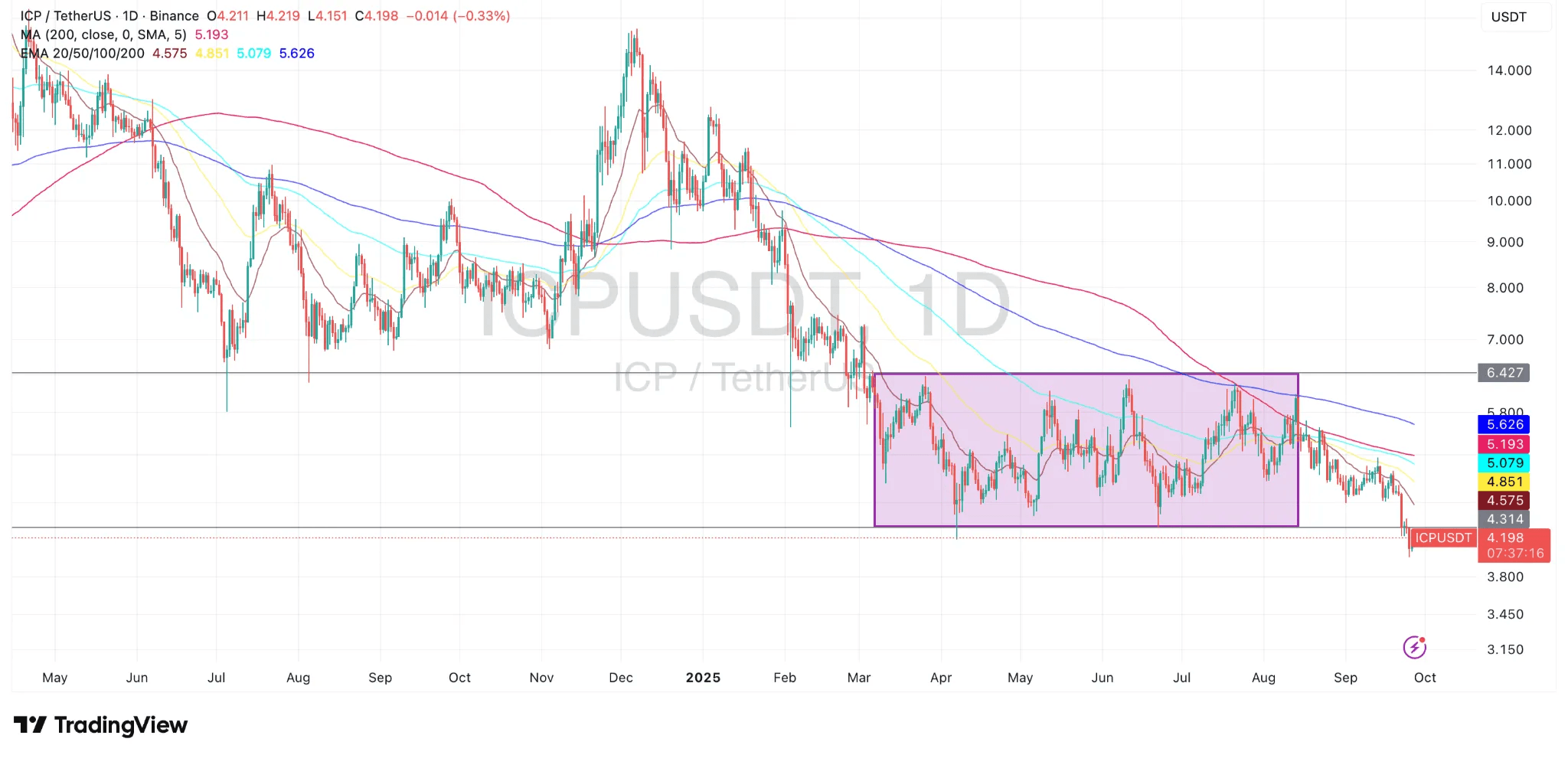

Internet Computer ($ICP) has come under notable selling pressure in September, breaking down from a prolonged consolidation phase that had stretched across much of the second and third quarter of 2025. The token, which spent months oscillating between roughly $4.30 and $6.40, slipped out of its accumulation zone earlier this month and is now testing fresh support levels.

Bearish Breakdown in September

In early September, $ICP attempted to stabilize near the $5 mark, aligning closely with its 20-day and 50-day exponential moving averages (EMA). However, momentum failed to sustain, and the token gradually slid beneath key moving averages — with the 100-day EMA ($5.07) and 200-day EMA ($5.62) now well above the current market price. The rejection from these resistance layers underscores the broader bearish trend that has dominated since late 2024.

$ICP/$USDT Price chart (TradingView)">

$ICP/$USDT Price chart (TradingView)">

As of writing, $ICP trades near $4.20, probing levels that were last tested in April. The move beneath $4.30 marks a critical technical development, as this price acted as a lower boundary of the multi-month consolidation box. If sellers maintain control, the next logical target lies around the psychological $4.00 mark, with deeper declines potentially extending toward $3.50.

Bullish Case: A Rebound from Oversold Conditions

Despite the recent weakness, a counter-argument emerges from oversold signals and the possibility of a short-term rebound. Historically, each dip into the $4.00–$4.20 range has attracted buying interest, triggering at least temporary recoveries. If $ICP manages to reclaim $4.50 in the coming sessions, it could pave the way for a retest of the $5.00–$5.20 zone, where the 50-day EMA and 200-day simple moving average (SMA) currently cluster. A successful break above these dynamic resistance levels would inject fresh optimism, potentially bringing $6.40 — the top of the former consolidation box — back into focus.

Broader Market Context

It is worth noting that $ICP’s decline coincides with general softness across the altcoin market in September, where renewed strength in the U.S. dollar and cautious investor sentiment around risk assets have weighed on crypto valuations. In this context, $ICP’s breakdown mirrors the struggles of many mid-cap tokens failing to sustain momentum after summer rallies.

Outlook

The technical picture for $ICP is delicately balanced. On the one hand, the loss of range support around $4.30 signals vulnerability and could open the door to deeper losses if market sentiment deteriorates. On the other hand, the price now sits near a historically reactive zone where bargain hunters may step in. For traders, the $4.00 level is the key short-term line in the sand, while $5.20 and $6.40 remain decisive resistance levels to monitor on any recovery attempts.

For now, the burden of proof lies with the bulls. Unless $ICP reclaims its lost moving averages, the broader trend remains tilted toward further downside, but September’s oversold backdrop may offer the stage for a temporary bounce.

bsc.news

bsc.news