Hyperliquid ($HYPE) has moved against the broader market since the start of the year, supported by several internal and distinctive drivers. Analysts observe that liquidation losses have actually helped push $HYPE’s price higher.

How long can $HYPE continue to outperform the market? Several on-chain and market data points offer a more nuanced view.

Drivers Behind Hyperliquid’s Market Outperformance

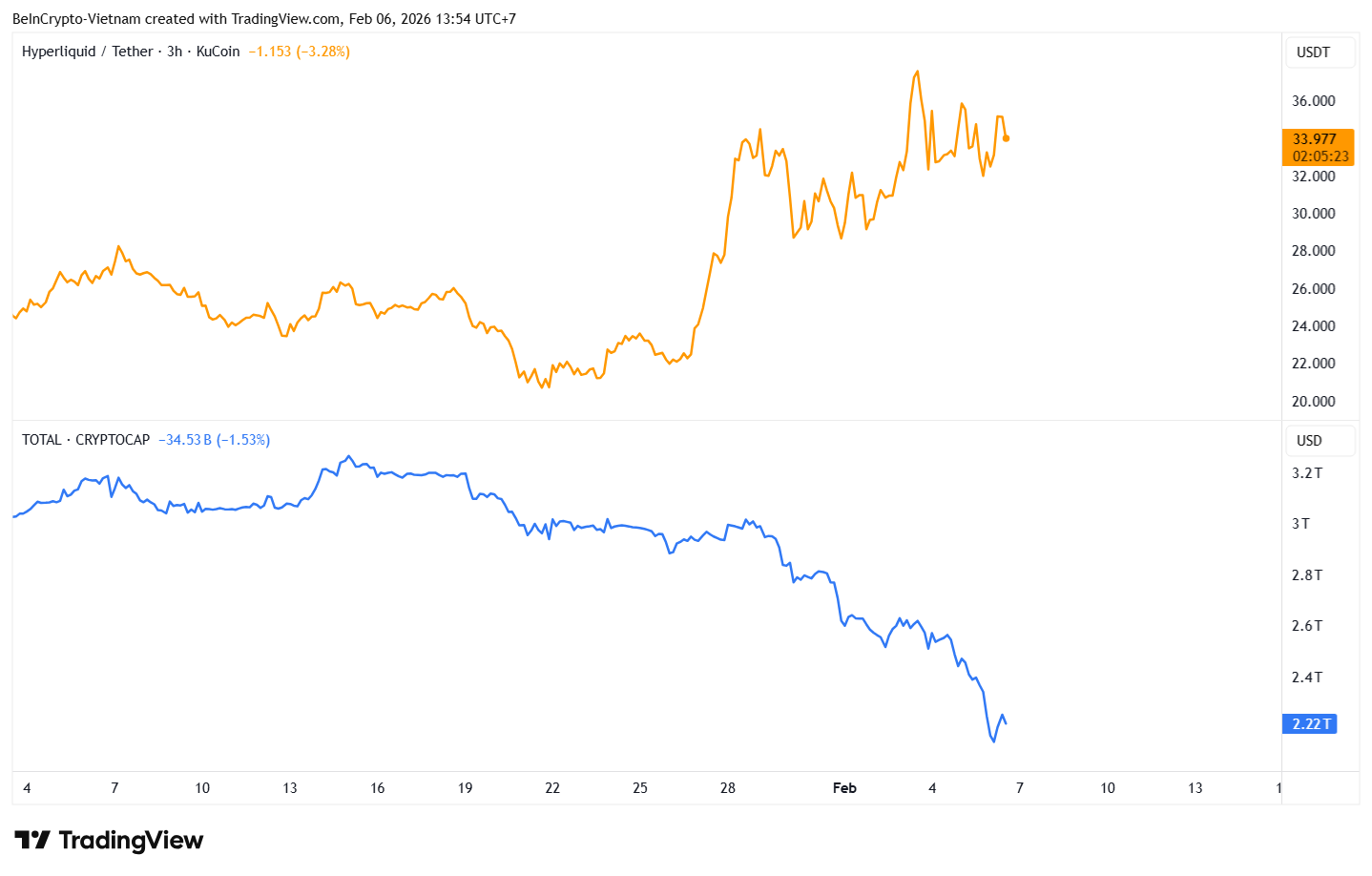

While capital continues to flow out of the broader crypto market, Hyperliquid ($HYPE) has attracted inflows. TradingView data shows that since mid-last month, the total crypto market capitalization has fallen from $3.2 trillion to $2.2 trillion. Over the same period, $HYPE rose 60%, from $20.6 to $33.6.

$HYPE Price And Total Crypto Market Capitalization. Source: TradingView">

$HYPE Price And Total Crypto Market Capitalization. Source: TradingView">

This divergence suggests that $HYPE’s internal catalysts have outweighed the market’s heavy selling pressure.

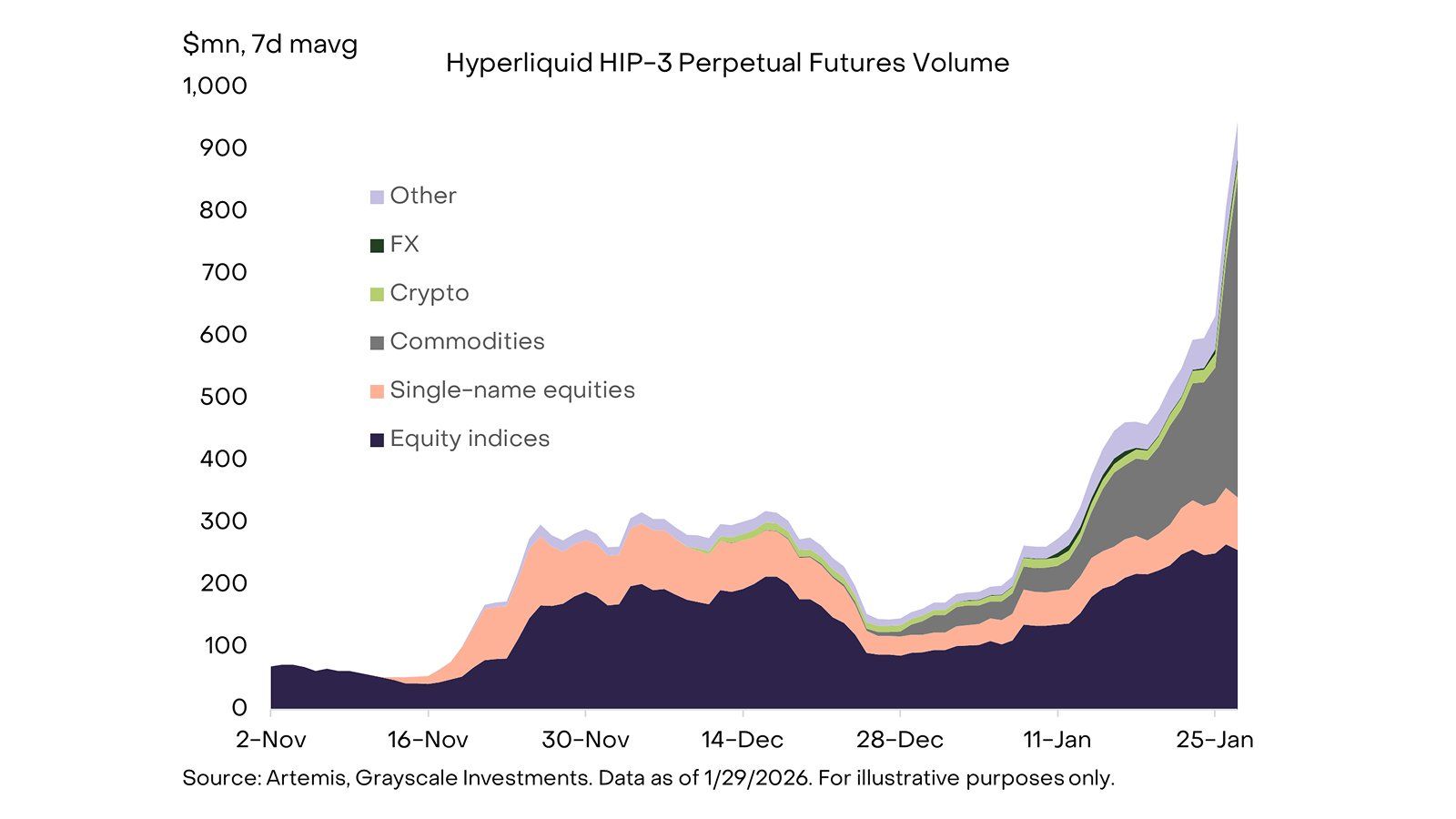

Recent reports from BeInCrypto attribute part of this momentum to a sharp surge in trading volume for HIP-3 futures contracts on Hyperliquid.

Grayscale Research highlights a boom in perpetual futures trading for non-crypto assets on Hyperliquid earlier this year. The platform recorded a seven-day average trading volume exceeding $900 million.

In addition, Ripple Prime has opened institutional access to Hyperliquid’s on-chain derivatives tools. This move supports liquidity and broader adoption.

Another development strengthened $HYPE on February 5, a day marked by the most fearful market sentiment in a year. Coinbase officially enabled $HYPE trading, leaving the token largely unaffected by the broader sell-off.

A listing on a major exchange like Coinbase boosted liquidity and demand. It attracted both institutional and retail investors. This allowed $HYPE to absorb selling pressure and even extend gains while the market declined.

“Coinbase is listing $HYPE! There are two nuances for this listing:

- This is likely a precursor for spot $HYPE ETFs to begin trading since Coinbase is the custodian.

- US investors still have trouble getting $HYPE exposure; a Coinbase listing alleviates that.”

— Steven.hl, Yunt Capital, said.

Some analysts add that $HYPE’s absence from Binance may be an advantage. It may help the token avoid widespread sell-offs. Investor MartyParty notes that $HYPE is the only Layer-1 asset not listed on Binance. As a result, it has avoided being pulled into this “liquidity hunt.”

Why Do Larger Liquidations Push $HYPE Higher?

Other analysts argue that $HYPE’s price story runs deeper.

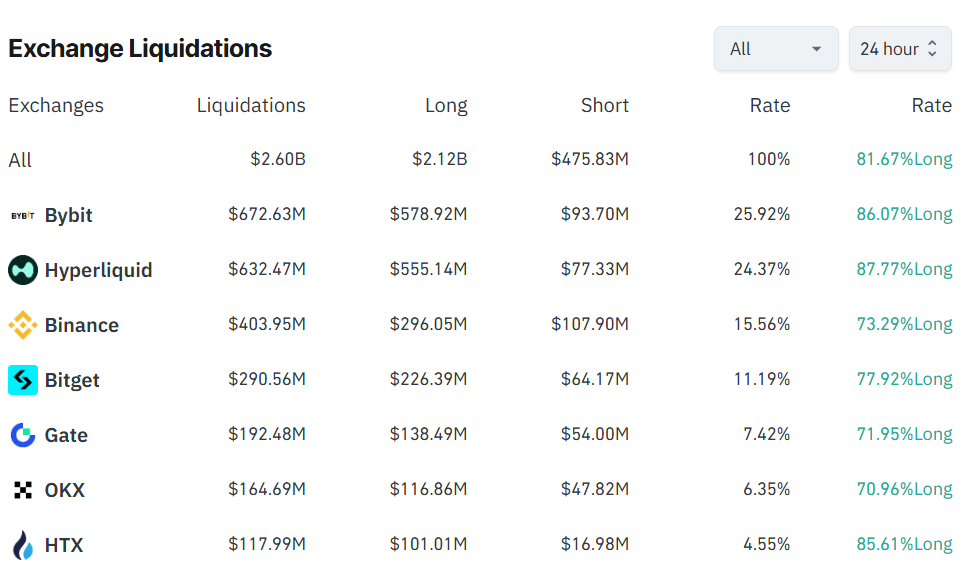

Coinglass data shows that out of more than $2.6 billion liquidated in 24 hours, Hyperliquid accounted for over $630 million. This figure was slightly lower than Bybit’s, but higher than Binance’s.

Analysts explain that heavier liquidations tend to support $HYPE’s price because of a fee-revenue-based buyback mechanism. High liquidation volume means higher trading volume, which drives higher fee revenue.

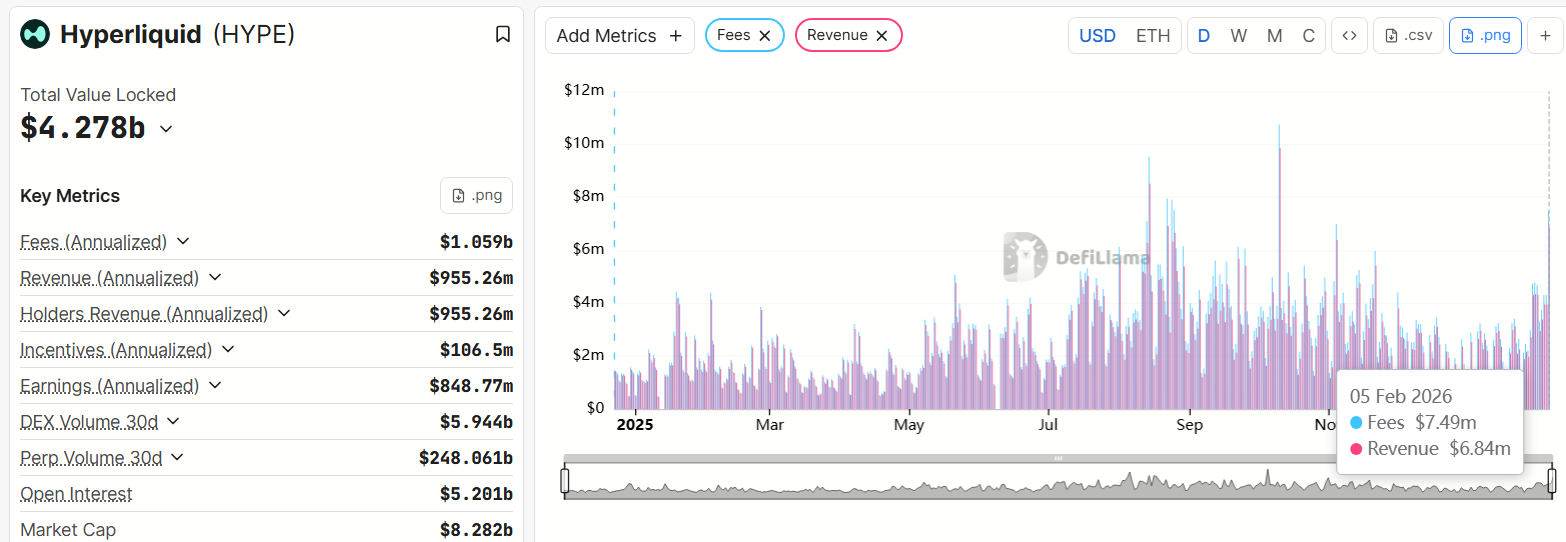

DefiLlama data shows that on February 5, Hyperliquid generated $7.49 million in fees and $6.84 million in revenue. This marked the highest level since the market crash on October 10 last year.

For most projects, market crashes reduce revenue. Hyperliquid, as an exchange, benefits from liquidation activity instead. This dynamic directly impacts the price of $HYPE.

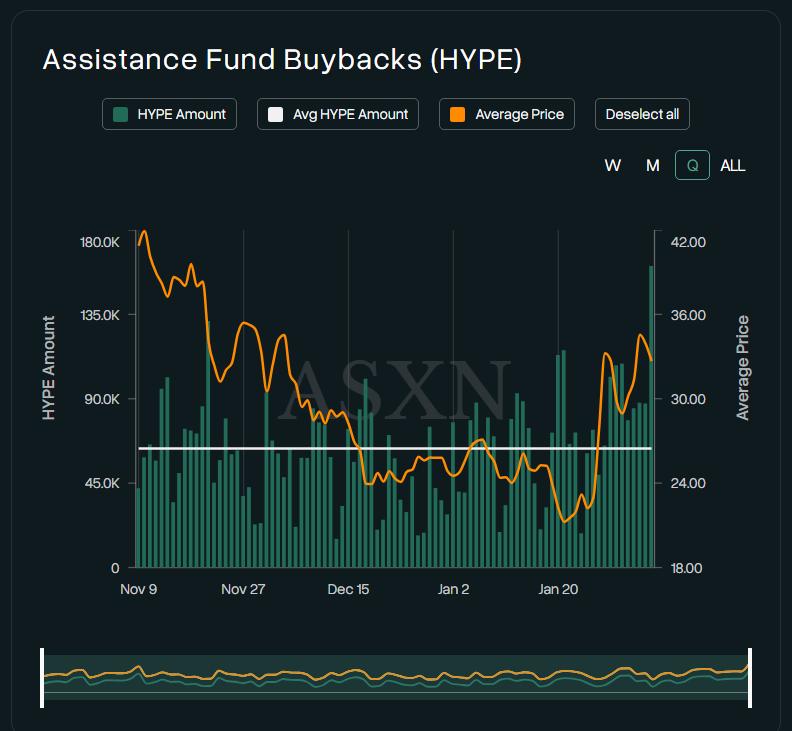

Data from Hyperscreener shows that more than 160,000 $HYPE tokens were bought back on February 5. This was the highest level since the October 10 market dump.

$HYPE Amount Buybacks Per Day. Source: Hyperscreener">

$HYPE Amount Buybacks Per Day. Source: Hyperscreener">

This structure gives $HYPE a unique mechanism to counter negative market pressure.

“The recent uptick here is most likely due to a lot of liquidations, which tend to drive significant fees and revenue.”

— Analyst Thor said.

However, focusing too heavily on positive narratives may cause investors to overlook risks. On February 6, 9.92 million $HYPE tokens are scheduled to unlock. In addition, negative market sentiment may persist and could outweigh $HYPE’s positive catalysts.

The latest analysis from BeInCrypto emphasizes the importance of the $30 level. Price action above or below this threshold will form the basis for predicting $HYPE’s next move this month.

The post What is Helping Hyperliquid ($HYPE) Hold Firm Amid Extreme Market Fear? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com