-

$XRP outperforms Bitcoin and Ethereum in 2026 as investors rotate into less crowded trades.

-

CNBC highlights $XRP ETF inflows reaching $1.62 billion, signaling growing institutional confidence worldwide today.

-

Ripple confirms no IPO plans for 2026 after raising $500 million privately last year.

$XRP has emerged as one of the hottest crypto trades of the year, even outperforming giant Bitcoin & Ethereum in performance and becoming the 3rd-largest cryptocurrency by market cap.

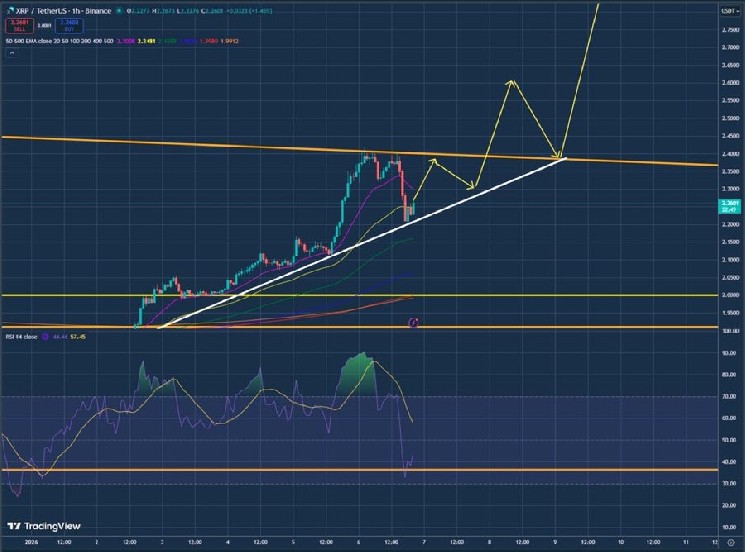

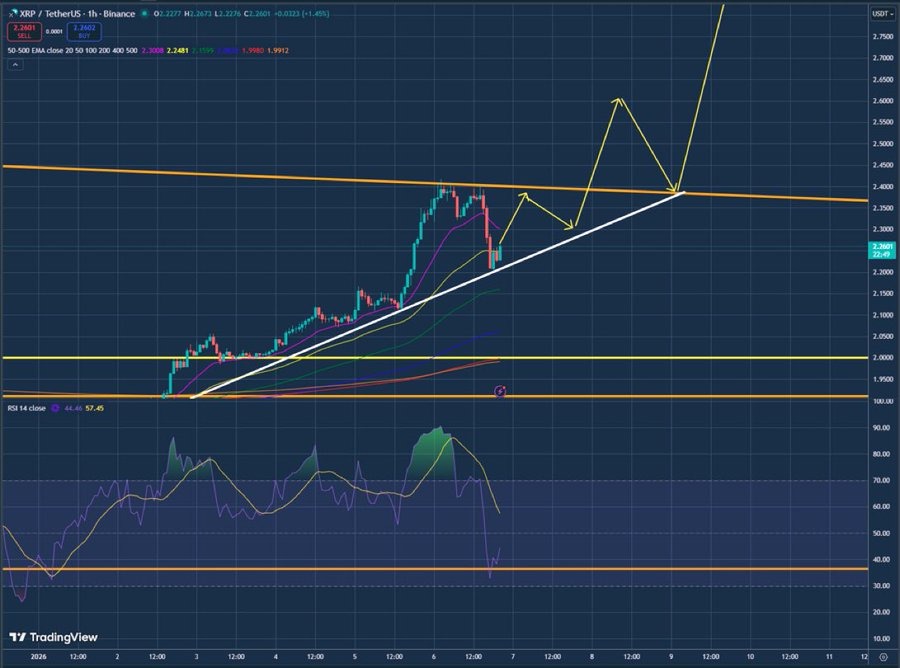

Since the start of the year, $XRP has climbed more than 20%, briefly trading near $2.40. What stands out is not just the price move, but the reason behind it.

$XRP as a “Less Crowded Trade”

Speaking on CNBC, journalist Mackenzie Sagalos explained that $XRP benefited from a shift in investor mindset during late 2025. She noted that many traders treated $XRP as a “buy-the-dip” opportunity rather than a momentum trade.

With Bitcoin becoming more stable and crowded, traders were clearly hunting for assets with higher upside potential, and $XRP fit that profile well.

This strategy paid off quickly. In early January, $XRP jumped as new buyers entered, while selling stayed low. Institutional interest also played a key role, with steady money flowing into $XRP ETFs during a quiet period.

Since the launch of the $XRP ETF, total inflows have reached around $1.62 billion, showing sustained confidence from large investors.

Since early January, $XRP has been forming higher lows, showing that buyers are entering earlier on each dip. As long as the price stays above the $2.20 zone, the structure remains stable, with room for a move back toward $2.60 – $3 if momentum returns.

Meanwhile, the RSI has cooled to 45, which often acts as a healthy reset during ongoing uptrends.

Will $XRP Hit $5 by the End of 2026?

With steady ETF inflows and supportive fundamentals, $XRP has the potential to extend its current rally toward the $5 level later this year.

Although short-term volatility is expected, the recent pullback appears to be a healthy pause within a broader uptrend, not a full trend reversal.

coinpedia.org

coinpedia.org