Cardano price today trades near $0.2696 after consolidating gains from the bounce off $0.23 crash lows. The token has fallen 73% from its August highs above $1.00, but founder Charles Hoskinson’s revelation of $3 billion in personal unrealized losses underscores that even insiders are feeling the pain of this bear market.

Hoskinson Reveals $3 Billion Unrealized Loss

Cardano founder Charles Hoskinson disclosed over $3 billion in unrealized losses during a live broadcast from Tokyo, offering a rare look at his personal exposure during the market downturn. The revelation counters claims that crypto founders are insulated from losses affecting retail investors.

Hoskinson emphasized that he could have cashed out but chose to remain committed to building the ecosystem. He framed the downturn as a transition period as financial systems adjust to new technology rather than a breaking point.

The founder pointed to Cardano-based projects including Starstream and Midnight as examples of long-term development focused on data integrity and privacy applications. He stated he has no plans to exit his positions and views the selloff as part of a longer cycle.

Derivatives Data Shows Deleveraging Complete

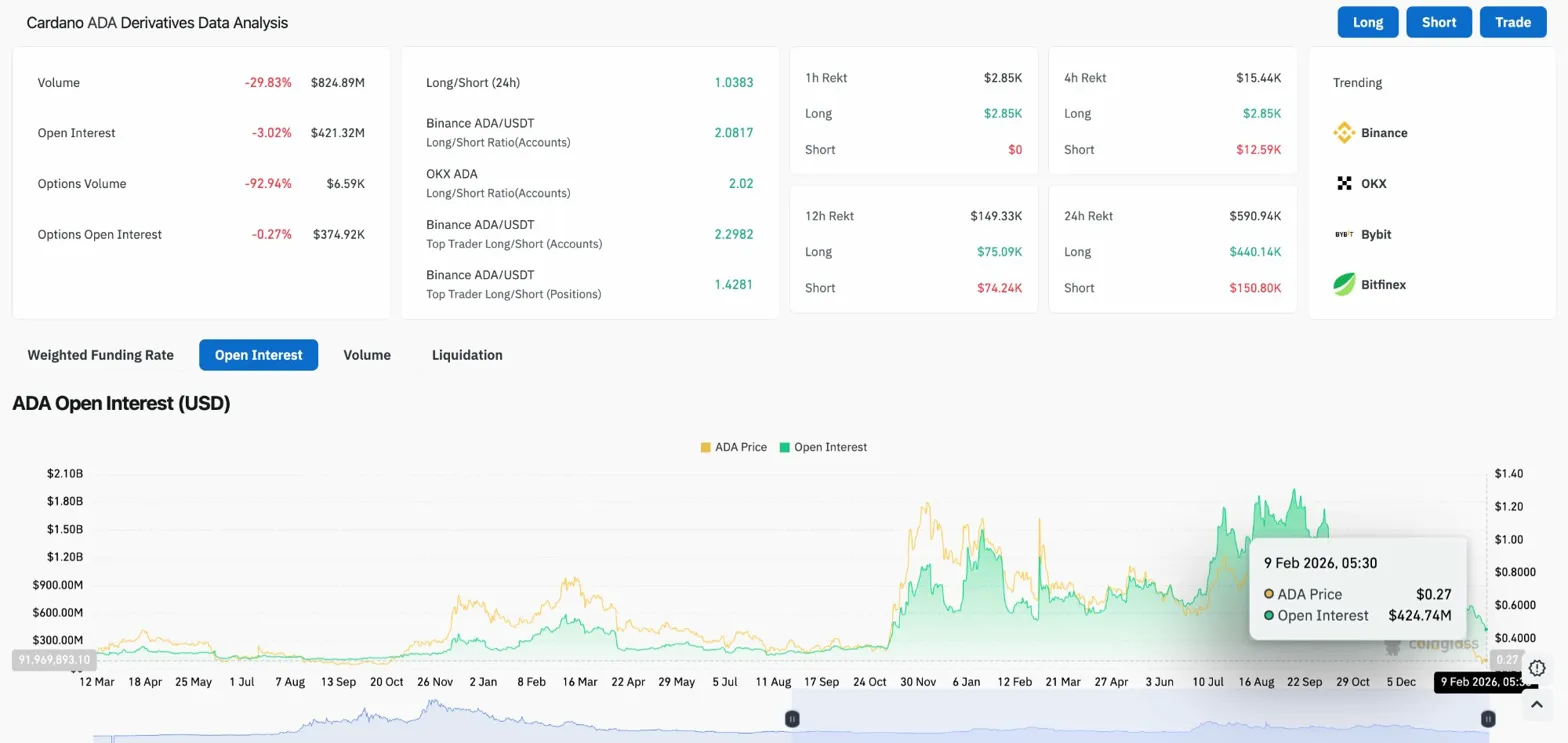

Open interest dropped 3.02% to $421.32 million while volume collapsed 29.83% to $824.89 million. Options volume cratered 92.94% to just $6.59K, reflecting exhausted trading activity following the volatility spike.

The long/short ratio sits at 1.03, nearly balanced after the crash cleared leveraged longs. On Binance, top traders maintain a 2.29 ratio by accounts, showing some bullish bias remains among larger players.

Related: Aster ($ASTER) Price Prediction: $ASTER Rebound Meets Supply Zone as Leverage Continues to Drop

Over the past 24 hours, $590.94K in positions were liquidated, with $440.14K from longs and $150.80K from shorts. The relatively low liquidation volume compared to crash peaks suggests leverage has been substantially cleared from the system.

The open interest chart shows $ADA open interest has fallen from peaks above $2 billion during the rally to current levels around $424.74 million. This deleveraging removes the forced selling pressure that accelerates crashes and creates conditions for more stable price action.

Daily Chart Shows Descending Channel Structure

On the daily chart, Cardano trades within a descending channel that has guided price action since August. The channel resistance currently runs through approximately $0.35, while support sits near $0.20.

Price trades well below all four major EMAs. The 20 day sits at $0.3076, the 50 day at $0.3522, the 100 day at $0.4219, and the 200 day at $0.5203. The Supertrend indicator remains bearish at $0.3414.

The $0.50 horizontal resistance zone highlighted on the chart represents the first major supply area if a recovery develops. The current price of $0.27 sits roughly 73% below the August highs above $1.00.

Short Term Chart Shows Consolidation Triangle

On the 30-minute chart, Cardano has formed a consolidation pattern between $0.26 and $0.29 following the bounce from crash lows. A descending trendline from the February 6 high caps rallies near $0.275.

RSI sits at 48.14, neutral territory that provides room for movement in either direction. MACD has converged near zero, reflecting the sideways price action during consolidation.

Related: Solana Price Prediction: SOL Defends $87 After 20% Surge While ETFs Continue To Exit

The consolidation pattern will resolve with a directional move. A break above $0.28 would signal continuation toward the $0.30 zone, while a break below $0.26 would target a retest of the $0.23 crash low.

Outlook: Will Cardano Go Up?

The trend remains bearish while price trades within the descending channel, but the deleveraged market and founder commitment suggest conditions for recovery are forming.

- Bullish case: A daily close above $0.3076 would reclaim the 20 day EMA and signal that the crash low marked capitulation. CME futures launch and Midnight development provide structural catalysts if broader sentiment improves.

- Bearish case: A close below $0.26 would break consolidation support and target the $0.23 crash low. With Hoskinson sitting on $3 billion in unrealized losses, further declines would test even the most committed holders.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com