Crypto markets enter the final stretch of October 2025, walking a tightrope between renewed optimism and macro uncertainty. Bitcoin has struggled to reclaim $110,000 while Ethereum continues to hover below the $4000 mark.

Against this backdrop, we used OpenAI’s ChatGPT-5 to analyze on-chain data, sentiment, and news signals to determine this week’s strongest cryptocurrency setup. After crunching the numbers and news signals, the AI’s verdict was clear: Chainlink ($LINK) stands out as the top contender for “Crypto Pick of the Week.”

Why Chainlink Is This Week’s Winner

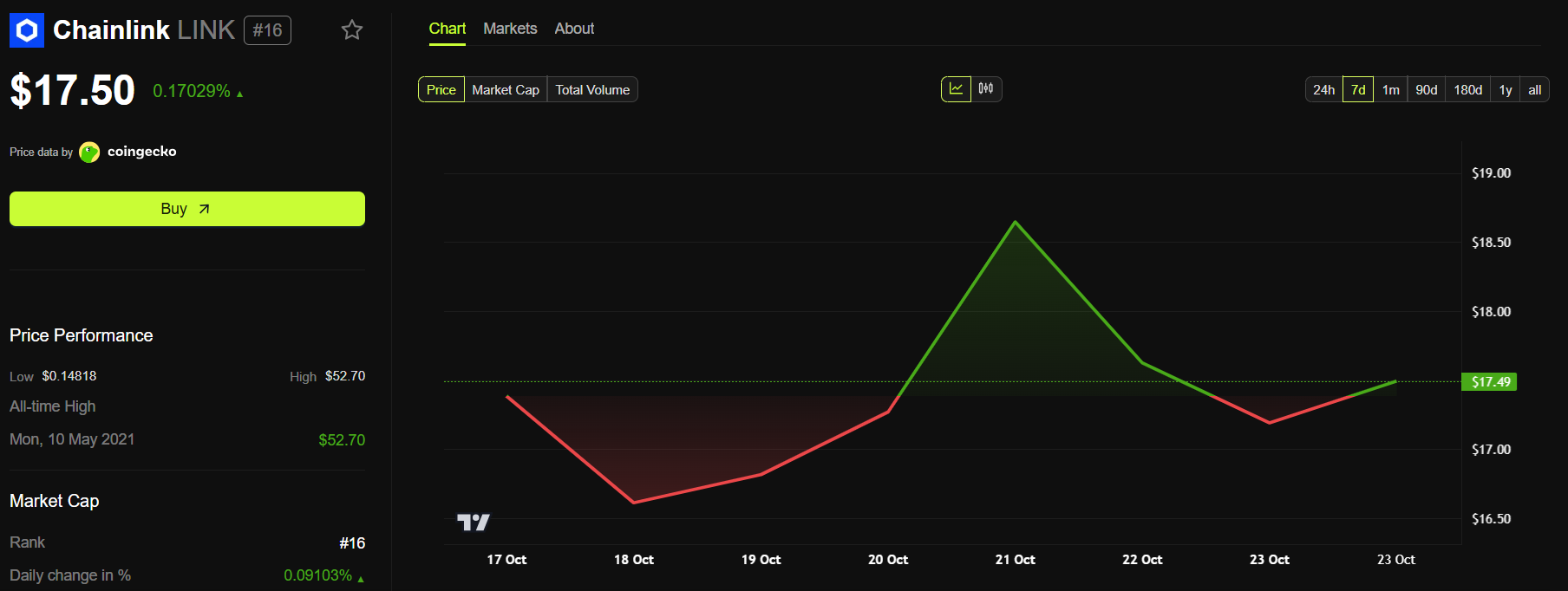

Trading around $17.50 at press time, with a market capitalization of nearly $12.2 billion, Chainlink quietly proves that utility and adoption can still drive price action in a choppy market.

Here’s a look at why it earns the “AI’s Crypto Pick of the Week” crown for the fourth week of October, 2025.

1. Whales Are Moving In

After a mid-October pullback, large holders or “whales” are accumulating $LINK again.

“13 million Chainlink $LINK accumulated by whales over the past week,” popular crypto analyst Ali noted on X.

The accumulated $LINK amounts to nearly $230 million based on the press time price. ChatGPT suggests that’s classic “off-exchange accumulation” behavior, which is often a precursor to a supply squeeze.

This wave of buying helped spark a small rebound around October 20, even as the broader crypto market cooled. Few other large-caps showed such clean, accumulation-led strength this week.

Onchain data shows a lot of players accumulating $LINK.

— Ted (@TedPillows) October 20, 2025

Bought some spot. ✌️ pic.twitter.com/Xfm2HEtkvt

2. Real Adoption, Not Vaporware

Chainlink isn’t just riding hype cycles; it’s also landing tangible integrations. Recent highlights include:

- The US Department of Commerce and Chainlink will bring macro data from the Bureau of Economic Analysis (BEA) on-chain, a move to bring official economic data (GDP, PCE, etc.) to blockchain developers.

- SWIFT, DTCC, and Euroclear collaborations advancing tokenization and corporate-action pilots using Chainlink’s interoperability layer (CCIP).

- New integrations with projects like Jovay, an Ethereum Layer 2 focused on real-world assets (RWAs), showcase Chainlink’s role as a critical infrastructure for institutional DeFi.

In short, Chainlink isn’t just another oracle provider; it’s becoming the connective tissue between traditional finance and the on-chain world.

3. The Market Narrative Favors $LINK

Even as Bitcoin and Ethereum drift sideways, Chainlink has shown idiosyncratic momentum, meaning it’s moving on its own merit.

When the US dollar briefly strengthened this week, $LINK still managed to bounce, suggesting that investors are viewing it as a relatively safe haven among altcoins with real use cases.

4. Technical Picture: $LINK Has Room to Run

$LINK price has dipped slightly (-2%) over the past week. But analysts are eyeing a potential breakout above $20, which could open the door to a $22–$25 range if momentum continues.

For traders, it’s one of the few large-cap setups that’s both constructive and not overextended.

🔗 #$LINK Looks Ready to Rip#$LINK just bounced off the Fibonacci .618 zone around $16 and is now pushing to reclaim $20. With major companies and agencies using Chainlink as a core data source, it’s massively undervalued at these prices.

— CryptoPulse (@CryptoPulse_CRU) October 20, 2025

Smart money is already accumulating.… pic.twitter.com/Fu6UccBcYN

Near-Term Catalysts to Watch for Chainlink

- Continued whale accumulation: Additional large withdrawals or shrinking exchange balances could push $LINK through resistance.

- Institutional tokenization headlines: New SWIFT or DTCC pilot updates can trigger short-term sentiment spikes.

- On-chain macro data narrative: As more developers integrate BEA data feeds, Chainlink could dominate “real-world data” conversations.

- Macro tailwinds: A softer US dollar or stable Bitcoin could help $LINK outperform other large-caps.

Risks & Counterarguments

- Macro pressure: Another BTC drawdown or dollar rally could drag $LINK down with the broader market.

- Competition: Rivals like Pyth Network are gaining ground in the oracle and target="_blank" rel="noreferrer noopener">unexpected unlocks could weigh on price.

Chainlink’s combination of institutional adoption, on-chain accumulation, and narrative momentum gives it one of the strongest setups heading into late October.

Provided Bitcoin holds its range and the dollar doesn’t strengthen further, $LINK could make another push toward the $20–$22 zone in the coming days. A break below $16 would invalidate that view, but for now, the bias remains bullish with caution.

While short-term traders eye the charts, long-term builders are already integrating Chainlink into the next generation of DeFi infrastructure. And that, according to the AI models, is exactly why $LINK is this week’s crypto pick to watch.

The post AI Picks Chainlink ($LINK) as Top Crypto for Fourth Week of October 2025 appeared first on BeInCrypto.

beincrypto.com

beincrypto.com