shot up to over $140 million in a day.

- CryptoPotato reported earlier today BTC’s voyage to $31,000, which actually resulted in the asset breaking above that level and tapping $31,500 (on Bitstamp) for the first time in over a year.

- This notable price surge comes amid growing interest in the asset, especially after BlackRock, and several other financial giants, filed to launch a spot Bitcoin ETF.

- However, the tides quickly changed in the following hours as BTC was not only unable to continue upwards or remain at that level but was sharply driven south.

- In a matter of an hour, the cryptocurrency plummeted by over $1,500 and slipped to just under $30,000.

- Several altcoins have suffered as well, with ETH dropping below $1,900, while ADA, MATIC, AVAX, and DOGE have slumped by 3%.

- Litecoin, on the other hand, has dumped by almost 6% in a day and has nosedived beneath $100. BCH and LEO remain among the few larger-cap alts still in the green.

- This enhanced volatility has resulted in over $140 million worth of liquidations, according to CoinGlass. Somewhat expectedly, over 93% of all 46,000 wrecked traders have had long positions.

cryptopotato.com

cryptopotato.com