The $WLFI price has more than doubled after plunging to a record low of $0.072 as whales continued buying and as the $USD1 stablecoin continued its growth.

Whales are buying the World Liberty Financial token

World Liberty Financial ($WLFI) jumped to a high of $0.1455, up 100% from its lowest level on Friday when most tokens plunged in the biggest meltdown of the year.

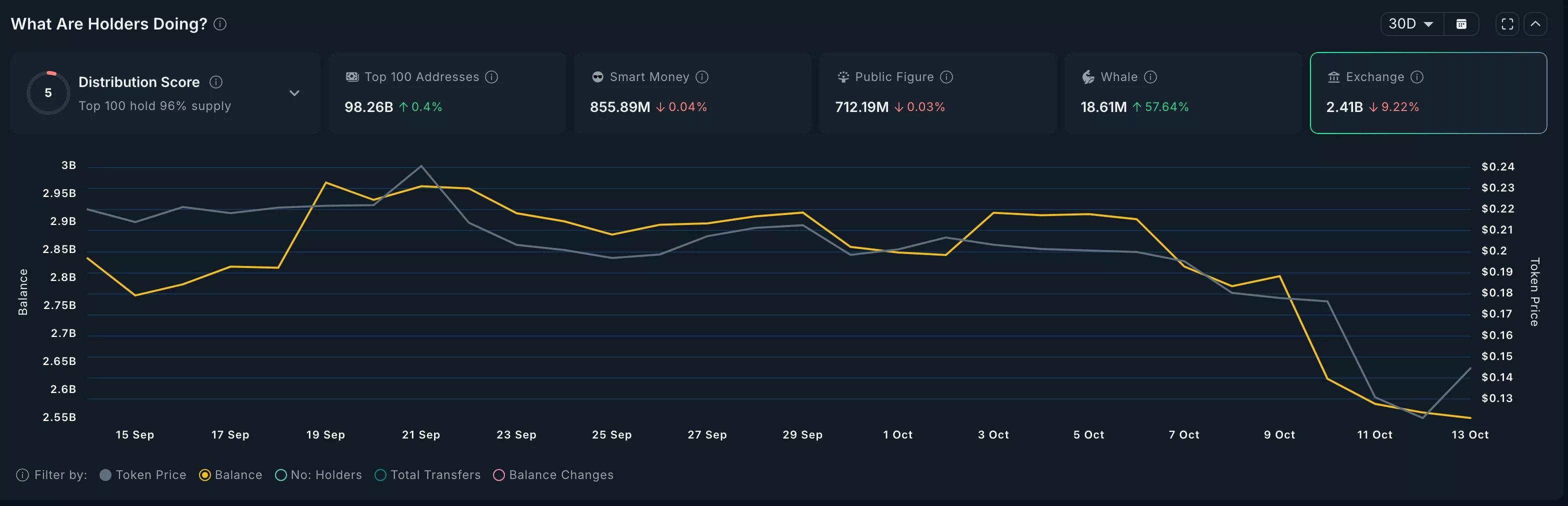

On-chain data show that whales have boosted their positions in the token in the past few weeks. These investors now hold 18.61 million tokens, a 57% monthly increase. They have bought over 400,000 tokens since Friday when the crypto market crashed. Notably, World Liberty Financial bought $WLFI worth $10 million during the last crash.

While others panic, we stack. 🦅

— $WLFI (@worldlibertyfi) October 11, 2025

Today we bought $10 million worth of $WLFI — and this won’t be the last time.

We know how the game is played.https://t.co/do3wPuiuZc

Another notable metric is that the number of $WLFI tokens on exchanges has plunged in the past few months. There are now 2.41 billion coins, down from 2.97 billion in September. Tumbling exchange balances are a sign that investors anticipate the price to jump.

Meanwhile, the $USD1 stablecoin is seeing modest growth this month. Data compiled by Artemis show that the supply has jumped 1.79% in the last 30 days to $2.7 billion. Most of this supply stems from the $2 billion investment by Abu Dhabi’s MGX into Binance.

$USD1’s holders have jumped almost 40% in the last 30 days to 524,000, while monthly transactions doubled to over 31 million. The adjusted transaction volume rose to almost $10 billion.

$WLFI price technical analysis

The four-hour chart shows that $WLFI bottomed at $0.0718 on Friday and then bounced back to the current $0.1470. On the four-hour chart, it has hit resistance at the 25-period exponential moving average.

$WLFI has formed a small bullish flag pattern, which often leads to a breakout. It also remains along the strong pivot reverse point of the Murrey Math Lines.

Therefore, the token will likely continue rising as bulls target the major S/R pivot point at $0.200. A drop below support at $0.1200 will invalidate the bullish forecast.