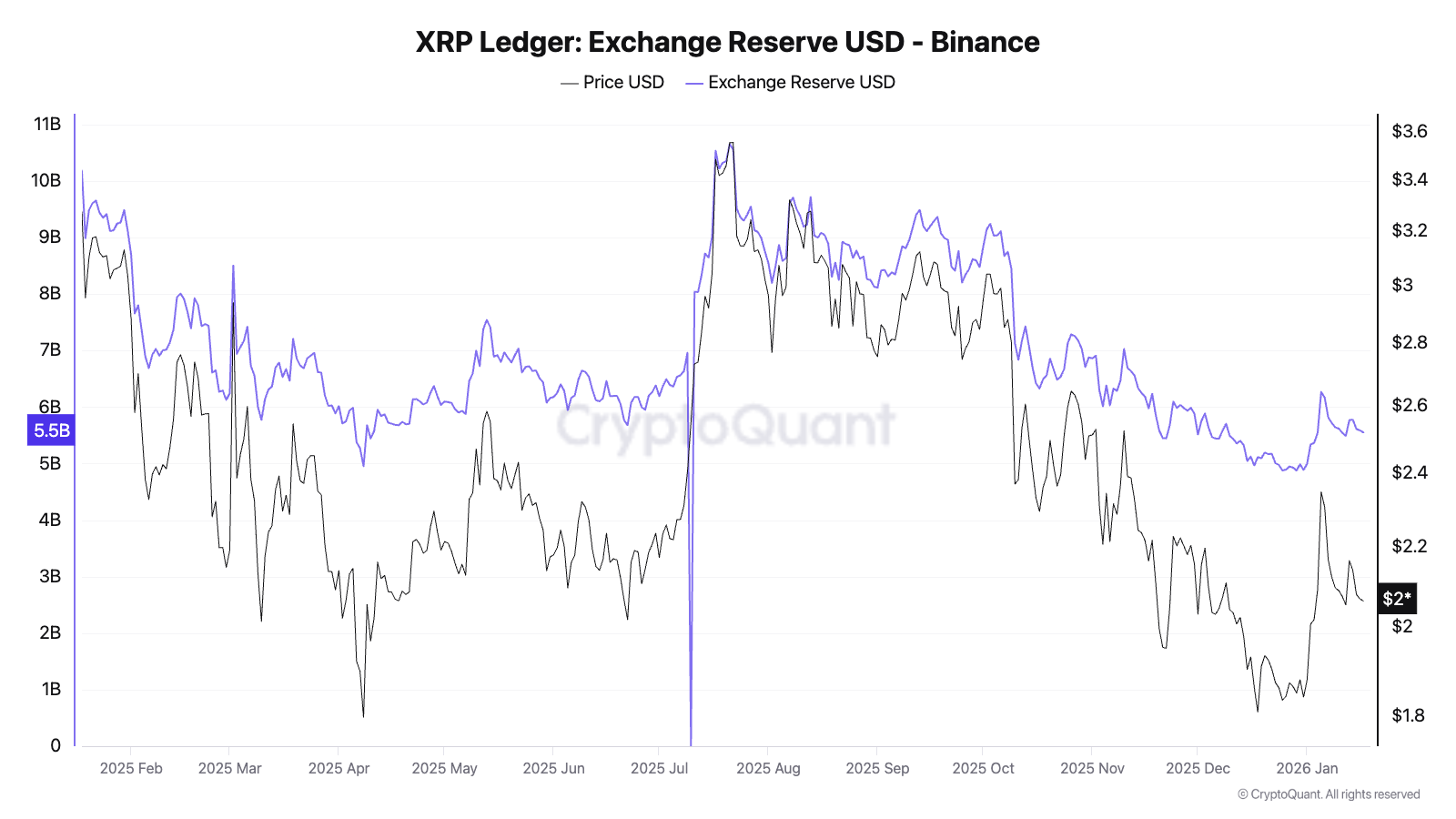

$XRP reserves held on Binance have fallen sharply over the past year, pointing to a major shift in market dynamics that could set the stage for a price rebound.

Specifically, on January 18, 2025, the total value of $XRP reserves on Binance stood at approximately $10.16 billion.

By January 17, 2026, that figure had dropped to about $5.55 billion, representing a decline of roughly 45% in exchange-held $XRP over 12 months, according to data retrieved from CryptoQuant.

This signals a substantial reduction in readily available supply on the world’s largest crypto exchange.

Temporary rebounds were repeatedly followed by fresh outflows, indicating that users continued moving $XRP off exchanges rather than redepositing it. By early 2026, reserves had fallen to near yearly lows, confirming a sustained contraction in exchange balances.

At the same time, $XRP’s price action shows a volatile but revealing pattern. In this case, sharp declines in reserves often coincided with price stabilization or strong upward moves, most notably in mid-2025 when a steep drop in exchange balances aligned with a rally.

This reflects a classic crypto supply dynamic, as fewer tokens on exchanges typically reduce selling pressure.

The continued decline in Binance’s $XRP reserves suggests investors are moving holdings into self-custody or long-term storage, behavior typically associated with accumulation rather than near-term selling. With less $XRP available on exchanges, any pickup in demand can exert a disproportionate influence on price.

If the trend continues, reduced exchange supply could become a catalyst for a rally. Historically, sustained reserve declines have preceded bullish phases, particularly when prices remain stable or recover.

While broader market conditions still matter, the 45% drop in Binance’s $XRP reserves reinforces the case for tightening supply that favors upside price movement in the months ahead.

$XRP price analysis

By press time, $XRP was trading at $2.06, down 0.65% on the day, while the token has declined 1.3% on the weekly timeframe.

At the current level, $XRP is hovering just above its 50-day simple moving average (SMA) near $2.02. This positioning suggests short-term price support is holding, with buyers defending the recent range rather than allowing a decisive breakdown.

However, the much higher 200-day SMA at roughly $2.53 highlights a broader bearish structure, indicating that $XRP remains well below its longer-term trend and would need a sustained move higher to signal a meaningful trend reversal.

Momentum indicators reinforce this cautious outlook, with the 14-day RSI sitting at about 50.7, firmly in neutral territory and showing neither overbought nor oversold conditions.

Featured image via Shutterstock

finbold.com

finbold.com