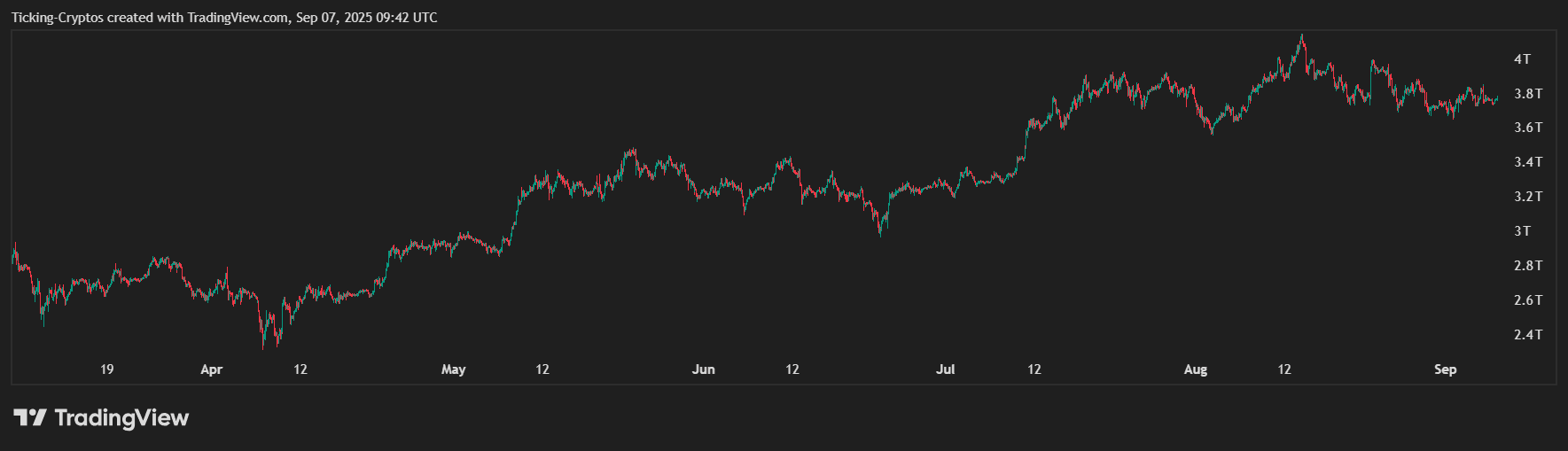

Crypto Market at a Standstill

The overall crypto market is moving sideways, with the total market cap chart showing a lack of strong direction in recent weeks. After peaking in mid-August, momentum has cooled, and the market is consolidating just below the $4 trillion mark. This pause reflects uncertainty among traders as they wait for clearer macro signals.

Despite this standstill, such consolidations often precede strong breakouts, making September a key month to watch.

Total market cap in USD - TradingView

Bitcoin Price Action

Bitcoin ($BTC) remains the market’s anchor, holding steady above the $110,000 zone after retreating from its all-time high near $120,000. The current consolidation suggests $BTC is building support, but with no immediate bullish catalyst, traders are shifting their focus to altcoins.

As history shows, when Bitcoin stabilises, liquidity often flows into the altcoin market — sparking strong rallies in selected tokens.

$BTC/USD chart over the past 6 months - TradingView

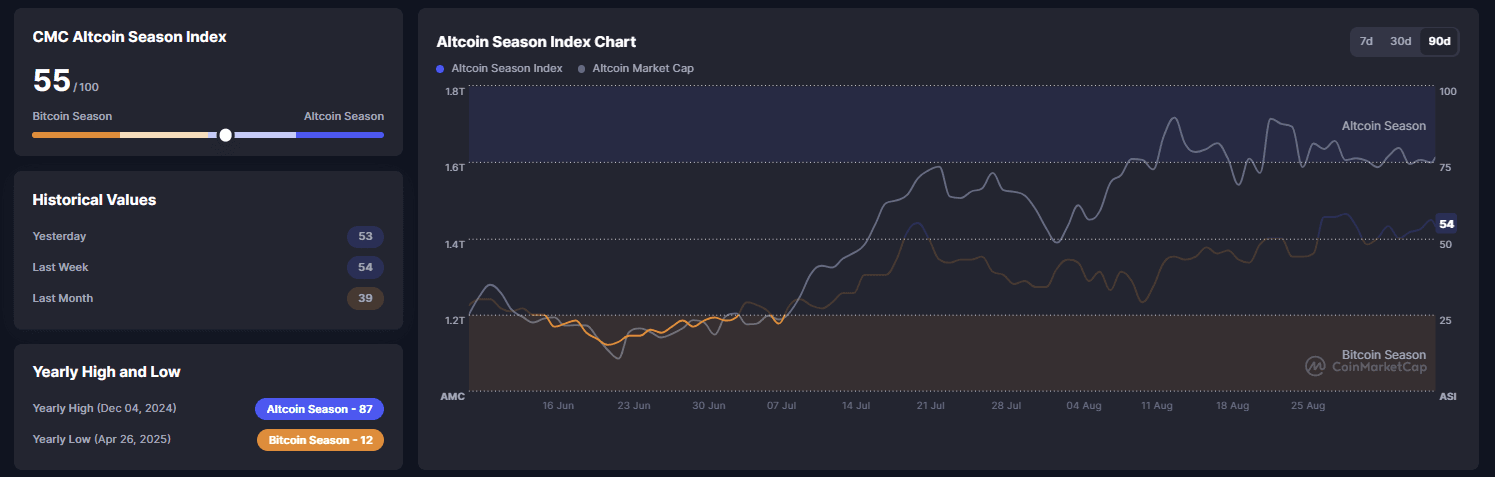

Altcoins Prepping for Gains

The CMC Altcoin Season Index currently sits at 55, slightly tilting toward altcoins. Compared to a reading of 39 last month, this signals growing strength outside Bitcoin. With altcoin dominance gradually climbing, September could mark the start of a fresh rotation into high-potential projects.

via CMC Altcoin Season Index

Top 3 Altcoins to Buy in September 2025

1. Chainlink ($LINK)

$Chainlink remains the leading oracle solution in the blockchain space, powering smart contracts with secure real-world data feeds. Its integrations span DeFi, gaming, and institutional pilots. With growing adoption of tokenized assets and real-world asset (RWA) markets, $LINK is positioned as the backbone for reliable data infrastructure. $LINK’s consistent partnerships and cross-chain expansion continue to drive long-term demand.

2. Ethena ($ENA)

$Ethena is making waves in the synthetic stablecoin and yield-bearing sector. Its protocol offers decentralized alternatives to traditional finance, with $ENA as the governance and utility token. In an environment where regulatory frameworks like MiCA are gaining traction, protocols like Ethena provide a compliant yet innovative pathway for investors to earn yield on-chain. $ENA’s growth reflects rising demand for hybrid DeFi-CeFi solutions.

3. Conflux ($CFX)

$Conflux is a high-performance Layer 1 blockchain often described as the “Asian Ethereum.” It offers regulatory compliance in China and strong ties with enterprises in the region. With increasing interest in blockchain adoption in Asia, $CFX stands out for its unique positioning and strong government-backed partnerships. Its hybrid PoW/PoS consensus also makes it an efficient, scalable alternative for next-gen applications.

Outlook

While the broader crypto market consolidates, the data points to a brewing altcoin rotation. $Bitcoin stability above $110,000 and an Altcoin Season Index of 55 suggest the stage is set for altcoins to outperform in September. $$LINK, $ENA, and $CFX are three projects with strong fundamentals and market positioning, making them standout picks as the month unfolds.

cryptoticker.io

cryptoticker.io