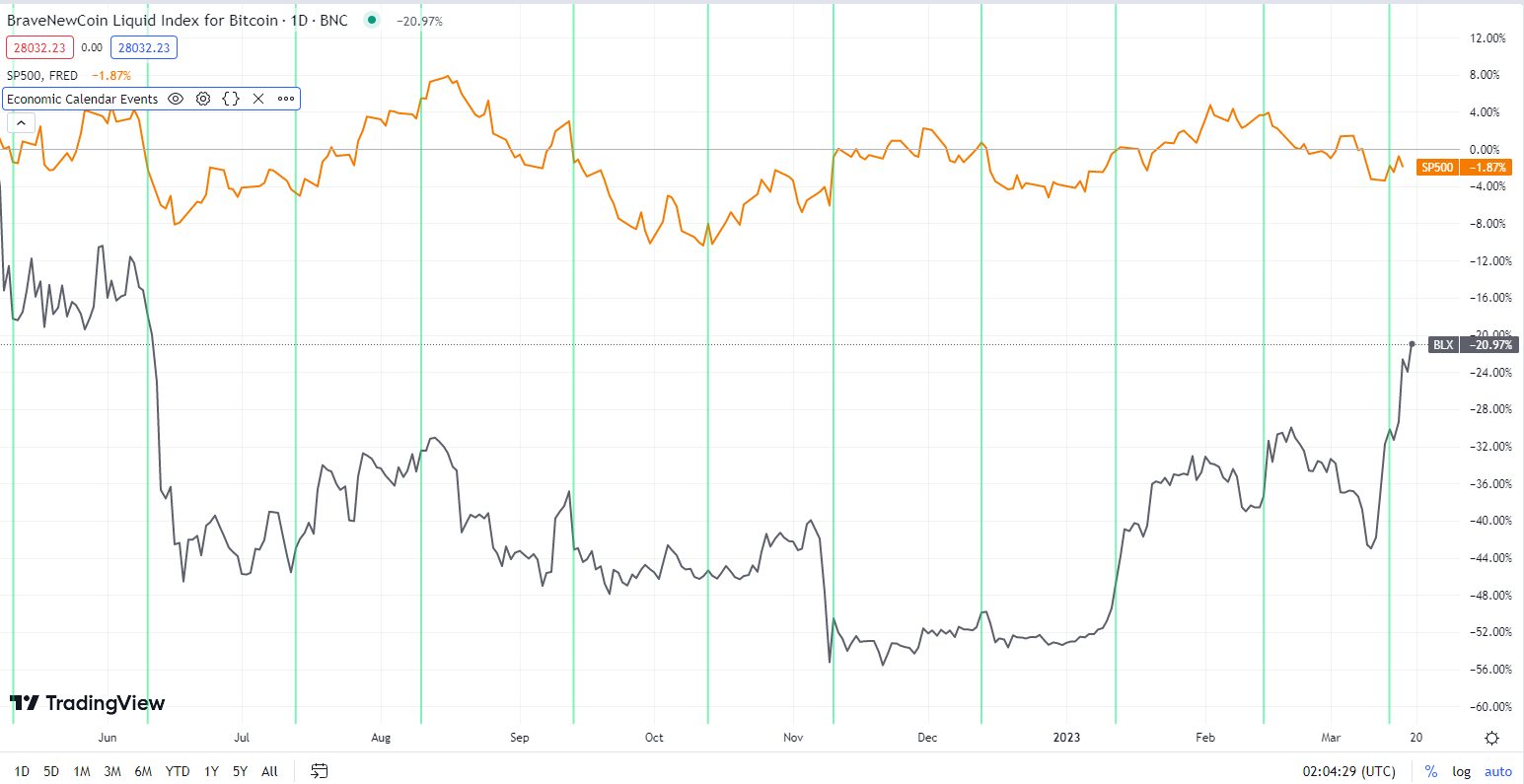

The 30-day Pearson Correlation Coefficient between Bitcoin and the S&P 500 currently sits at -0.2. With the Nasdaq Composite, this correlation sits at 0.8. The correlation between Bitcoin and equity markets has broken. The S&P 500 is up just 0.3% in the last month, the Nasdaq Composite is up by ~3,1%. Conversely, the price of Bitcoin is up ~15.7% and has been enjoying strong gains.

Bitcoin has been touted as having the attributes of an uncorrelated asset. These are assets that move independently from the stock market and give investors a chance to beat the market.

Bitcoin has for a period of time, moved in lockstep with the equity market, both asset classes sold off and then soared together during extended periods in the last two years. There has been a prevalent view that Bitcoin’s price has been driven by the Federal Reserve and macro-events.

In the last year, for example, the correlation between BTC and the S&P 500 had moved closer together with both asset classes reacting similarly to events like BPI prints. When the correlation did break it was because of disastrous black swan events like the LUNA/Terra/USDT collapse and the FTX implosion.

The prices of BTC, and the S&P 500. Source: Brave New Coin, FRED

What is happening in the last month is very different, however.

Bitcoin was built to be a decentralized payment network that removed intermediaries and counterparties from transactions. It has a purposefully built hard-coded, predictable monetary supply. It was created during the 2008 financial crisis and it has found renewed support during the current banking crisis in the United States and Europe. Another factor is the hidden chaos in the developing world in countries like Lebanon and Turkey.

Each of the banking collapse incidents listed below has an element of political interference and special concessions, and law changes, made to direct markets in a particular direction. Importantly, such interference is not possible with Bitcoin.

Backstops and shutdowns, the US banking system wobbles

In the last two weeks, under different circumstances, three major American banks have been shut down. Silicon Valley Bank, Silvergate Bank, and Signature Bank have all had a run on deposits and have become entangled with regulators. This entire episode has created serious question marks surrounding the relationship between the government and the banking sector.

The collapse of Silicon Valley Bank is complicated and likely had a number of contributing factors. Extraordinarily, the bank did not have a Chief Risk Officer (CRO) between April 2022-December 2022. Danny Moses, an investor who predicted the 2008 financial crisis and was featured in the ‘Big Short’, said of SVB. “This isn’t greed, necessarily, at the bank level,” he continued. “It’s just ... complete and utter bad risk management on the part of SVB.”

SVB has also been accused of being a ‘woke bank’, more interested in ESG (Environmental, Social and Governance - a way for investors to measure how socially concious a business is) initiatives than its core banking services.

The collapse is also notable because SVB had long lobbied for looser risk requirements - arguing that if it did fail, its collapse would not require government intervention. In 2015, SVB CEO Greg Becker argued in front of Congress that the US$50 billion balance sheet threshold outlined by the Dodd-Frank Legislation was unnecessary for his bank. He said SVB and other mid-sized banks, or regional banks, did not present systemic risks in case of collapse. In 2018, Dodd-Frank was rolled back by law makers from both the Republican and Democratic parties.

Fast-forward to March 2023 and US financial regulators were forced to step in to provide special accommodations to SVB depositors after the Treasury deemed the bank “Systemically important”.

Another key factor in the collapse of SVB and the other bank's struggles is a reversing global bond market and interest rate regime. Years of low-interest rates meant that SVB struggled to make returns. Seeking profits, SVB and other banks poured money into bonds, primarily long-term US treasuries.

When interest rates started rising, SVB and other competitors had to sell the bonds they were exposed to because depositors needed to be paid more interest. The inverse relationship between interest rates and bond prices meant that these bonds were sold at a loss. Concerns around the bank’s ability to continue running this loss were a key factor in the run against SVB.

The Silvergate and Signature situations shared many characteristics of the SVB downfall — all three had overexposure to traditional banking risks like a lack of diversification and maturity mismatches. With these two banks, the added element of crypto gives their downfalls a unique angle.

Silvergate was a bank noted for serving the cryptocurrency industry and had clients including Circle and FTX. The bank voluntarily ceased operations and liquidated assets after intense regulatory scrutiny from Financial Regulators and US lawmakers.

US Senators including Elizabeth Warren stated that because Silvergate was FTX’s banking partner, and “reportedly facilitated transfer of FTX customer funds to Alameda Research,” it played some part in the fraud committed by the exchange and its sister companies.

Nic Carter, a noted digital asset analyst and advocate said on Twitter “The government also hastened the collapse of Silvergate by launching investigations and legal attacks on them. They’re the arsonist and the firefighter in one”. The fall of Silvergate raised other questions about the interference of politics in financial markets.

Signature Bank, like Silvergate, was a bank noted for its services to the cryptocurrency industry and ability to cater to clients with digital assets on their books. Signature Bank was shut down by the New York State Department of Financial Services and its assets was seized by the FDIC. What made Signature different from Silvergate is that it was *solvent* at the time it was taken over by the FDIC.

Barney Frank, a former Democrat congressman who was on the Signature Board said it was “an unjustified total shutdown”. The bank was experiencing a surge in withdrawals but Frank said the situation was stabilizing. “The bank failed to provide reliable and consistent data, creating a significant crisis of confidence in the bank’s leadership,” is the response offered by a NYDFS spokesperson when asked why the bank was seized.

A Swiss giant goes under

Following the chaos in the US banking sector, this week it was announced that UBS, the largest bank in Switzerland will buy out ailing rival Credit Suisse. The Swiss National Bank announced that the UBS rescue operation would “secure financial stability and protect the Swiss economy.” The deal was brokered by the Swiss government and special measures including government guaranteed liquidity were put in place to ensure it would happen. It occurred without the approval of shareholders because of changes in laws made to ensure that there was no uncertainty surrounding the deal.

In 2022, Credit Suisse recorded its worst financial year since the Global Financial Crisis and for some time has been dealing with a market concerned about its stability and performance.

_The rot has been setting in for some time at Credit Suisse. Source: NYSE CS stock price_

Last week the bank acknowledged that it had “material weakness” in its bookkeeping. Given the uncertainty that was created following the closure of three notable American banks, Credit Suisse experienced a surge in withdrawals.

The Swiss banking giant tried to stem the flow through strategies like offering higher deposit rates but it was not enough. UBS was able to acquire Credit Suisse at a significant discount. Shareholders were wiped out as UBS received the equivalent of 0.76 Swiss Francs per their shares, likely disappointing because shares were trading for 1.86 Swiss Francs on Friday.

Another collapse looms large

The shares of First Republic Bank sank by more than 45% in a single day on Monday, hitting record lows. The Californian lender appears to be on its last leg but said it is "well positioned to manage short-term deposit activity." The bank received a lifeline last week after a group of 11 banks lent First Republic US$30 billion.

There are whispers that JP Morgan is positioning itself to acquire First Republic. There are, however, views that regulators may be reluctant to let a major bank like JP Morgan make a sizable acquisition. The stock price of First Republic has reversed in the last day following statements from Treasury Secretary Janet Yellen who said the government may backstop more depositors at regional banks.

Bitcoin’s time to finally Shine?

With a new round of quantitative easing needed to ensure there is liquidity to guarantee bank depositors, further currency debasement and inflation seem likely. With gold already hitting new all-time highs, Bitcoin may yet prove itself to be the ultimate hedge and eventually do the same.

During the Covid-19-driven global GDP challenges, did Bitcoin perform? No, it crashed brutally, like everything else. During the Russia-Ukraine invasion, did Bitcoin have a moment? Not really, interest rates shot through the roof, and Bitcoin once again traded as a risk asset, dropping 66% over 12 months.

Bitcoin's price action over recent weeks suggests, however, that a new narrative is building. The market signal is clear and undeniable, as Bitcoin seeks to decouple from other risk asset classes.

Is Bitcoin, ready to assume a position as a safe haven asset in response to a globally fraught central bank monetary policy? We'll know soon.

bravenewcoin.com

bravenewcoin.com