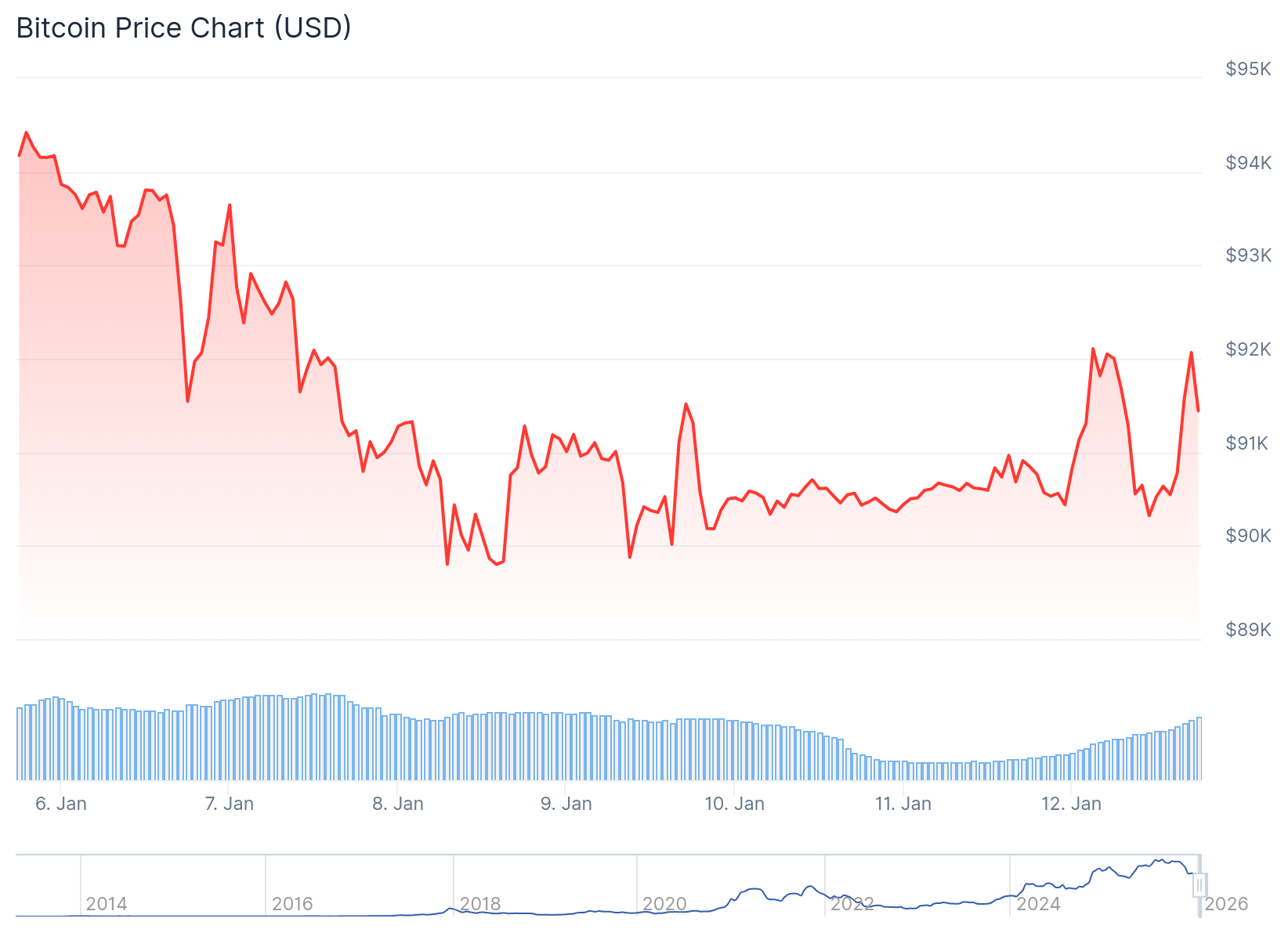

Bitcoin, alongside the wider crypto market, traded sideways on Monday, Jan. 12, amid rising political turbulence in Washington and uncertainty over U.S. monetary policy. Meanwhile, traditional safe-haven assets like gold and silver rallied sharply.

As of press time, Bitcoin (BTC) hovered near $91,400, up about 0.5% today, still down about 2.5% on the week. Total crypto market capitalization stood at roughly $3.2 trillion, also up slightly on the day.

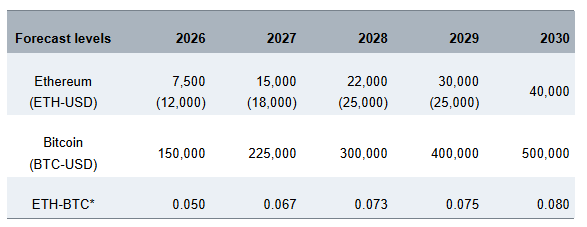

Ethereum (ETH) slipped 0.5% to around $3,100, also recording weekly losses of 2.5%. Despite the price stagnation, Standard Chartered analysts wrote in a research note to subscribers Monday morning that they’ve lifted their long-term ETH forecast, expecting it could reach $40,000 by the end of 2030, while the analysts forecast Bitcoin to $500,000 over the same period.

As the analysts explained, ETH could outperform thanks to continued buying from Tom Lee’s crypto treasury firm Bitmine, alongside dominance in stablecoins, tokenized real-world assets, and DeFi.

Most of the top ten cryptocurrencies are slightly down today, with the exception of Solana (SOL), up 2.2% to $142. XRP fell 0.7% to $2.07, while BNB declined 0.3% to about $903, and Dogecoin (DOGE) was flat around $0.138.

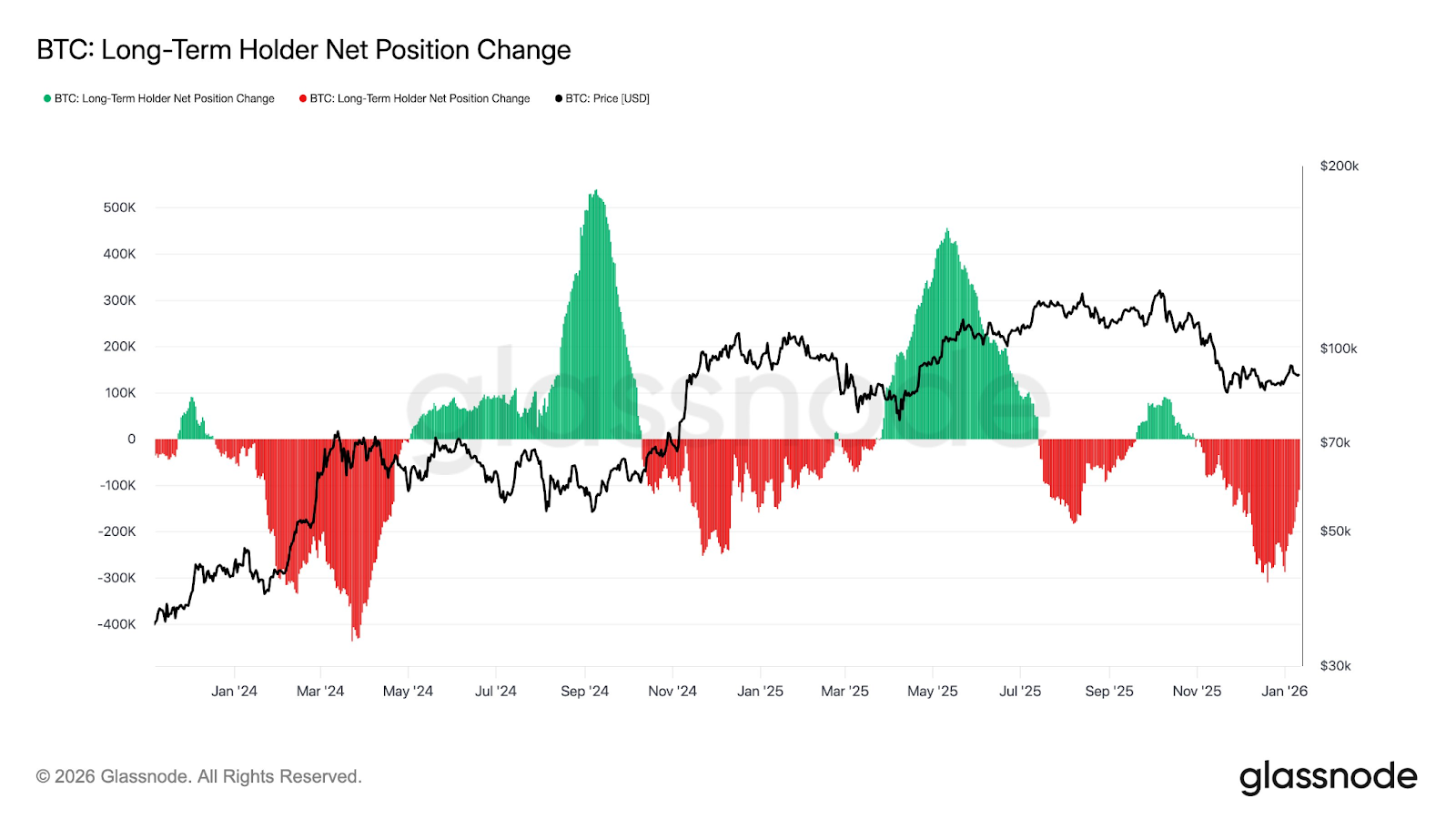

Market Absorbs Long-Held Supply

Analysts at glassnode noted in an X post today that long-term Bitcoin holder distribution has slowed, with net outflows easing from extreme levels, a sign the market may be absorbing older supply and working through overhead selling pressure.

“Long-term $BTC holder distribution has decelerated. Net outflows have rolled over from extreme levels, indicating that the market is progressively absorbing long-held supply and that a large portion of overhead supply may now be largely worked through,” the analysts wrote.

Meanwhile, researchers at Keyrock said in a report today that markets continue to trade without conviction, with investors cautious ahead of macro catalysts and policy clarity, leaving positioning light across risk assets. The analysts wrote:

“With uncertainty lingering and positioning light, the upcoming earnings season may prove decisive in breaking the current stalemate and restoring directional clarity across risk assets.”

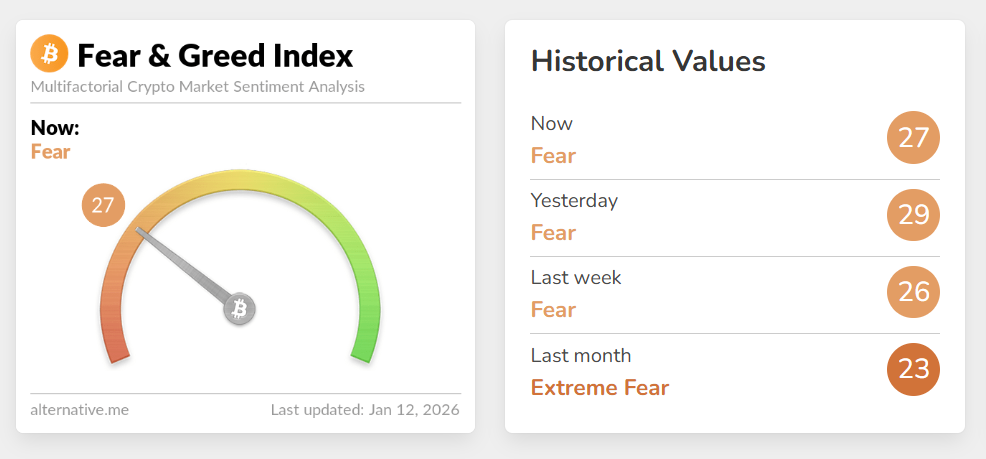

As of Monday morning, the Crypto Fear & Greed Index remains in the “fear” zone after several weeks of extreme fear, indicating that investor sentiment has softened but is still cautious and the market may be undervalued.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Monero led gains, jumping over 16% and hitting a new all-time high for the first time since 2018. Tether Gold and other gold-pegged altcoins also notably edged higher today as spot gold rallied, seemingly over geopolitical and Fed independence concerns.

On the downside, POL (ex-MATIC) led losses, sliding nearly 10% and reversing last week’s rally. Cardano-linked asset Midnight (NIGHT) was the second biggest loser today, down 7%.

Volatility triggered $257 million in crypto liquidations over the past 24 hours, Coinglass data shows. Long positions accounted for about $158 million, while short liquidations totaled roughly $99 million. Bitcoin saw the largest share at $62 million, followed by Ethereum with $53 million.

ETFs and Macro Conditions

Last week, spot Bitcoin ETFs recorded net outflows of $681 million, bringing cumulative inflows to $56.4 billion, according to SoSoValue. Meanwhile, spot Ethereum ETFs saw $68.6 million in weekly net outflows, while cumulative inflows stood above $12.4 billion.

On the macro front, risk sentiment deteriorated after Federal Reserve Chair Jerome Powell disclosed on Sunday, Jan. 11, that the Justice Department had issued subpoenas linked to his past Senate testimony, framing the move as political pressure.

“I have deep respect for the rule of law and for accountability in our democracy. No one — certainly not the chair of the Federal Reserve — is above the law. But this unprecedented action should be seen in the broader context of the administration's threats and ongoing pressure,” Powell said.

President Donald Trump denied knowledge of the investigation, saying in a brief interview with NBC News on Sunday night that Powell is “certainly not very good at the Fed, and he’s not very good at building buildings.”

U.S. stocks, bonds, and the dollar sold off Monday morning, reviving the so-called “Sell America” trade, CNN reports.

Precious metals, however, rallied sharply. Gold hit a new record high above $4,600 per ounce, while silver also reached a new all-time high of $85.70 as investors apparently seek safe harbors amid the subpoena news, as well as heightened geopolitical uncertainty globally, including escalating civil unrest and government crackdowns on protestors in Iran.

Analysts at QCP Capital said in a Monday update that near-term volatility risks “should remain elevated.” They added that markets will be sensitive to U.S. consumer price index (CPI) data set to come out tomorrow, Jan. 13, followed by the U.S. Supreme Court’s tariff ruling on Wednesday.