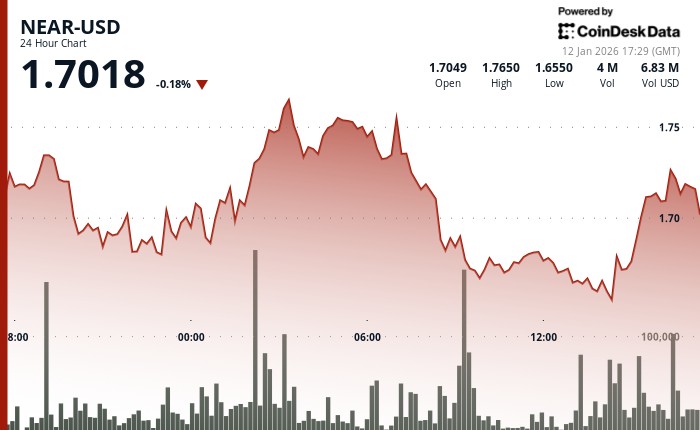

AI-focused token NEAR$1.6979 climbed 5.7% following the U.S. market open at 2:30PM UTC, spiking to $1.73 before experiencing a wave of sell volume, taking price back down to $1.68.

The advance lacked the conviction-level volume typically seen in sustainable rallies. Market participants may now question whether the move signals genuine accumulation or fleeting retail interest.

The token's move came with a catch. NEAR underperformed the CD5 cryptocurrency benchmark, indicating the rally reflected idiosyncratic factors rather than sector-wide momentum.

NEAR carved out a volatile $0.11 trading range between an intraday low of $1.6471 and a failed breakout peak of $1.7360. The session's most significant volume event hit at 14:00 UTC with 6.41 million tokens in activity—79% above the 24-hour simple moving average of 3.58 million. The surge marked a decisive reversal from session lows and established strong support at the $1.66-$1.67 level.

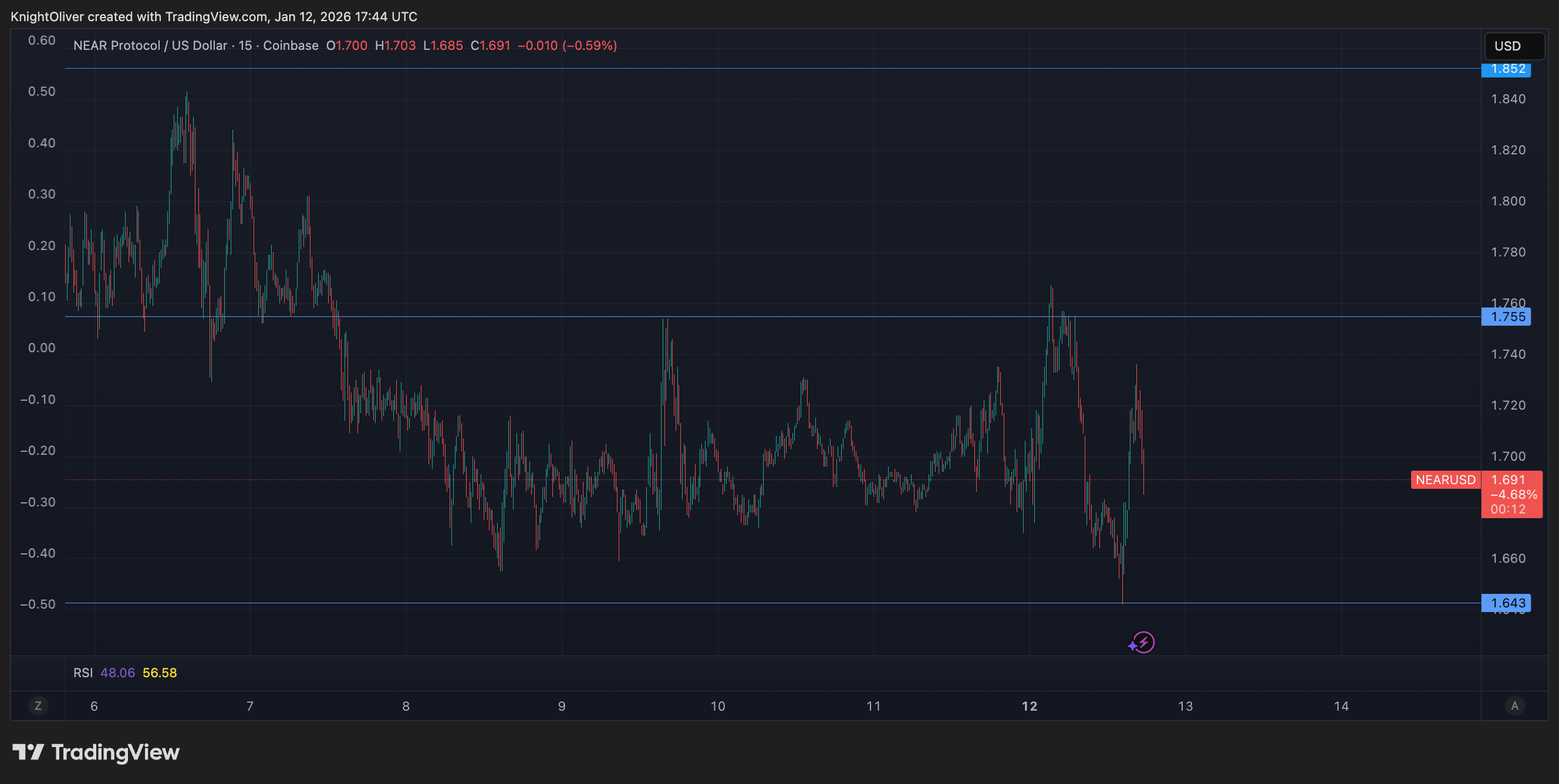

Technical levels became paramount as NEAR tested—and failed—to establish a new trading range above $1.72 in the absence of clear fundamental drivers. The 47% volume increase represents elevated retail interest rather than heavy institutional engagement.

Key technical levels signal range-bound consolidation for NEAR

Support/resistance structure:

- Primary support established at $1.66-$1.67 (14:00 UTC volume reversal zone).

- Immediate support at $1.710-$1.712 (session close area).

- Failed breakout resistance at $1.730-$1.736 (16:32 rejection level).

- Broader range cap at $1.74-$1.76 (multiple intraday rejections).

Volume analysis:

- 24-hour activity 46.98% above 30-day average (moderate elevation).

- Peak volume at 14:00 UTC: 6.41 million (79% above 24-hour SMA of 3.58 million).

- Breakout rejection volume at 16:33: 418,000 (368% above hourly average).

- Distribution phase at 16:34: 434K (sustained selling pressure).

Chart patterns:

- Range-bound consolidation with $0.11 total range (6.5% of price).

- Failed breakout above $1.72 resistance confirms continuation of consolidation.

- Higher lows formation post-14:00 UTC signals accumulation at lower bounds.

- Rejection candle at 16:32-16:33 confirms institutional resistance to higher prices.

Targets & risk/reward:

- Downside risk to $1.66-$1.67 support zone if consolidation breaks lower.

- Upside capped at $1.730-$1.736 until volume confirms above 6.5 million sustained.

- Range-trading opportunity between $1.67 support and $1.73 resistance.

- Breakout confirmation requires volume exceeding 80% above average with close above $1.74.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

coindesk.com

coindesk.com