Cardano faces a sharp decline, breaking key supports, but long traders remain dominant. Why the contrast?

Cardano ($ADA) has faced a significant 6.9% decline in the past 24 hours, with the price currently sitting at $0.3263. During this period, $ADA’s price ranged from a high of $0.3516 to a low of $0.322, indicating sharp fluctuations.

This drop follows a broader market correction, with Cardano experiencing a 9.1% loss over the past week and a 7.1% decline in the last 30 days. More concerning is the token’s performance over the past year, showing a dramatic 65.3% drop, as bearish sentiments dominate.

In terms of volume, Cardano has seen significant trading activity, with $1.4 billion in futures volume and $179 million in spot volume. The higher futures volume, particularly with long positions dominating at a ratio of 1.4357 on Binance, suggests traders are preparing for potential price swings.

$ADA is currently testing lower price levels, with the price moving near its support zone. However, unless it can regain momentum, break through the recent resistance, and reverse the downtrend, further downside movement could occur. What’s next?

What’s Next for Cardano?

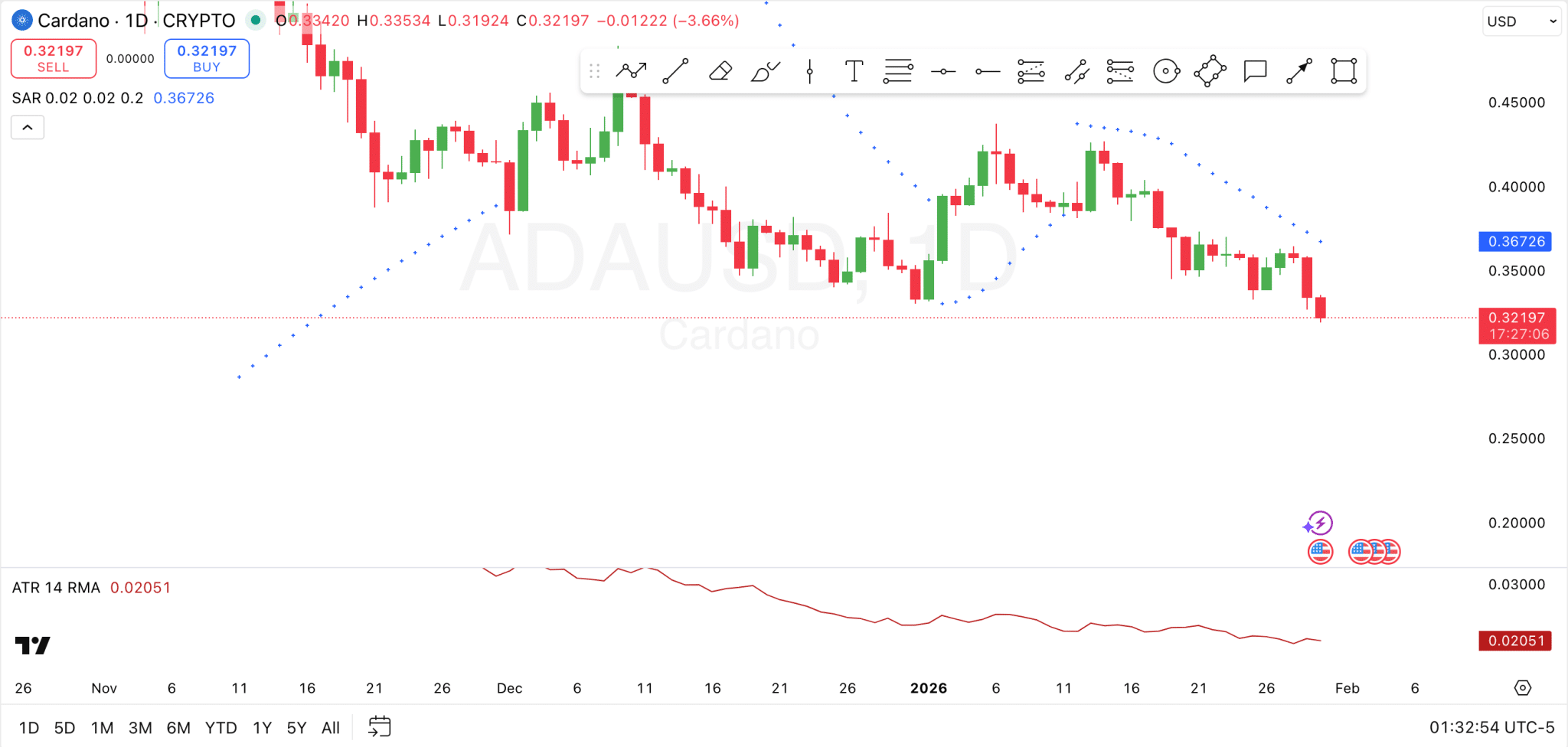

On TradingView’s technical charts, Cardano is currently showing bearish momentum, with the price trading below key resistance levels. The price has dropped below the Parabolic SAR at $0.3673. In addition, $ADA has tested support levels like $0.358, and $0.334, and is now pointing to deeper levels.

If further support is broken, the next support level to watch is $0.28. The SAR is currently providing resistance, and $ADA will need to break this level to reverse the bearish trend and initiate an upward movement towards levels like $0.40.

The Average True Range shows a relatively low volatility reading at 0.02051, suggesting that price movement may remain subdued unless there’s a significant catalyst. The low ATR reading indicates that Cardano’s price is moving within a narrower range and could either continue drifting sideways or break out with a significant move once volatility increases.

Overall, traders should closely monitor the resistance at $0.3673 to gauge whether $ADA can establish a more bullish trend in the coming days.

Cardano Long vs Short

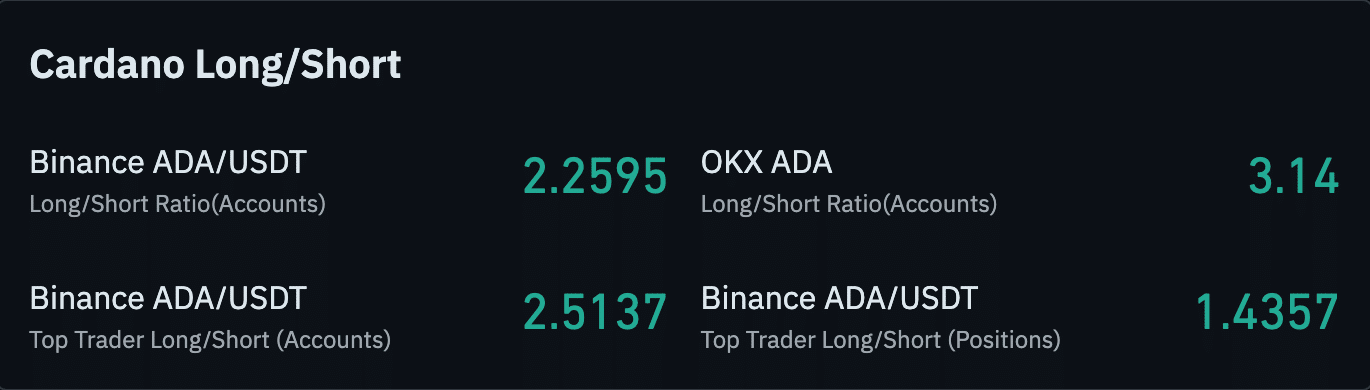

Meanwhile, the Long/Short ratios for Cardano provide useful insights into market sentiment and positioning across various exchanges. On Binance, the long-to-short ratio for $ADA/$USDT accounts stands at 2.2595, indicating that a majority of retail traders are holding long positions on Cardano.

When looking at the top traders on Binance, the ratio increases slightly to 2.5137. On OKX, the long-to-short ratio is even higher at 3.14, which further supports the notion of a more optimistic outlook from traders on that platform.

However, when examining the positions on Binance $ADA/$USDT, the ratio drops to 1.4357, indicating that while there are more long positions, there is a higher level of short positioning relative to the overall positions.

thecryptobasic.com

thecryptobasic.com