Cronos (CRO) delivered a stunning rally this week after Trump Media & Technology Group announced plans to create a $6.4 billion joint treasury in partnership with Crypto.com. The news instantly ignited buying interest, pushing CRO’s price from $0.16 to a peak of $0.37 in less than 24 hours.

Traders who held the token saw gains of more than 100%, while the sharp increase also fueled one of the largest daily trading volumes in CRO’s history.

Cronos Soars Over 100% Following Trump Media Partnership Announcement

— CryptoRank.io (@CryptoRank_io) August 28, 2025

On Tuesday, Trump Media & Technology Group revealed plans to launch a joint $6.4 billion Cronos treasury in collaboration with @cryptocom. Following the announcement, $CRO surged from $0.16 to $0.34,… pic.twitter.com/mdTB1U7LuN

What Are the Key Price Levels to Watch for CRO?

The token currently trades near $0.35 after consolidating slightly below its intraday high of $0.37. Despite a minor cooldown, momentum remains strong.

Key support now sits around $0.30 to $0.32, an area that previously served as a pullback zone. A deeper cushion lies near $0.27, where the initial breakout gathered strength. On the upside, $0.37 represents immediate resistance. A clean breakout above this level could open the door to $0.40 and possibly $0.42.

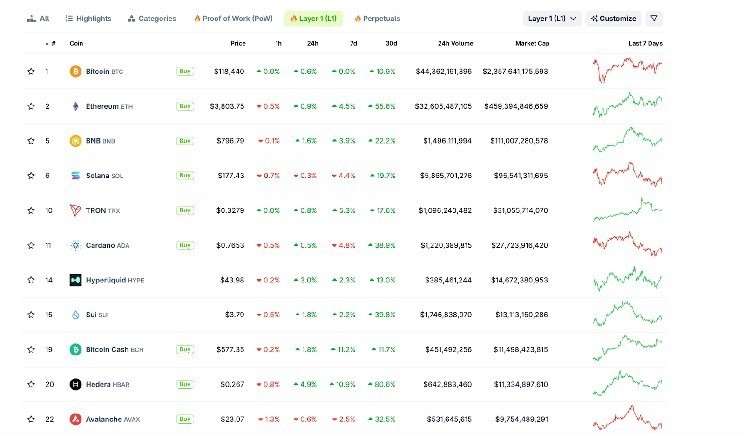

Market strength is evident in the surge in capitalization and trading activity. Cronos’ market cap jumped to $11.8 billion, reflecting a 55% increase in a single day.

Trading volume more than doubled to $2.4 billion, confirming genuine demand and strong market participation. Such numbers often accompany parabolic moves, though they can also precede periods of volatility.

Technical Indicators Flashing a Warning Sign

While the rally highlights renewed optimism, indicators suggest caution in the short term. The Relative Strength Index has spiked above 90, which places CRO in extremely overbought territory.

Such readings often lead to brief corrections or sideways movement as buyers and sellers battle for direction. Additionally, while the MACD remains bullish with a widening histogram, traders should closely watch for any early signs of momentum cooling.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com