The crypto market is huge. At its most recent peak in October 2025, its market cap reached over $4 trillion, rivalling the market caps of some mega companies and dwarfing the economies of nations. This surge was due to a shift towards clearer regulation, significant institutional inflows, especially through ETFs, and an overall renewed market optimism.

As of February 2026, that value has dropped by about half with swings in between. Why is this the case?

Why Emotions Matter More in Crypto

First, ask yourself: Emotion or Fundamentals… Which has the biggest impact on the cryptocurrency market?

The reality is that crypto behaves nothing like traditional finance – it is, in fact, more speculative. The crypto market trades 24/7, with high retail participation and narrative-driven cycles. Emotions, specifically Fear and Greed, have a stronger hold over the cryptocurrency market, often driving price extremes that charts and valuation models struggle to explain.

For example, the price of Bitcoin jumps 15% on news of institutional money inflows, and over the next 48 hours, the coin’s market value drops by 32% on the announcement of regulatory concerns or, in odd cases, for no particular reason. That’s a dramatic swing that happens in reality, and for the most part, defies what analysts would call “a fundamental value change.” It’s simply psychology operating at scale.

Research demonstrates that socio-psychological and behavioral factors, such as loss aversion and regret, herding behavior, and overconfidence, have a substantial influence on investment decisions in the global market, but with more amplification in the crypto market. This means the crypto market remains extremely sensitive to the behavior of investors.

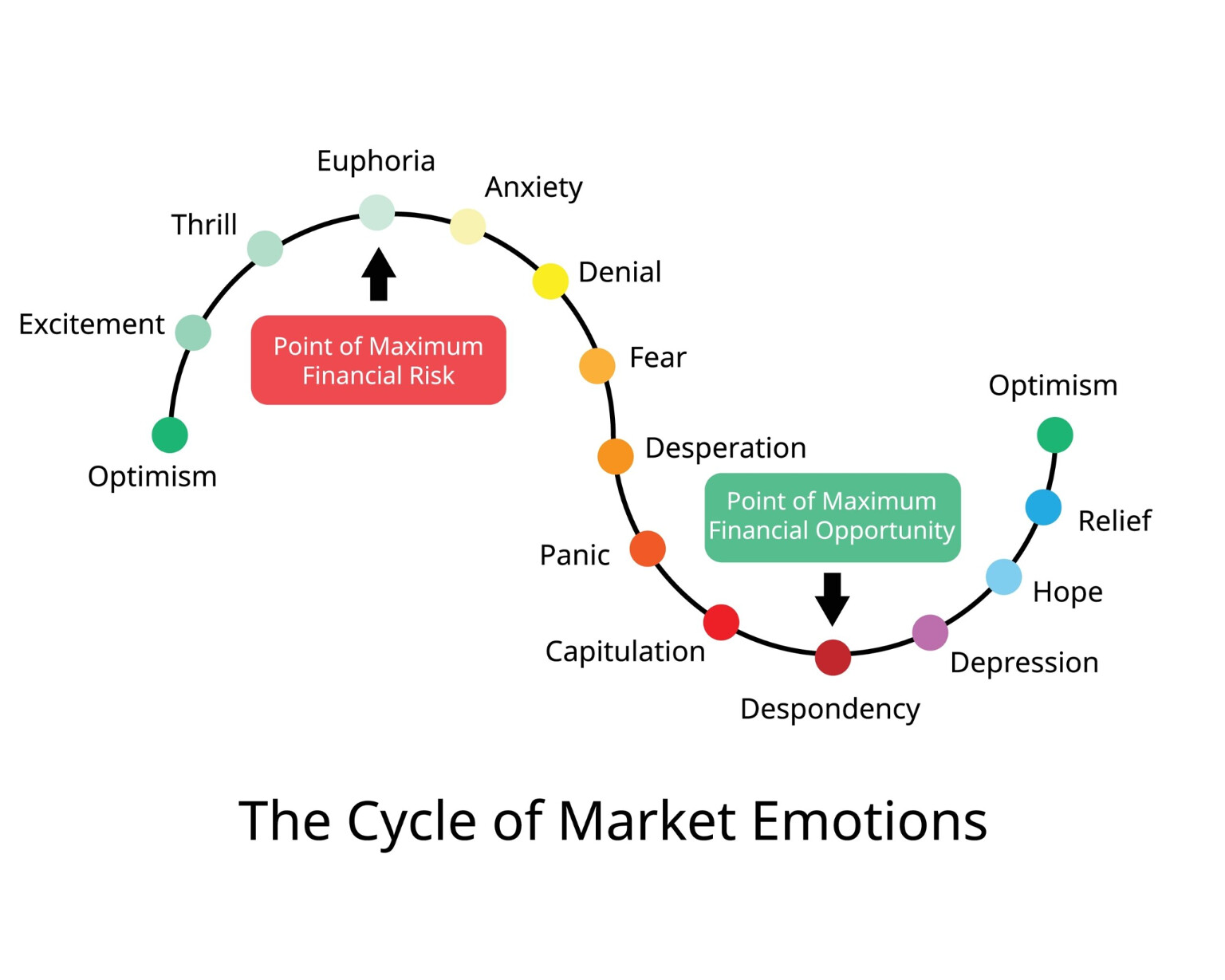

Investors feel good, greed sets in, and the market is green… Fear sets in, massive sell-offs follow, and the market is down. Hence, having a clear understanding of the market psychology and emotional cycles can be the huge difference between a costly mistake and disciplined decision-making.

This piece explores how fear and greed drive price action, volatility, and decision-making in crypto markets, helping you recognize emotional cycles so you can make more disciplined, risk-aware decisions.

What Is Market Psychology?

Market psychology refers to the collective sentiment and behavior of investors that influence financial markets. Unlike traditional economic theory, which assumes that economic participants make rational decisions based on economic or earnings data, market psychology recognizes that emotions and cognitive biases often drive trading decisions, sometimes more powerfully than fundamentals.

At its core, market psychology explains the gap between the ideal decision of an investor informed by rational models and what they actually do when fear, greed, cognitive biases, and social pressure set in.

An individual investor may put in all the work, plan out their strategies, and even maintain composure during a period of market uncertainty. However, when other investors simultaneously panic, their collective actions create cascading price movements and an emotional feedback loop where selling triggers more selling.

This herd mentality, in which investors follow the crowd without conducting a deep analysis of the market situation, is particularly prominent in crypto markets and is a significant factor that influences market direction.

Fear and Greed Explained

Fear in Crypto Market

Typically, in any market, fear emerges when investors perceive threats to the preservation of their capital, albeit more slowly in traditional markets. But in crypto, fear can spike instantly due to sudden price crashes, exchange failures (especially following a security breach), and regulatory announcements.

Panic Selling and Loss Aversion

Panic selling is fear’s most visible manifestation. A recent example is the case of flow (FLOW), which experienced panic-driven token sell-offs and over 40% depreciation in market value due to a major security exploit. An investor who planned to HODL Bitcoin ($BTC) for 6 months may abandon that course of action within minutes when losses hit 20%. Other times, an investor might sell a winning position too early because of loss aversion or hold a losing position too long, hoping to recover losses.

Market Capitulation

Other than panic selling, market capitulation is another factor that marks the extreme end of fear cycles. During this period, even long-term holders surrender to despair and exit positions, often at or near market bottoms. As of early February 2026, Glassnode data reveals that approximately 9.3 million $BTC (about 45% of the circulating supply) were trading below their purchase price, the highest level of underwater holdings since January 2023. As Bitcoin dropped to about $60,000 on February 5-6, over $1 billion in leveraged positions were liquidated in a single day, exemplifying fear’s most destructive force in crypto markets.

Shift to Stablecoins or Cash

There is also the scenario in which investors shift their volatile assets to stablecoins or cash as fear intensifies across the crypto market. Technically, when stablecoins see rapid inflows, it is usually an indicator of a market-wide risk aversion.

Greed in Crypto Market

During a bull market and sustained price gains, reasoning often flies out the window for many investors, and greed tends to dominate. Greed in crypto markets manifests as:

Fear of Missing Out (FOMO)

Imagine chasing a moving train headed to your final destination! This is the case for FOMO-driven investors. They begin to chase an asset that’s already in motion. The fear of missing out (FOMO) on opportunities overshadows risk considerations, and market participants become increasingly aggressive as prices pump.

For example, the Bitcoin bull run of 2025 saw the coin hit an all-time high of $126,000 in October. Leading up to that milestone, the search interest for cryptos spiked dramatically, with hundreds of thousands of new entrants jumping in on the rally to avoid missing out. This sort of impulsive, greed-induced approach often coincides with late-stage bull markets, when the risk of losses is highest.

Recent Success vs Long-Term Performance

In some cases, market participants decide to invest in an asset based on its early successes or its most recent performance, neglecting pre-existing trends. Because upside narratives often spread instantly in the crypto space, these investors become overconfident as the price of the asset increases, validating their investment decisions. In that moment, the possibility of a price reversal is nonexistent to such investors.

Excessive Leverage

This is enabled by easy access to margin trading and derivatives, and it amplifies greed-driven risk-taking. Crypto platforms often allow traders to control positions that exceed their actual capital, with leverage ratios up to 100x or more. This means that a trader with $5,000 in capital could hold positions up to $500,000 (100x leverage). While this can magnify profits during favorable moves, a mere 1% adverse price movement completely liquidates the position.

For example:

| Scenario 1: Price rises 2% | Scenario 2: Price falls 1% | |

|

Capital: $1,000

Leverage: 100x Position size: $100,000 |

Profit: $2,000

(200% gain on original capital) |

Loss: $1,000 (100% of original capital)

The entire position is liquidated; the trader loses everything |

During the 2025 rally, leverage ratios hit yearly highs, and when markets reversed, over $2 billion in leveraged positions were liquidated within a single 24-hour period.

Investors chase narratives and hype

Many investors shy away from fundamentals and personal research and continue to chase viral narratives and stories. Memecoins and tokens with minimal utility are usually the go-tos because they attract billions during bull markets. Investors justify purchasing these tokens not through deep analysis but by believing others will pay higher prices, often exemplifying the greater fool theory.

Why Crypto Markets Amplify Fear and Greed

24/7 Global Trading

Traditional stock markets close on holidays, weekends, and overnight, giving emotions time to cool off. The crypto market, on the other hand, never sleeps. A widely spread narrative at 2 AM, whether true or false, can trigger global selloffs before most crypto stakeholders even know it. This continuous operation creates an uninterrupted cycle of fear and greed.

High leverage availability

High leverage means that traders can magnify gains and equally suffer devastating losses. Knowing that you could potentially rake in significant gains from small price movements with a leverage of 50x, 100x, or more, fuels a continuous cycle of greed.

Social media and real-time narratives

Social media platforms like Telegram, X (formerly Twitter), and Reddit have become an integral part of the crypto economy. These are channels often used to propagate speculations, sentiments, and real-time narratives at unprecedented speed to millions of people. Orchestrated misinformation with high engagement can instantly shift market sentiment bullish or bearish.

Thin liquidity during stress events

During stress events, crypto markets often experience thin liquidity, meaning relatively small flows can cause outsized price movements. This mechanical fragility amplifies fear and greed.

Common Fear-Driven and Greed-Driven Market Phases

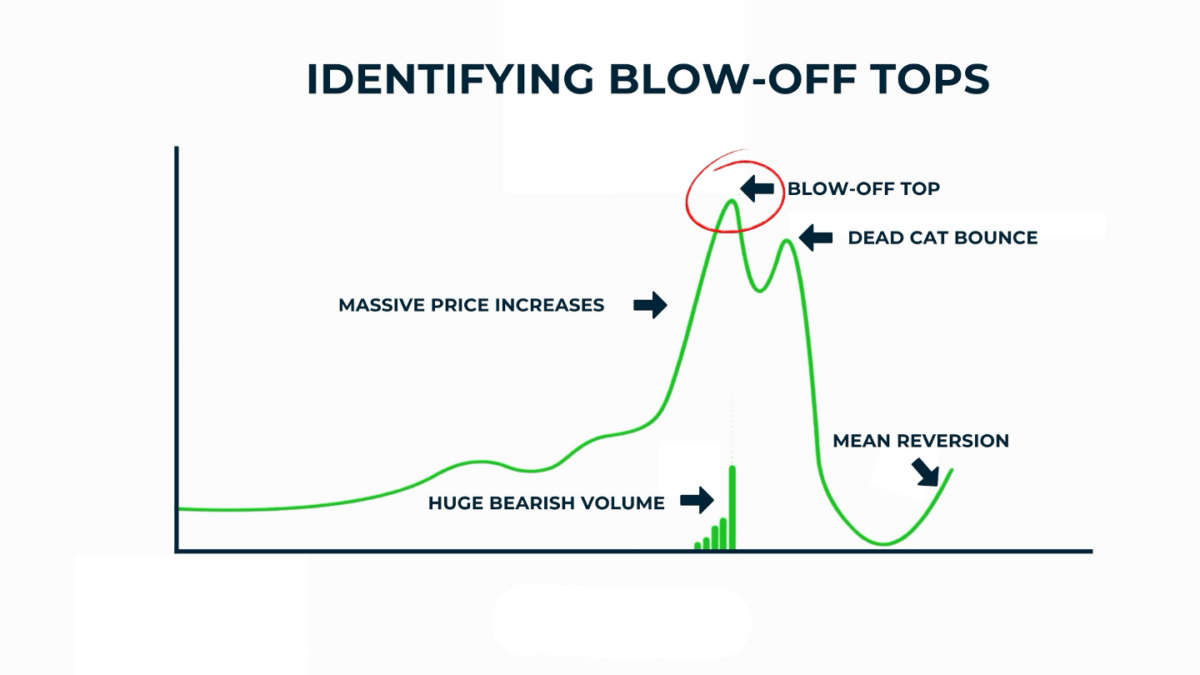

Blow-off tops

A blow-off top is a chart pattern in which an asset’s price and trading volume see a significant jump, followed by a sharp, dramatic decline. This phase is often characterized by parabolic price moves and euphoric sentiment. The disposition of market participants is one of widespread belief that “this time is different.” That line of action is narrative-driven rather than aria-describedby="caption-attachment-913136">

Sharp capitulation wicks

On price charts, a sharp capitulation wick appears as long downward candles, often accompanied by high volume. During this phase, fear dominates the market, prices drop violently, and sellers rush to exit, often liquidating leveraged positions at almost any cost.

Historically, sharp capitulations often mark short-term bottoms and potential rebounds, as overleveraged positions and fearful participants are flushed out. The question is: can you time this rebound? Maybe not, it remains unpredictable, as the market may just continue to accumulate losses.

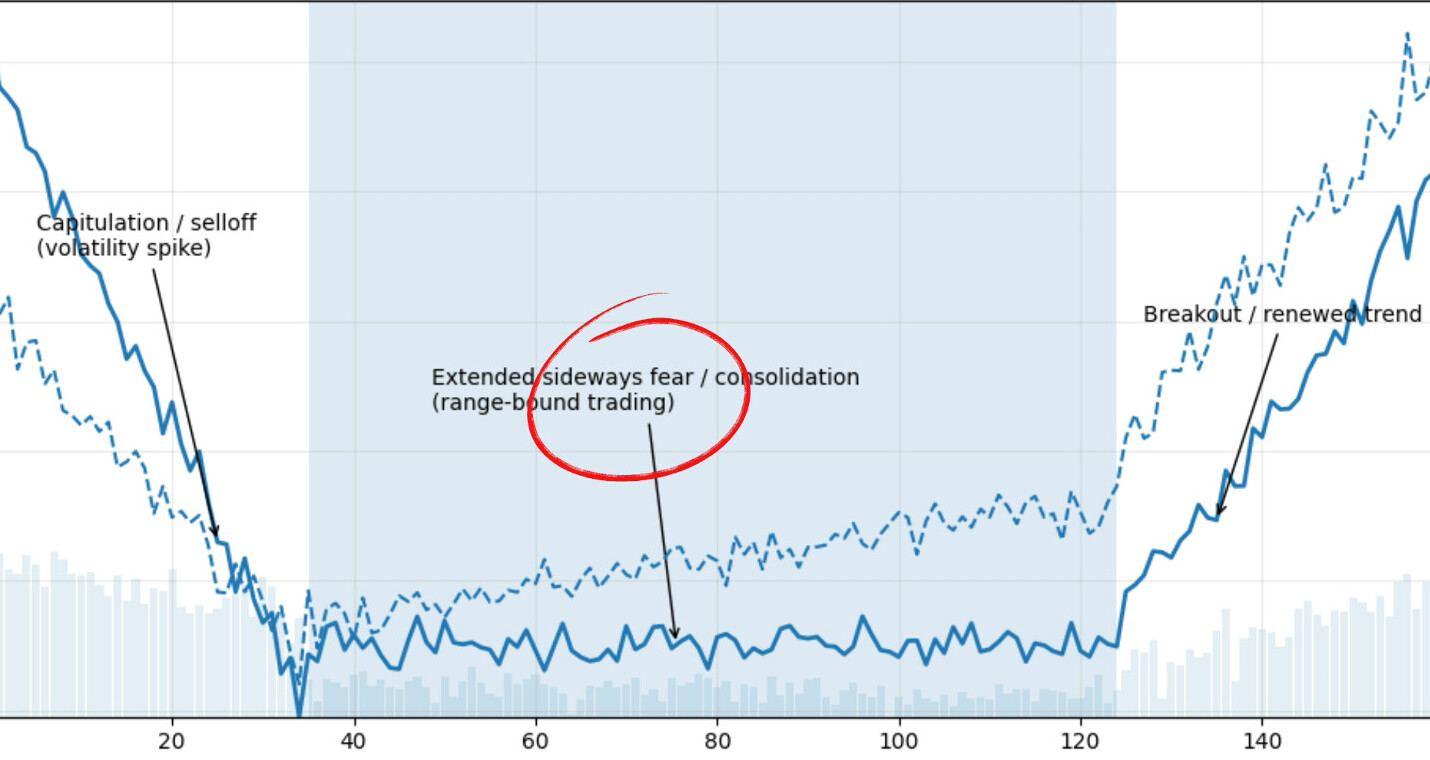

Extended sideways fear phases

This is often referred to as the consolidation period for an asset and typically happens between extremes. The extended sideways fear phase gradually grinds through investor psychology. It is marked by a range-bound market, reduced participation, low confidence, and lingering skepticism that persists for weeks or even months.

Euphoria during parabolic runs

The Euphoria phase is greed-driven and characterized by late bull markets. At this point in the market, investors believe that prices will continue to rise, causing them to ignore risks and take on speculative positions. The Euphoria phase historically precedes market corrections that erase substantial gains.

Indicators That Measure Market Sentiment

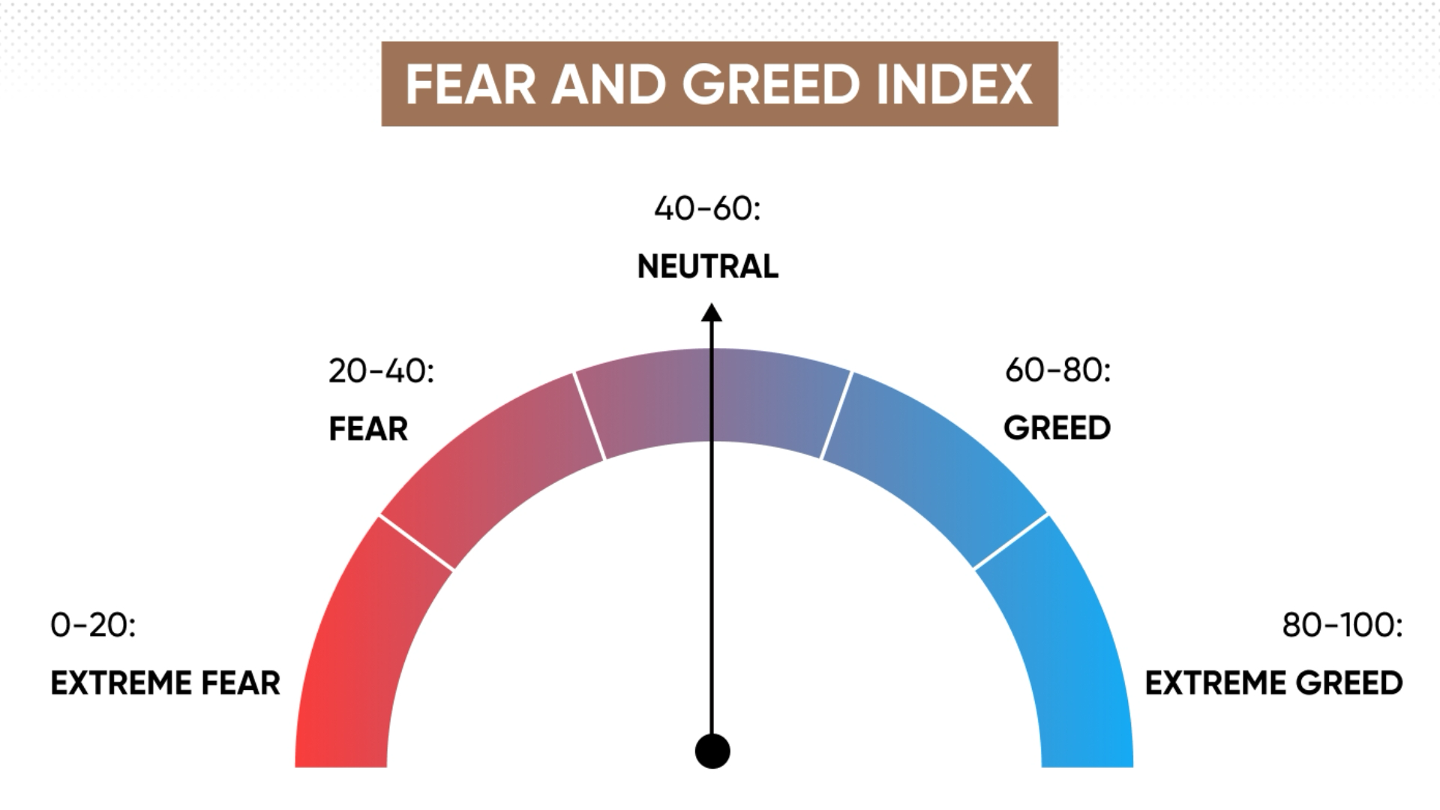

Fear and Greed (F&G) index

The Fear and Greed Index combines all investors’ feelings about the market in one number with a range of 0-100. It indicates whether investors feel frightened or greedy. When the index is low, investors are nervous and have low trading activity (risk-averse).

When the index is high, investors feel confident and/or are willing to take risks (risk-seeking). The index considers factors such as price movement, volatility, volume of trades, and investor sentiment into one overall score. The Fear and Greed index can indicate how emotional the market is; however, it does not indicate where the price of an asset will go next.

Funding Rates

Funding rates show which side of the market is using more leverage in perpetual futures. A positive funding rate means long traders pay short traders, indicating that the market is leaning bullish (perp. price > spot price). On the other hand, negative funding means short traders pay long traders, indicating that the market is leaning bearish (perp. price < spot price).

When funding rates become extreme, it suggests positions are crowded and highly leveraged. In those moments, even small price moves can trigger forced liquidations, often leading to sharp pullbacks or volatility spikes.

Open Interest

Open Interest (OI) is a tool that monitors the number of open positions in a specific crypto contract (futures or options). Simply put, OI provides traders and investors with information about interest and liquidity in a particular contract.

- Rising open interest means new leveraged trades are being added.

- If prices rise and open interest increases, it suggests growing confidence or greed.

- If price rises while open interest falls, the move may come from positions closing rather than new buying.

- Sudden drops in open interest usually signal liquidations, when fear forces traders out.

Social sentiment signals

A social sentiment indicator is an automated metric-driven tool that gauges public perceptions by analyzing the emotional tone of human-generated posts, comments, and mentions across social media platforms such as Reddit, X, and Telegram. If the overarching sentiment from social media is negative, that might prompt sell-offs and volatility spikes. Positive sentiments on the other hand could signal accumulation.

How Fear and Greed Affect Retail and Institutional Behavior

Retail emotional cycles

Retail investors are those individuals who trade with their personal money. This group of individuals often exhibits more impulsive, emotional responses to market movements. During fear phases, retail investors quickly sell volatile assets (typically memecoins and heavily speculative assets) and move their money into stablecoins or exit their positions entirely. The reverse is the case during a greed phase. Retail capital flows in the direction of meme tokens and altcoins in a bid for outsized returns.

In essence, fear and greed lead retail investors to engage in momentum-following, narrative-driven behaviour. They hold through price increases and capitulate during declines.

Liquidity provision during stress

Retail investors frequently buy near peaks driven by greed and FOMO. But during fear-driven crypto sell-offs, they often panic and capitulate, creating buying opportunities for larger, more patient capital. This dynamic creates a wealth-transfer mechanism in which institutions often provide liquidity during periods of stress. They do so by absorbing retail selling and systematically benefiting from this predictable pattern.

So how do institutions benefit from emotional extremes? The idea is simple: when panic selling occurs, opportunities for discounted entry points arise. This is where institutional investors come in to accumulate assets for a low price with a target of strong long-term returns. Because this emotional cycle often repeats itself, institutions continue to benefit from its predictability.

Institutions adopt a risk framework

Institutional investors such as hedge funds, asset managers, and family offices often take a structured risk management and longer time horizon approach to crypto. In terms of fund allocation, they push money to derivatives and to larger, established cryptocurrencies like Bitcoin and Ethereum.

During a market downturn, institutional investors are less emotional and typically make limited changes to their portfolios, rather than reducing their positions to cut losses. This distinction in market reaction speaks to the risk appetite of both classes of participants.

Managing Emotional Bias as a Crypto Participant

Set predefined risk limits

Setting portfolio allocation limits, position sizes, and stop-loss limits prior to entering into a trade will help an investor put guardrails in place to prevent greed driven behavior.

Avoiding impulsive decisions

During peak fear or greed phases, the tendency to make impulsive decisions rises. Hence, it is a good approach to implement a waiting period between decision and execution, especially when making an unplanned trade that equals or exceeds your predefined limits.

Separating narratives from data

Always stick to verifiable data, not narratives. A token might surge on the hype of potential partnerships. It is the responsibility of an investor to verify the authenticity of those partnerships by seeking official communications from those involved. You must also be wary of social media hype, as it sometimes amplifies compelling narratives that may or may not reflect reality.

Long-term vs short-term mindset

Short-term is trading, and long-term is investment. Determining which category you fall into in advance matters significantly for emotional management. Traders, with a short-term mindset, actively react to market volatility. Investors, on the other hand, can often ignore it. An investor who purchased ETH as a 2-4 year position can weather a 35% price drop more easily than someone looking to cash out profits in a few weeks.

The Role of Fear and Greed in Crypto Cycles

Since the inception of Bitcoin, the crypto market has seen multiple boom-bust cycles, each accompanied by evolving technology, new narratives, participants, and changing regulatory frameworks. One thing, however, remains persistent: the psychological patterns of traders and investors.

During the fear phase, loss aversion has continued to drive panic selling, and in the greed phase, FOMO has continued to pull investors into late-stage rallies.

There are arguments that a mature crypto market, such as one with high institutional adoption, robust infrastructure, and regulatory clarity, may reduce the frequency of extremes. This, in actual fact, is true today.

Regulations are clearer, ETFs provide crypto exposure without actually holding crypto, and a lot more institutional money is flowing into the crypto market. However, as long as uncertainty, leverage, and human psychology coexist, fear and greed will remain a structural force in crypto, even though extremes may be nerfed.

Conclusion

Fear and greed are unavoidable features of the crypto market. They are structural features of an open, global, and emotionally responsive financial system. Understanding how these forces operate does not necessarily guarantee better outcomes, but it represents the first step toward more disciplined market participation.

Knowing when the market is in a fear phase can prevent costly mistakes, such as capitulating at bottoms. Similarly, recognizing euphoric conditions can prompt appropriate risk management before corrections occur. Simply said, emotional awareness is a competitive advantage.

cryptopolitan.com

cryptopolitan.com