Solana is stabilizing after recent volatility as traders focus on key support zones and nearby resistance levels to gauge short-term trend direction.

Solana ($SOL) and the broader crypto market are attempting a recovery after recent volatility, rising about 2.2% over the past 24 hours. During this press, $SOL is changing hands just above $103.

The price moved within a relatively tight daily range, briefly pushing above $105 before pulling back to levels like $101.70. Trading activity remains elevated, with 24-hour spot volume near $988 million, while futures volume is significantly higher at roughly $11.04 billion, highlighting strong derivatives participation during the rebound.

Despite the daily uptick, Solana is still down roughly 16.2% over the past week, and more than 22% in the last 30 days. Market capitalization stands near $58.6 billion, up about 1%, while open interest sits around $6.3 billion.

Solana Price Prediction

Solana is currently consolidating just above the $95 support zone, which has emerged as the most immediate demand area following the latest sell-off. This level aligns with yesterday’s intraday low and prevented a deeper breakdown. A daily move below that level would weaken the structure and expose $SOL to the next downside support around $90.

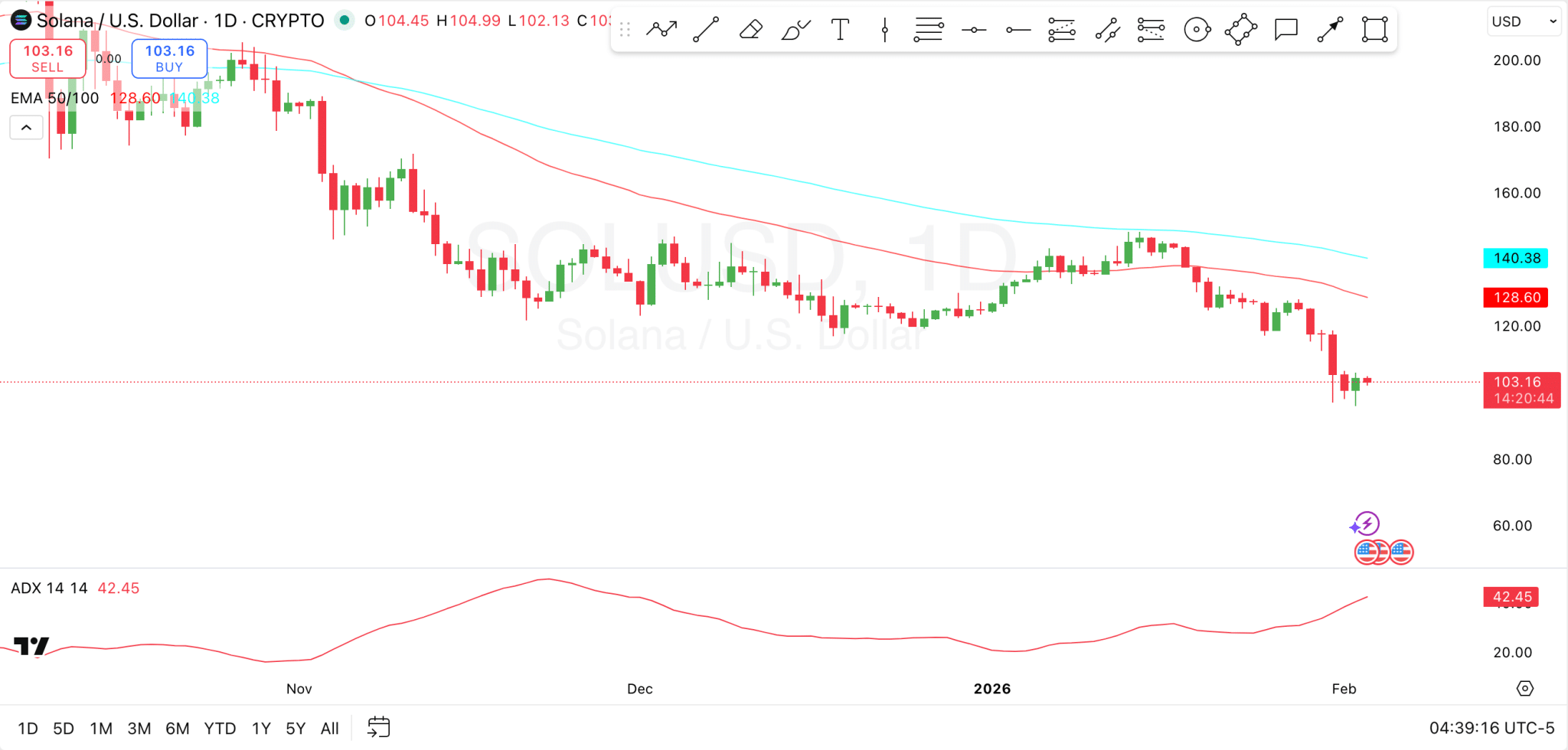

On the upside, the 50-day EMA near $128.6 represents a key trend resistance, while the 100-day EMA around $140.4 marks a major overhead barrier. As long as $SOL remains below these moving averages, rallies are likely to be corrective rather than trend-reversing.

Elsewhere, the ADX is elevated around 42, signaling a strong and well-established trend, which currently points to sustained downside pressure rather than consolidation. The downward slope of the 50-day and 100-day EMAs reinforces the bearish bias, confirming that the broader trend remains negative.

For sentiment to improve, traders would need to see the ADX begin to flatten alongside price reclaiming $110 and eventually closing above the $128 resistance zone. Until then, Solana remains vulnerable to further downside.

Solana is Defending Key Support Levels

In an X market commentary, analyst BitGuru noted that Solana is currently defending the $97–$100 support zone, which is acting as a critical short-term floor after the recent decline. According to the analyst, a decisive breakdown below this area would increase downside risk and could trigger a deeper flush toward the $92–$95 region.

On the upside, BitGuru highlighted initial resistance in the $110–$115 range, where previous selling pressure emerged. Above these are stronger recovery targets between $122–$126, which Solana would need to reclaim to signal improving momentum and a potential trend shift.

thecryptobasic.com

thecryptobasic.com