Chainlink ($LINK) has been in a steady downtrend for the past month, sliding to $11.5 as market volatility continues to weigh on major altcoins. Despite this weakness, sentiment around Chainlink is shifting quickly.

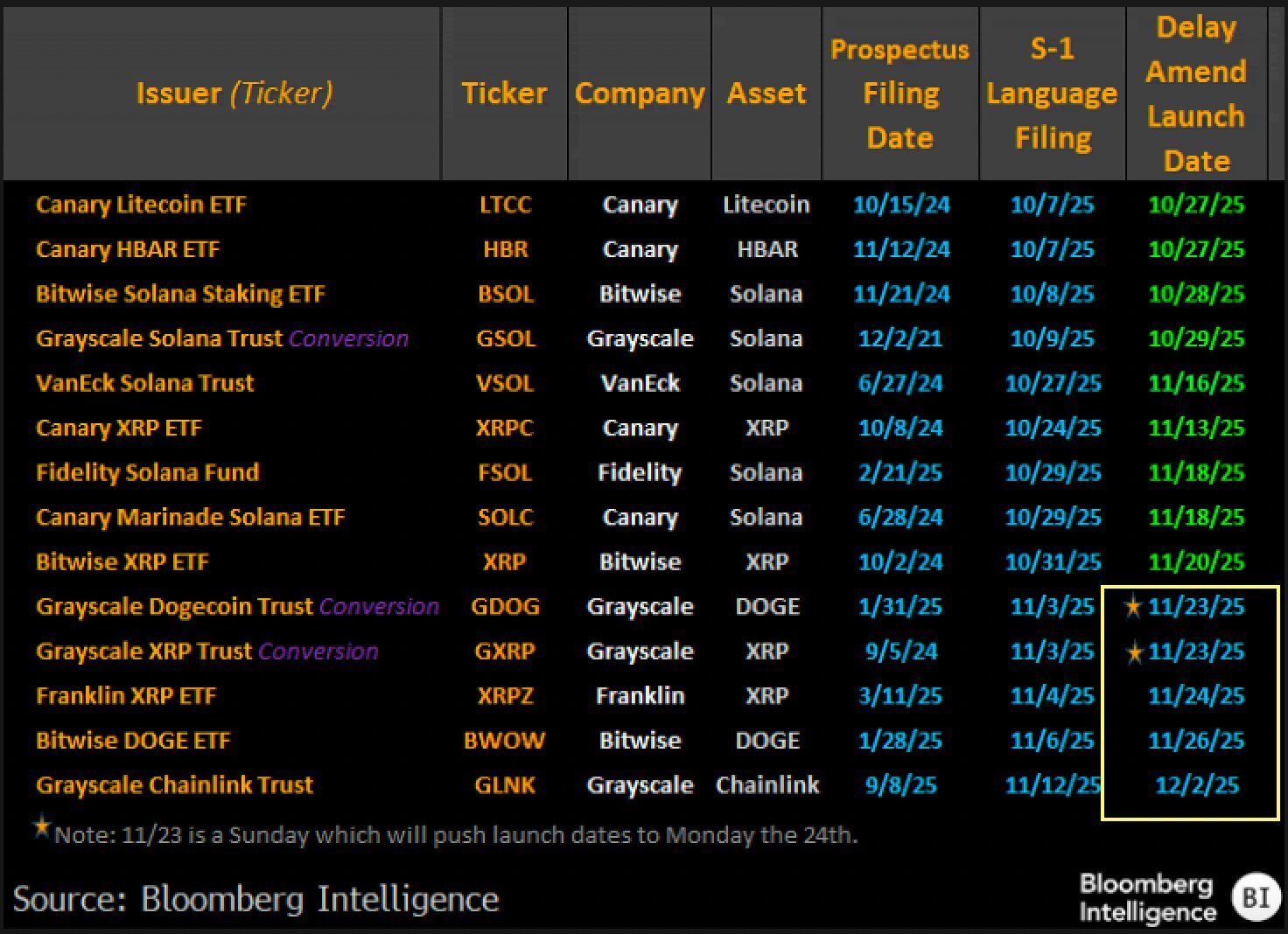

With $XRP and Dogecoin spot ETFs debuting this week, $LINK is increasingly viewed as the leading candidate for the next major altcoin ETF — a catalyst that could reshape its price trajectory.

Can Grayscale File For Chainlink ETF?

Grayscale recently published an in-depth research report that reads like a strong endorsement of Chainlink’s long-term value. The firm emphasizes that $LINK functions as critical infrastructure, enabling secure communication between on-chain smart contracts and off-chain real-world data.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The report notes that $LINK is the largest non-Layer-1 token by market cap, offering broad exposure across the crypto economy. It highlights Chainlink’s expanding institutional partnerships, its growing role in real-world asset tokenization, and accelerating demand for its services.

Grayscale’s extensive analysis suggests deep institutional conviction — a strong sign that the firm may be positioning $LINK for its next ETF product.

Analyst Hints That $LINK ETF Is Coming Soon

Bloomberg ETF analyst Eric Balchunas has also fueled speculation. In two separate posts, Balchunas stated that a Chainlink ETF — likely Grayscale’s GLINK — is already in development. He first suggested it could launch as early as next week.

“Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their $XRP spot is also launching on Monday. $GLNK coming soon as well, week after I think,” stated Balchunas.

Following the successful rollout of the $XRP and Dogecoin ETFs, he reiterated on Monday that GLINK could debut by December 2, aligning with the rapid pace of altcoin ETF approvals.

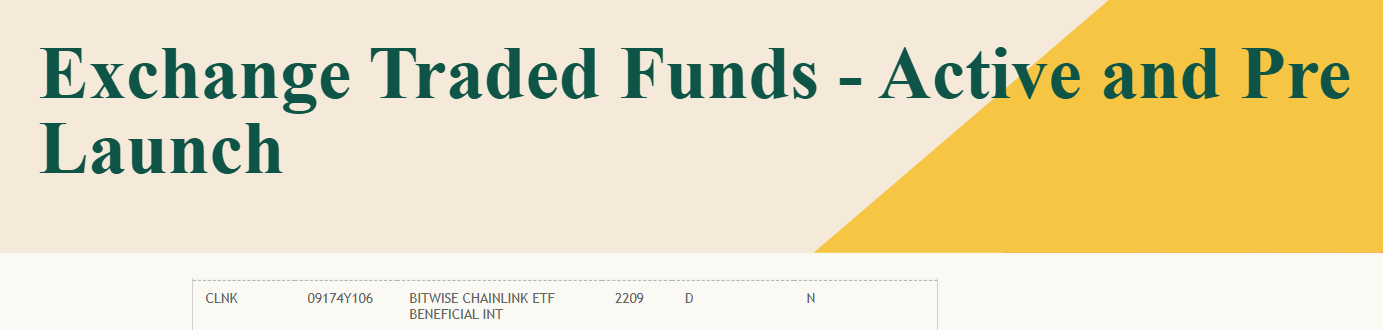

The Depository Trust & Clearing Corporation (DTCC) has added even more weight to the narrative. Its website lists the Bitwise Chainlink ETF Beneficial Interest, suggesting another $LINK ETF is already positioned for approval.

Bitwise has a strong track record in this space, having launched the first Solana ETF and the second $XRP ETF. With $LINK already listed and Bitwise aggressively expanding its ETF lineup, the probability of a near-term launch increases significantly.

$LINK Price Awaits a Bounce Back

$LINK is trading at $12.81, pressing against the $12.94 resistance level while still trapped under a month-long downtrend. The technical structure suggests hesitation, but ETF-driven demand could shift momentum quickly.

If a spot $LINK ETF is approved, fresh capital could break the downtrend and push $LINK above $13.77 and $14.66. A rally of this magnitude would help erase its 31% decline since early November.

$LINK Price Analysis">

$LINK Price Analysis">

If approvals are delayed, $LINK may lose support and fall back to $11.64 or lower. This would result in the bullish thesis being completely invalidated and extending $LINK’s downtrend.

The post ETF Boom Continues: This Altcoin Could Be Next After $XRP & DOGE appeared first on BeInCrypto.

beincrypto.com

beincrypto.com