Bitcoin SV (BSV) is again trading close to its all-time low in dollar terms. It also recently dropped to its lowest-ever levels against Bitcoin (BTC) in the past months.

BSV, a spinoff fork from Bitcoin Cash, has been consistently losing value against BTC for two years.

The Bitcoin SV (BSV) Saga

In April 2021, Bitcoin Satoshi’s Vision (BSV) was being rooted to reach $500 per coin. While it was quite close to the critical level, it has dropped almost 94%. BSV was developed as a Bitcoin Cash hard fork in late 2018 with the goal of building upon the Bitcoin protocol but being more technologically advanced.

But BSV has encountered numerous difficulties, including a 51% attack and removal from the Robinhood trading platform. Many are now labeling it a ‘dead coin.’

There have been many hard and soft forks in the cryptocurrency world. In August 2017, the original Bitcoin blockchain underwent a hard fork, creating Bitcoin Cash (BCH). The following year, a community-wide disagreement led to the hard fork of Bitcoin Cash to BSV.

Block Size Debate

To address the issue of scalability, Bitcoin SV pushed for increasing the block size while still attempting to maintain the original Bitcoin protocol’s goals. A bigger block size on paper facilitated more rapid transaction processing, which might also result in lower transaction fees.

The creators of Bitcoin SV (BSV) thought that Bitcoin Cash did not sufficiently solve the scalability problems that Bitcoin was experiencing. Some people even believed BCH altered the protocol’s structure, leading to the hard fork.

Bitcoin SV argues for bigger block sizes (up to 128 MB) to facilitate greater transaction volume and scalability. Compared to Bitcoin (BTC), Bitcoin Cash allows a greater block size (32 MB). To prioritize decentralization and security, Bitcoin (BTC) sticks to smaller block sizes and continues to adopt layer-two scaling via the Lightning Network.

BSV, a proof-of-work (PoW) system, has yet to really draw in investors. This is despite processing millions more transactions than BTC and BCH. Aside from this, it’s also steadily losing value.

TradingView data shows BSV trade volume was at a 24-hour total of $26 million. At press time, BSV is trading at a price point of $25.

Transactions Remain Under 1M

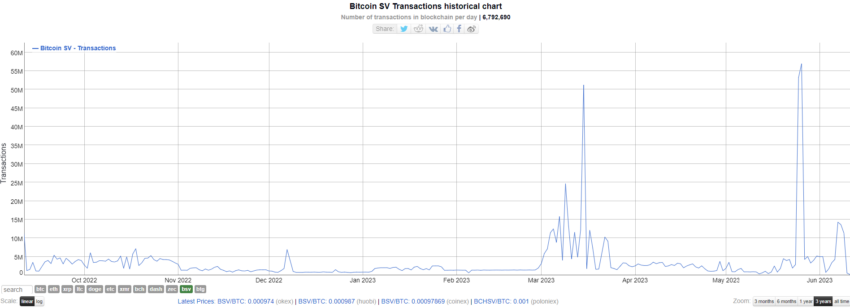

According to BitInfoCharts data, BSV processed over 50 million transactions on March 15 before surpassing that number to more than 56 million the following month. These were just spikes and outliers, however. The chain has failed to see sustained increases in transactions.

On average, BSV processes between under five million transactions.

This comes after businessman and Bitcoin SV (BSV) advocate Calvin Ayre predicted that 2023 would be the year for the chain. Ayre argued that BSV’s ability to handle millions of transactions with low fees positions it as the blockchain of choice for the future, particularly with the introduction of the IPv6 standard and the anticipated growth in internet traffic.

Ayre even claimed that BSV would serve as the foundation for the web3 revolution, but this doesn’t appear to be the case.

beincrypto.com

beincrypto.com