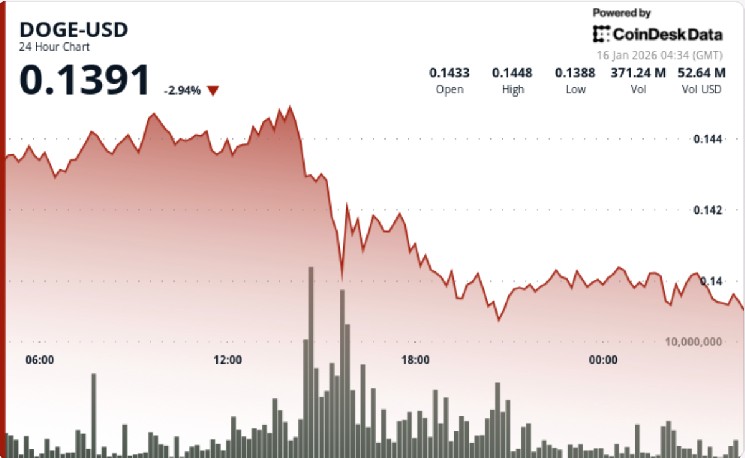

Dogecoin slid 3.5% to $0.139 as sellers forced a break below the $0.14 level, with rising volume confirming that downside pressure — not quiet consolidation — drove the move.

News background

The drop comes as risk appetite across meme coins cools after an uneven start to the year, with traders increasingly quick to sell rallies in the absence of fresh catalysts. While broader crypto markets held relatively steady, Dogecoin underperformed as liquidity thinned and positioning skewed defensive.

The move also followed renewed discussion in crypto media around bullish chart patterns on longer-term DOGE charts, including inverse head-and-shoulders setups. But in the near term, those narratives failed to translate into sustained demand, leaving price action exposed once key technical levels gave way.

More broadly, traders remain cautious around meme tokens as leverage resets and capital rotates selectively across the market, favoring assets with clearer institutional flow signals.

Technical analysis

Dogecoin fell from $0.1439 to $0.1394 over the 24-hour period ending January 16, breaking decisively below the $0.1420 support zone that had underpinned recent trading. The breakdown accelerated at 16:00 on January 15, when volume surged to roughly 1.01 billion tokens — about 108% above the 24-hour average — confirming active selling rather than a low-liquidity drift.

Price action formed a clear bearish structure, with lower highs capped near $0.1450 before the break and rallies increasingly sold into as the session progressed. Once $0.1420 failed, DOGE slid quickly toward the $0.14 handle, where only limited buying interest emerged.

The final hour underscored the imbalance. A brief rebound stalled near $0.1402, drawing fresh supply before price rolled over again. A sharp volume spike near the close accompanied a drop to $0.1393, suggesting forced selling or liquidation-driven flows rather than discretionary profit-taking.

Price action summary

- DOGE dropped from $0.1439 to $0.1394, a decline of roughly 3.5%

- $0.1420 support broke on volume running more than 100% above average

- Rallies failed near $0.1402, confirming resistance had flipped overhead

- Late-session selling pushed price to new local lows near $0.1393

- Structure shifted firmly bearish with consecutive lower highs and lows

What traders should know

This was not a “range day” — it was a support failure.

Heavy volume during downside moves tells the story: sellers were in control, and buyers stepped back once $0.1420 gave way. Until DOGE can reclaim that level, rallies are likely to be treated as selling opportunities rather than trend reversals.

Key levels to watch:

- Holding $0.1390–$0.1400 may slow the decline, but doesn’t reverse the trend

- A break below $0.1390 opens the door toward the $0.1350 area

- Bulls need to reclaim $0.1420, and then $0.1450, to reset near-term momentum

For now, Dogecoin is trading like a market in active distribution, not quiet consolidation — and that distinction matters as long as volume continues to confirm downside pressure.

coindesk.com

coindesk.com