Stellar’s price has remained under pressure as broader crypto market weakness continues to weigh on altcoins. $XLM has declined steadily, validating a bearish chart pattern and reinforcing short-term downside risks.

While traders may look to capitalize on this momentum, on-chain behavior suggests $XLM holders are positioning differently.

Stellar Holders Could Rescue $XLM

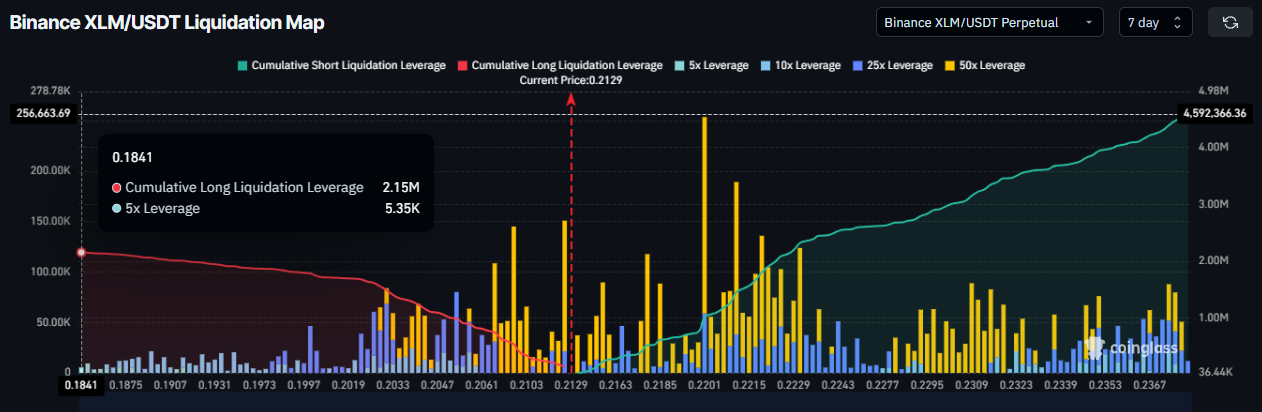

Derivatives data highlights a clear imbalance in market positioning. The liquidation map shows exposure skewed roughly 68% toward short traders, signaling strong bearish conviction. Such dominance often increases sensitivity to volatility, as crowded trades amplify price reactions when momentum shifts.

Below current levels, a dense cluster of long liquidation leverage sits between $0.20 and $0.185. A move into this zone could trigger forced liquidations, adding selling pressure and accelerating a decline. This setup explains why bears are eyeing further downside, as liquidity pockets remain vulnerable under key supports.

$XLM Liquidation Map">

$XLM Liquidation Map">

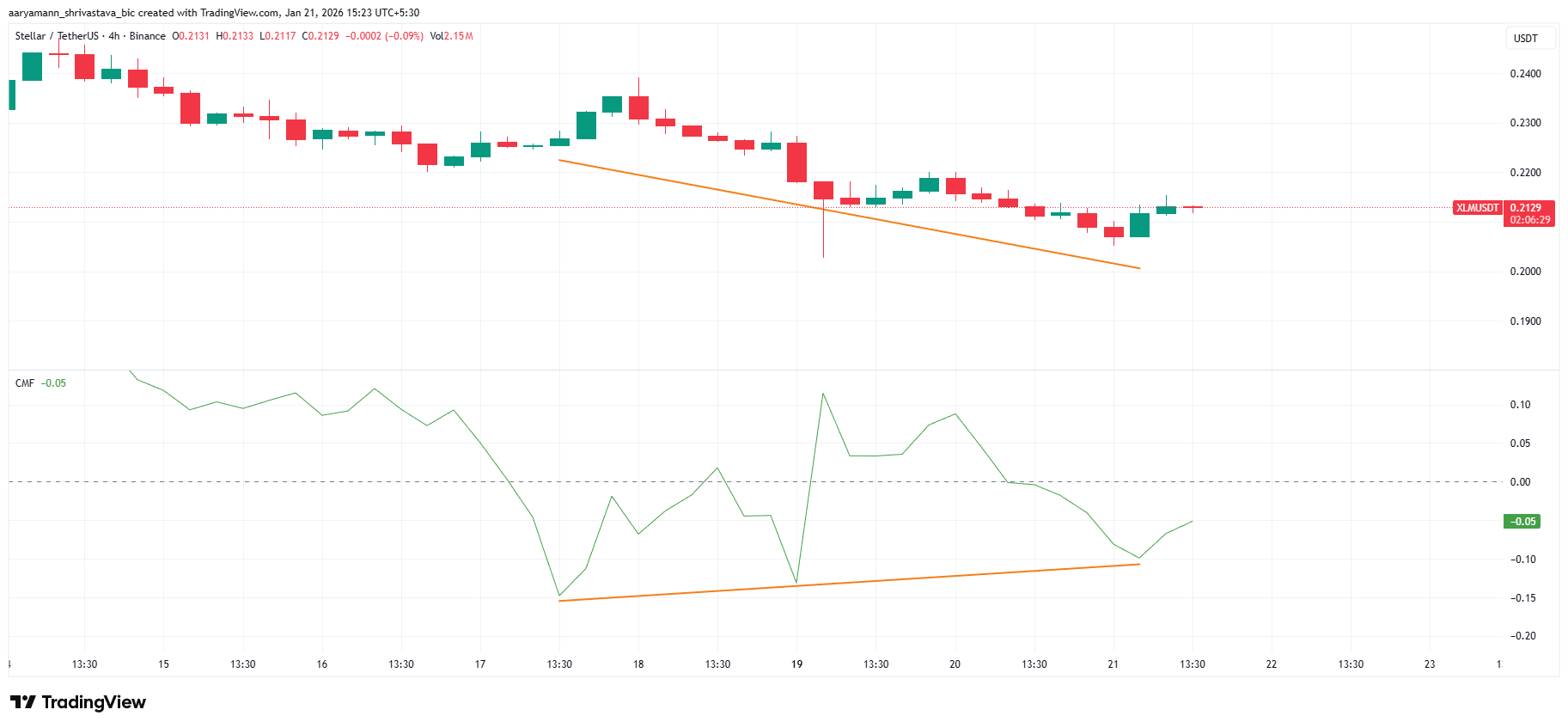

Despite bearish positioning, macro indicators offer early signs of divergence. The Chaikin Money Flow has formed higher lows for four consecutive days, even as the $XLM price printed lower lows. This bullish divergence suggests capital inflows are increasing beneath the surface.

CMF tracks buying and selling pressure through price and volume. Rising CMF during a price decline often signals accumulation rather than distribution. For Stellar, this pattern implies investors are gradually building positions, creating conditions for a potential short-term reversal once selling pressure fades.

$XLM CMF">

$XLM CMF">

$XLM Price Needs To Secure Support

$XLM trades near $0.212 at the time of writing, holding just above the $0.210 support level. Earlier this week, the altcoin broke down from a descending triangle pattern, a formation that typically favors bearish continuation. That breakdown keeps downside risks elevated in the near term.

The descending triangle projects a potential 14% drop toward $0.188, placing $XLM roughly 11% away from the target. However, the price may stabilize before reaching that level. Support is likely to emerge around $0.210 or, at worst, near $0.201. This uncertainty supports a neutral-to-bearish outlook.

$XLM Price Analysis. ">

$XLM Price Analysis. ">

A shift in momentum depends on defending key levels. If $0.210 holds as support, Stellar could regain stability. A sustained bounce may push $XLM toward the $0.230 resistance zone. Reclaiming that level would invalidate the bearish pattern and signal a short-term reversal driven by improving demand.

beincrypto.com

beincrypto.com