Crypto investor sentiment has flipped to “greed” for the first time since October, marking a sharp turnaround after a liquidation event that sent traders fleeing from risk.

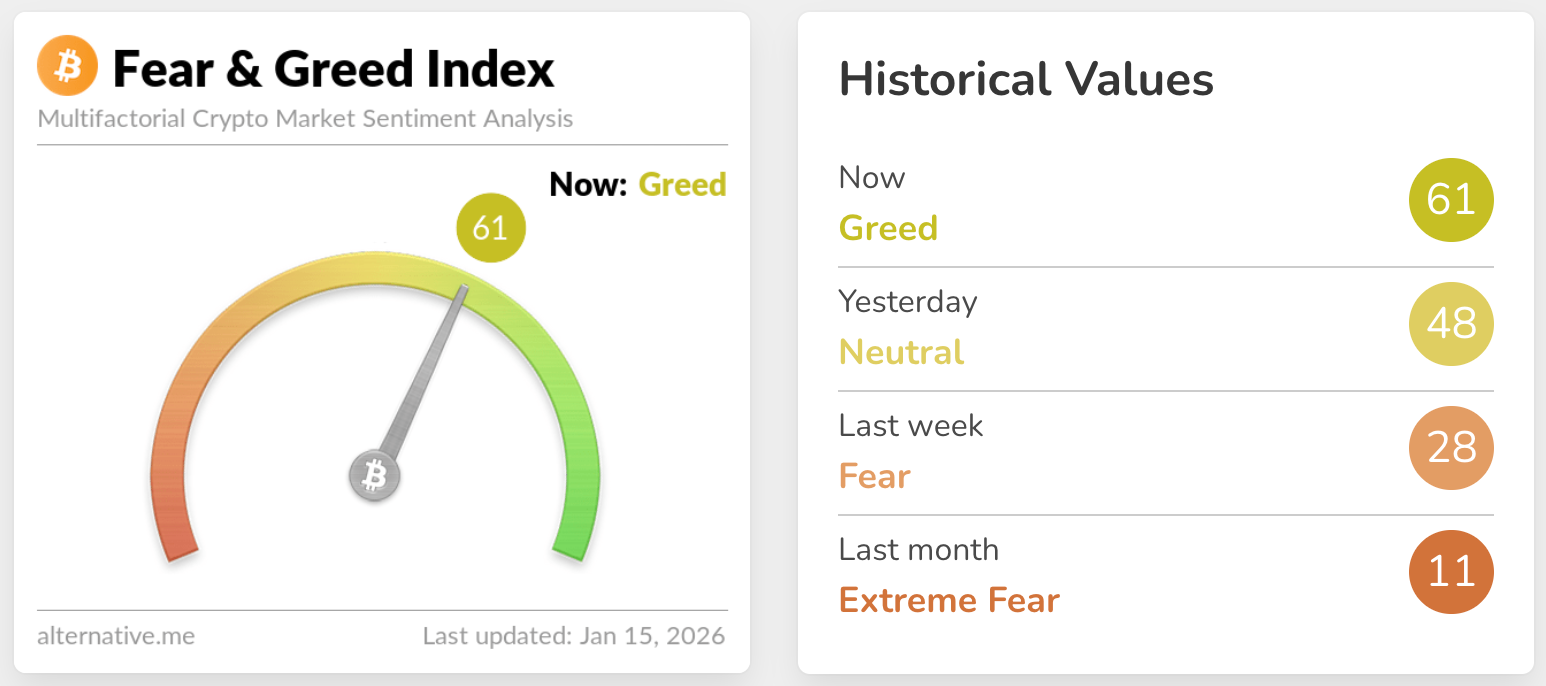

The Crypto Fear & Greed Index, a widely watched gauge of market mood, rose to 61 on Thursday, according to data from Alternative.me. The reading follows weeks of “fear” and “extreme fear” and comes just a day after the index stood at 48, a neutral level.

Sentiment collapsed on Oct. 11, when roughly $19 billion was liquidated from crypto markets in a single day, hammering altcoins and triggering a prolonged risk-off stretch.

In the weeks that followed, the index slipped into low double digits several times across November and December, reflecting deep caution among traders.

The recent improvement has moved in step with a rally in bitcoin. Over the past seven days, bitcoin has climbed from about $89,800 to hit a two-month high of $97,704 on Wednesday, according to CoinGecko data, helping stabilize broader market confidence.

Such sentiment indicators are often used as context rather than signals. Extreme fear has historically coincided with market bottoms, while sustained periods of high greed have tended to appear closer to market peaks. At a reading of 61, the index points to improving risk appetite, but not the kind of exuberance typically seen near major tops.

For now, the shift highlights how quickly mood has turned as bitcoin reclaims levels last seen before the October washout, even as traders watch whether prices can hold after the recent run-up.

coindesk.com

coindesk.com