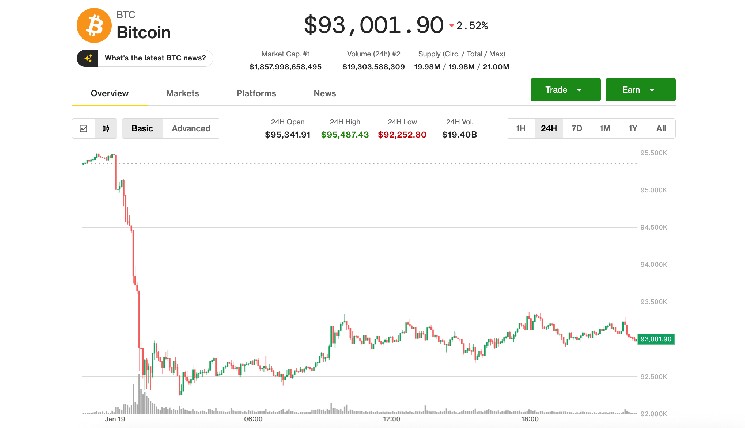

Bitcoin BTC$92,745.06 price stabilized above $93,000 during Monday’s U.S. session after an overnight sell-off knocked the asset down to $91,800. The drop came after U.S. President Donald Trump reignited trade tensions, threatening new tariffs on Denmark and other European countries over disputes tied to Greenland.

In a low-liquidity trading environment with U.S. markets closed for a holiday, BTC pared some losses but was still down 2% on the day. Ethereum's ether ETH$3,198.92 was off 3.7%, holding just above $3,200. Altcoins fared worse, with SOL, DOGE, ADA, LINK, and AVAX falling 5-6%, and SUI plunging more than 10%.

Meanwhile, gold surged again to a new record of nearly $4,700 per ounce, extending its allure as a safe haven amid geopolitical upheaval. The precious metal is now up more than 70% over the past 12 months.

Matt Howells-Barby, VP at Kraken, said the overnight pullback reinforced a broader pattern of relative weakness in crypto markets.

"Crypto has consistently displayed asymmetric downside risk" since the Oct. 10 crash, where "markets much more likely to punish any negative news more severely than reward positive catalysts," he said. Coming into this week, BTC was positioned at near key levels for further upside, but geopolitical headlines quickly derailed the momentum, he noted.

Still, he said that the relatively modest scale of the pullback — some 3.5% — suggests traders could be preparing for Trump potentially to dial down the tariff threats, a setup dubbed as "TACO" (Trump always chickens out), similarly to last year's pattern with U.S. threat of levies against China and other countries.

Regardless of how the new threat of the tariff war plays out, as political and business leaders gather in Davos at the World Economic Forum, "the next few days will likely create a lot of volatility with crypto markets moving on any remarks hinting at further escalation or de-escalation surrounding EU-U.S. tariffs." Howells-Barby said.

'Renewed conviction'

Bitfinex analysts, meanwhile, noted that selling pressure from long-term BTC holders eased, dropping to roughly 12,800 BTC per week from a peak of over 100,000 BTC during this market cycle.

However, Bitfinex warned that BTC now faces tough resistance from a dense long-term holder supply zone between $93,000 and $110,000, where previous rallies have stalled and could limit prices once again.

"For a more durable rally to take hold, market structure will need to transition into a regime where maturation supply begins to outweigh long-term holder spending," they said.

Historically, this configuration was last observed during August 2022–September 2023 and again from March 2024–July 2025, they said, both periods that preceded stronger and more sustained BTC rallies.

"Such a shift would drive LTH supply higher, signaling renewed conviction and reduced sell-side pressure," they added.

coindesk.com

coindesk.com