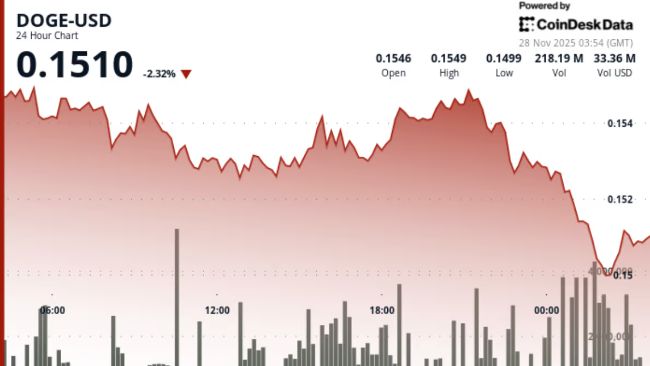

Dogecoin cracked below the $0.152 floor in a high-volume breakdown that erased the previous week’s stability, as ETF inflow momentum collapsed and sellers overwhelmed key support zones.

News Background

- The newly launched DOGE ETFs saw their first clear demand shock as inflows plunged from $1.8 million to just $365,420 — an 80% single-session collapse.

- The sharp drop in institutional participation came as broader crypto markets attempted recovery, with Bitcoin retesting $92,000 and high-beta altcoins rebounding sharply.

- DOGE underperformed the sector by a wide margin. While BNB, Solana, and Avalanche printed multi-percentage gains, DOGE faced persistent distribution pressure, amplified by weak ETF demand and fading speculative flows.

- Meme coin products, which often show intense initial interest followed by swift cooling, continued that historical pattern as DOGE liquidity thinned at the same moment technical levels failed.

Technical Analysis

- The break below $0.152 established a clear shift from consolidation into a defined downtrend.

- Lower highs, combined with repeated failures to retest the $0.155 zone, created a descending structure that tightened into the early morning session before breaking decisively.

- Volume confirms the move: a 265M surge (67% above average) during the breakdown validates a genuine structural failure rather than a low-liquidity wick. The 16.6M spike at 02:08 UTC highlights where supply overwhelmed bids, triggering rapid continuation toward the $0.150 psychological threshold.

- Momentum has now flipped decisively bearish. The trend structure shows clean stair-step declines, and Fibonacci retracement projections between $0.1495 and $0.1478 align with the next liquidity pockets.

- Indicators show no bullish divergences yet, suggesting sellers maintain control until deeper tests of the lower range are completed.

Price Action Summary

- DOGE traded from $0.1548 down to $0.1502 over the session, with the heaviest selling concentrated during early morning hours. The breakdown accelerated precisely as ETF inflow data hit markets, creating a synchronized technical-fundamental sell trigger.

- Attempts to stabilize near $0.151 repeatedly failed, turning that region into immediate overhead resistance. By the end of the session DOGE drifted sideways above $0.1500, with narrowing ranges and declining volume pointing to temporary exhaustion but no confirmed reversal.

- The psychological $0.150 level is now the only meaningful near-term support before deeper retracement zones activate.

What Traders Should Know

- DOGE sits at a fragile juncture. Losing $0.1500 opens the path directly into $0.1495 Fibonacci territory, followed by a heavier liquidity cluster near $0.147.

- Any recovery attempt must reclaim $0.152 quickly — without that, momentum remains decisively bearish.

- ETF inflow disappointment compounds the chart damage; unless institutional demand returns, technicals will dominate price action.

- Traders should expect continued correlation with Bitcoin’s intraday direction and remain vigilant around volatility spikes, as DOGE remains highly sensitive to liquidity shifts and whale activity.

coindesk.com

coindesk.com