Key takeaways

- $XRP has lost its fourth place in the market to $BNB after losing 3% of its value in the last 24 hours.

- The coin is struggling to overcome the $2.2 resistance level despite growing ETF demand.

$XRP loses fourth place to $BNB

$XRP, the native coin of the Ripple ecosystem, has lost more than 2% of its value in the last 24 hours and is currently trading at $2.11 per coin. The bearish performance comes despite rising Open Interest (OI) and institutional inflow into $XRP ETFs.

According to CoinGlass, $XRP’s OI has increased to $4.09 billion on Thursday, up from $3.93 billion on Tuesday. The increase, albeit minor, suggests that investors are beginning to lean more into risk.

If the OI continues to increase, it could see $XRP’s price rally higher in the near term and target the nearest resistance level. Despite that, the OI sits below the yearly high of $4.55 billion, recorded on January 6.

Furthermore, interest in $XRP spot Exchange Traded Funds (ETFs) continues to build. SoSoValue reports that $XRP ETFs gained nearly $11 million in inflow on Wednesday. Since their launch in November, $XRP ETFs have recorded just one outflow, totaling nearly $41 million on January 7. The cumulative inflow now stands at $1.25 billion with net assets at $1.54 billion.

Will $XRP resume its uptrend soon?

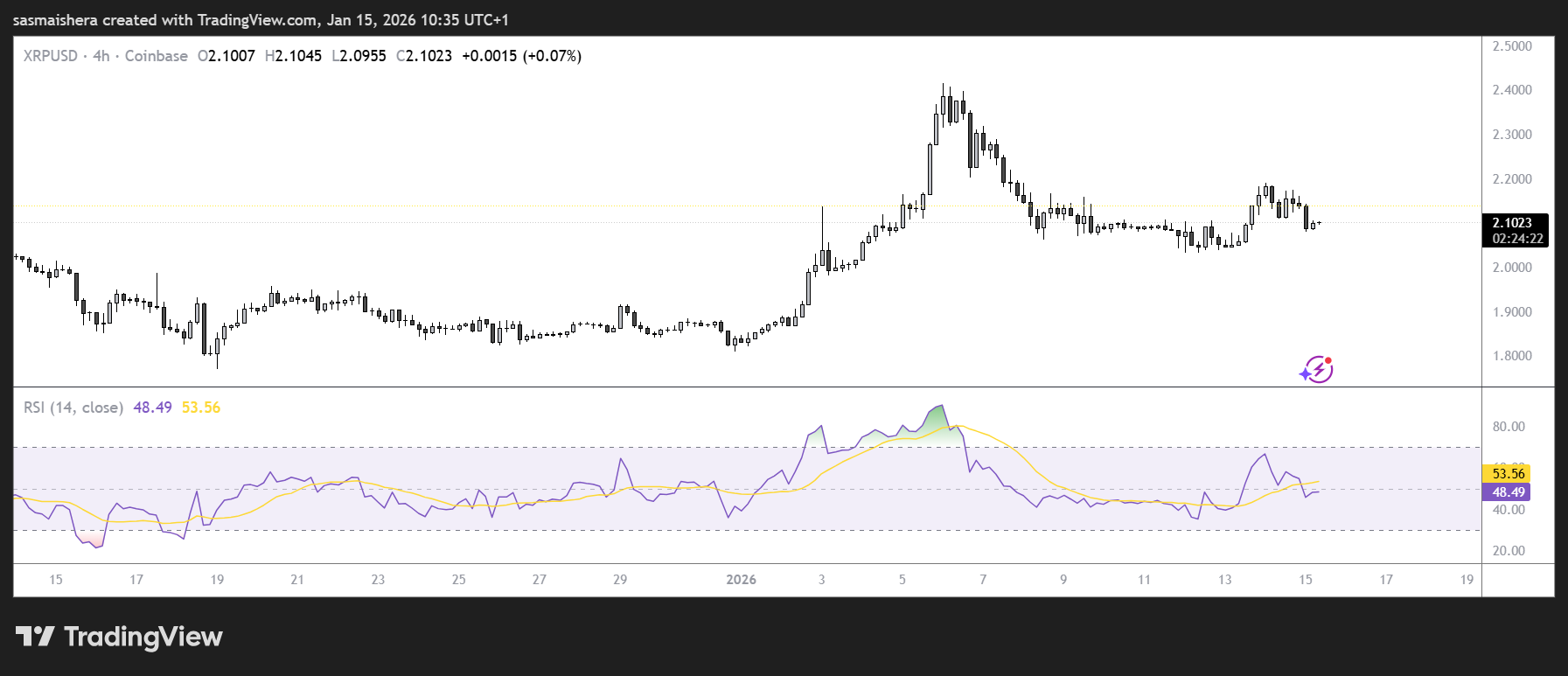

The $XRP/USD 4-hour chart is bearish and efficient as Ripple has underperformed over the past few days. The coin is still trading above the key support provided by the 50-day Exponential Moving Average (EMA) at $2.08.

A minor decline in the Relative Strength Index (RSI) to 53 on the 4-hour chart confirms the buildup of downside pressure. If the RSI continues to decline, $XRP could retest the $1.90 support level in the near term.

$XRP/USD 4H Chart">

$XRP/USD 4H Chart">

However, the Moving Average Convergence Divergence (MACD) indicator on the same chart holds above the signal line, which could allow investors to bet on $XRP’s price soaring higher.

If the daily candle closes above the 100-day EMA at $2.21, $XRP could extend its rally towards the 200-day EMA ($2.33).